Financial Statements summarizes individual transactions to show totals, ratios, and statistics required by users to analyse a company’s financial data. Broadly, Financial Statements include the following four major statements, which form a part of the statutory requirements for companies in most countries:

-

Balance Sheet

-

Profit & Loss A/c

-

Trial Balance

-

Receipts & Payment A/c

All books are displayed as a monthly summary with opening and closing balances.

-

Select a month, and press Enter to display all transactions for the month. The opening and closing balances, as well as the total of all transactions, are displayed.

-

Select a transaction to bring up the voucher. The voucher is displayed either in alteration mode or otherwise, depending on your access rights.

1. Balance Sheet Report in Tally.ERP9

A balance sheet is a financial statement that reports a company's financial position. This report shows the balance between the assets and liabilities of a firm. The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Owner's Equity. You can view this:

1. Go to Gateway of Tally > Display > Balance Sheet .( Press Alt+F1 for Detailed)

Note : By default, the Balance Sheet report will be generated as on the date of the last voucher entry. You can change the date to view the report for the required period.

Balance Sheet of Swayam Sales ( After complete of all given Assignments)

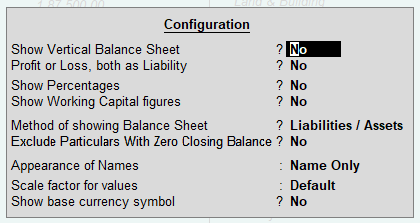

2. Press F12 to configure the Balance Sheet .

3. Press Ctrl+A to accept.

You can Configure Balance Sheet by Pressing F12:Configuration as below :

Set Closing Stock Manually in the Balance Sheet

In Tally.ERP 9, the value of closing stock displayed in the Balance Sheet is based on the costing method defined for each stock item in the stock item master. The general principle of accounting is to value the stock at purchase cost or market value, whichever is lower. The value of closing stock can be entered manually.

For example, consider that the market value of stock on 1-9-2020 is Rs. 15,00,000. To show this amount as the closing stock value:

-

Set the option Integrate accounts and inventory to No in F11: Features (F1:Accounting Features).

-

Create a ledger ‘Stock’ (under Stock-in-Hand).

-

Alter the ledger ‘Stock’ as created above and specify date as 1/09/20 and value as Rs. 15,00,000 in the Closing Balance of Stock Ledger.

The Balance Sheet appears as shown below:

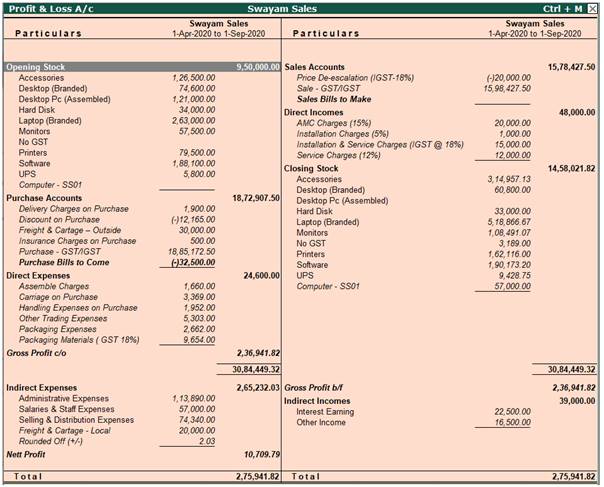

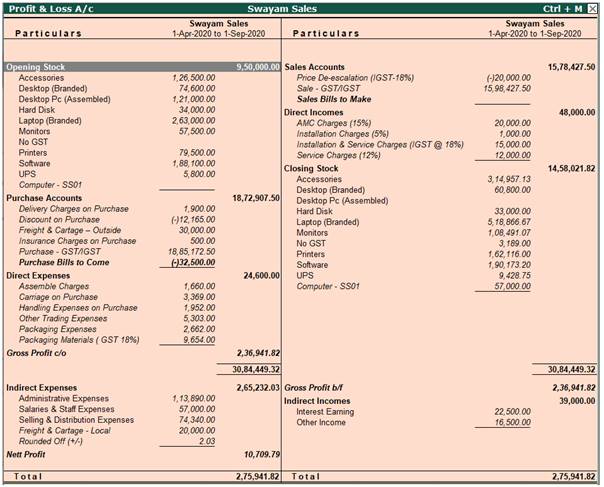

2. Profit & Loss Account Report in Tally.ERP9

The Profit & Loss A/c is a periodic statement, which shows the net result of business operations for a specified period. All the expenses incurred and incomes earned during the reporting period are recorded here.

The Profit and Loss Account in Tally.ERP 9 displays information based on the default primary groups. It is updated with every transaction/voucher that is entered and saved.

You can view the Profit & Loss account details in Tally.ERP 9 for a specified period.

You can view this:

1. Go to Gateway of Tally > Display > Profit & Loss A/c .

2. Click F1 : Detailed to view the Profit & Loss Account in detailed format. The Profit & Loss Account appears as shown below:

The Profit & Loss Account is generated and updated immediately from the date of opening of books till the date of last entry.

3. Press F2: Period to change the period as required.

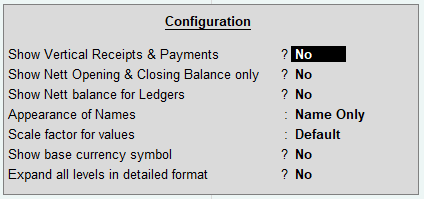

You can configure the Profit & Loss account details to view it in the required format by Pressing F12: Configure.

3. Receipts and Payments Report in Tally.ERP9

Receipts and Payments Account is a report of cash and bank transactions during a period. It is used in place of an income and expenditure statement.

In other words,

-

It is a consolidated summary of cash book, prepared for the required period.

-

It starts with opening balance of cash and bank, and ends with closing balance of cash and bank.

-

It does not take into account outstanding receivables and payables.

-

It may be of capital or revenue nature, and relating to the current, previous or subsequent year, so long as they are actually received or paid.

The Receipts and Payments account displays information based on default primary groups. It is updated with every cash or bank transaction or voucher entry.

You can view the Receipts and Payments account details in Tally.ERP 9 for a specified period.

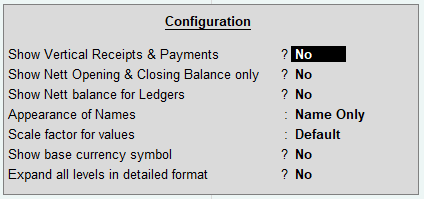

1. Go to Gateway of Tally > Display > Receipts and Payments .

The Receipts and Payments account appears as shown below:

The Receipts & Payments account is generated and updated right from the date of opening of books until the date of last entry.

2. Press F2: Period to change the period as required.

3. Select the required group and press Enter to go to Receipts and Payments Summary reports, and further drill down to go to Ledger Monthly Summary , ledger vouchers, and finally to the voucher alteration mode.

Note: The Receipts & Payments account is displayed according to the configuration of settings in the F12: Configure .

4. Trial Balance Report in Tally.ERP9

A trial balance is a summary of all ledger balances, and helps in checking whether the transactions are correct and balanced. If journal entries are error-free and posted correctly to the general ledger, the total of all debit balances should be equal the total of all credit balances.

Note :

1. By default, the Trial Balance report will be generated as on the date of the last voucher entry. You can change the date to view the report for the required period.

2. As per accounting principles, the Trial Balance does not display the closing stock.

To View Trial Balance…

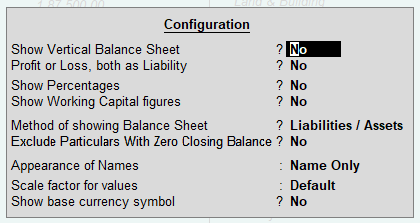

1. Go to Gateway of Tally > Display > Trial Balance . The Trial Balance appears as shown below:

2. Press F12 to configure the Trial Balance , as required.

3. Press Ctrl+A to accept.

|