A business may incur day-to-day expenses such as rent, telephone bills, Internet Bill, stationery, petty-cash expenses, and so on, to carry out the operations. These expenses attract GST.

If you are a registered dealer and purchasing from another registered dealer, and paid GST at the time of payment or purchase, you are eligible to claim the Input Tax Credit. Ensure to enable the expense ledger with GST.

| Note : If it is a URD purchase of more than Rs. 5,000, you need to pay GST and then claim ITC. |

You can record an expense using a purchase voucher. This will auto-calculate the GST amounts.

Setup:

You have to create the Expenses Ledger with GST Applicable and with all GST Details like Nature of Transactions, Taxability, GST Rate etc. etc.

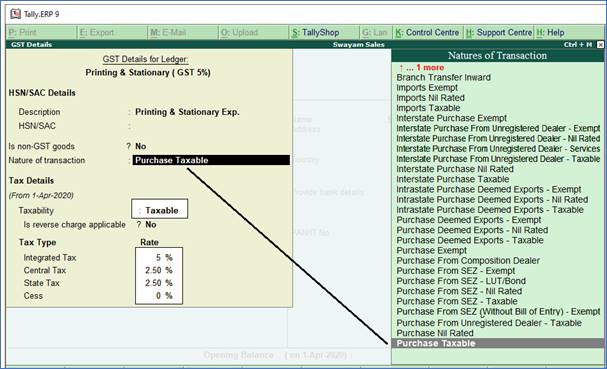

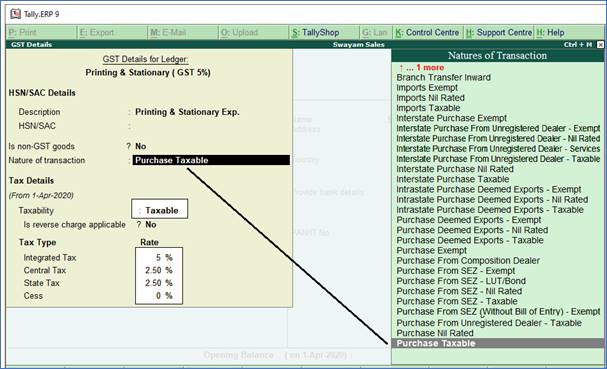

Say, for example, create a Expenses Ledger ‘Printing and Stationary’ which attracts GST 5% as below:

1. Go to Gateway of TallyERP9 → Accounts Info → Ledger → Create

2. Under Statutory Information, Set/alter GST Details should be YES with GST Applicable. Then you will get GST Details for Ledger Screen as below:

3. Select ‘Purchase Taxable’ under Nature of transaction lists as displayed above.

4. Mention GST Rate under Tax Type

5. Select Goods or Service accordingly, then Press CTRL + A ( to Save) |