Tally.ERP9 provides various GST Reports to File GST Returns very smoothly with 100% accuracy.

GST Return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

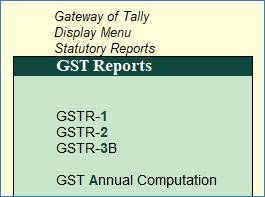

Here is a list of all the GST Reports required to file GST Returns as prescribed under the GST Law which Tally.ERP9 provides.

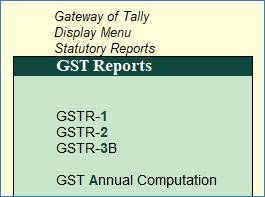

Go to Gateway of Tally → Display → Statutory Report → GST ( Press DOG in Gateway of Tally)

GSTR-1

GSTR-1 is the return to be furnished for reporting details of all outward supplies of goods and services made, or in other words, sales transactions made during a tax period, and also for reporting debit and credit notes issued. Any amendments to sales invoices made, even pertaining to previous tax periods, should be reported in the GSTR-1 return.

GSTR-1 is to be filed by all normal taxpayers who are registered under GST. It is to be filed monthly, except in the case of small taxpayers with turnover up to Rs.1.5 crore in the previous financial year, who can file the same on a quarterly basis.

GSTR-2

GSTR-2 is the return for reporting the inward supplies of goods and services i.e. the purchases made during a tax period.

GSTR-2 is to be filed by all normal taxpayers registered under GST, however, the filing of the same has been suspended ever since the inception of GST.

GSTR-3B

GSTR-3B is a monthly self-declaration to be filed, for furnishing summarized details of all outward supplies made, input tax credit claimed, tax liability ascertained and taxes paid.

GSTR-3B is to be filed by all normal taxpayers registered under GST.

GSTR-9 ( GST Annual Computation)

GSTR-9 is the annual return to be filed by taxpayers registered under GST. It will contain details of all outward supplies made, inward supplies received during the relevant previous year under different tax heads i.e. CGST, SGST & IGST and HSN codes, along with details of taxes payable and paid. It is a consolidation of all the monthly or quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed during that year.

GSTR-9 is required to be filed by all taxpayers registered under GST, except taxpayers who have opted for the Composition Scheme.

GSTR-9 cannot be filed unless GSTR-3B and GSTR-1 are filed. Currently GSTR-9 does not allow any revision after filing.

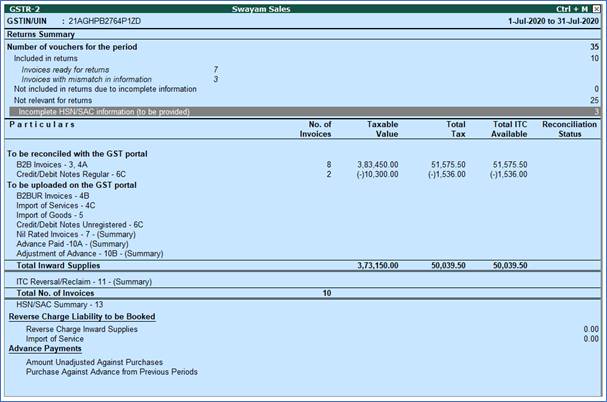

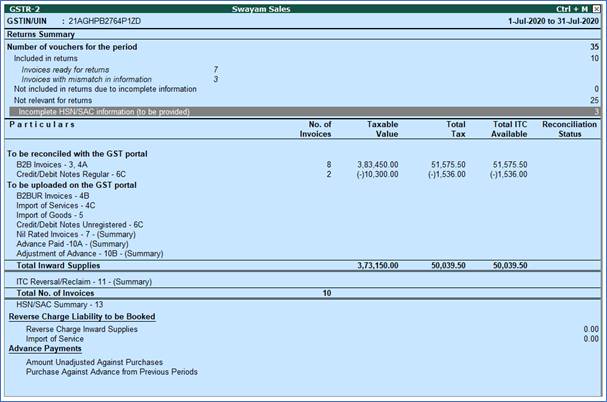

1. View GSTR-2 Report in Tally.ERP9

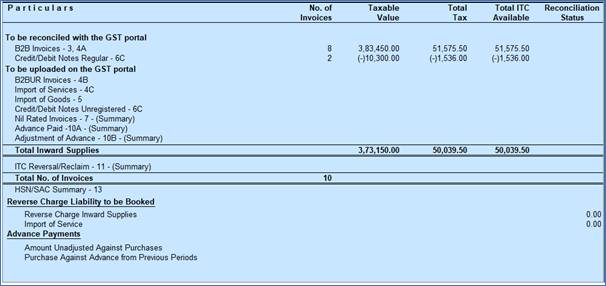

GSTR-2 report includes the details of all inward supplies (Purchase) made in the given period.

The inward supply (Purchase) details include B2B invoices to registered and unregistered dealers, import of goods and services, adjustments to purchases in debit/credit notes, nil rated invoices, advances paid and adjusted, and tax credit reversed or re-claimed.

Note:

GST council has deferred filing of GSTR-2 until further orders. Accordingly, the uploading, saving, and submitting of GSTR-2 are suspended on the GST portal. When GSTR-2 is reintroduced you can generate the returns from Tally.ERP 9. |

Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR–2 .

Click F1 : Detailed to view the breakup of:

As per the GST return format view, there are two sections in this report:

The Reconciliation Status column displays the status as:

-

Completed if a status is set for all the vouchers in the table.

-

Not Complete if status is not set for any/multiple/all the invoice(s). It displays the overall status of the table based on the invoice matching.

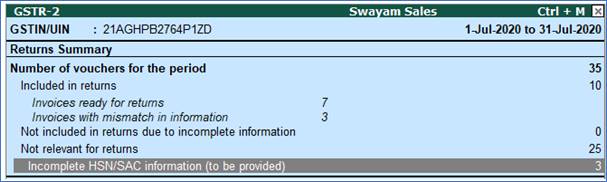

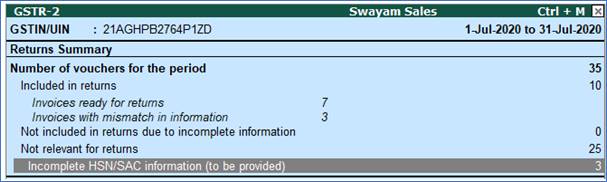

2. Transaction Summary in GSTR-2 Report

This section provides a summary of all transactions recorded in the reporting period. You can drill down on each row to view the details.

Total number of vouchers for the period

Drill down shows the Statistics report.

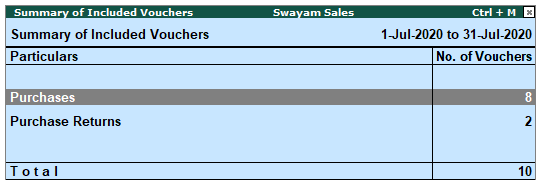

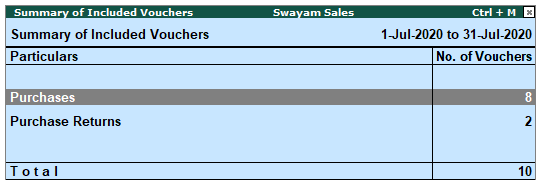

Included in Returns

Drill down from this row to view the Summary of Included Vouchers report, with the list of voucher-types with voucher count.

Not included in returns due to incomplete information

Displays the count of all vouchers for which tax type/tax rate not specified, vouchers have incomplete/incorrect adjustment details, and UQC is not selected. You can correct exceptions in the vouchers before exporting GST returns. If the computed tax is not equal to the tax entered in the invoice, the transaction appears under Incomplete/Mismatch in information (to be resolved)

Not relevant for returns

Drill down from this row to view the Summary of Excluded Vouchers report, with the transaction type-wise voucher count.

Invoices with mismatch in information

Displays the count of all vouchers for which information required for filing returns is missing in the invoice. You can correct exceptions in the vouchers before exporting GST returns.

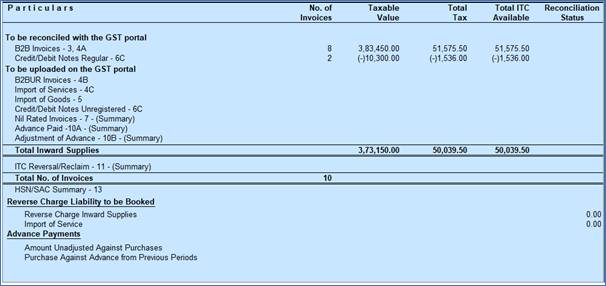

3. Particulars Information (GSTR-2 Report)

1. B2B Invoices - 3, 4A

The taxable, exempt and nil rated purchases made from regular dealers are captured here. If your tax invoice had exempt and nil rated items along with taxable items, then the total invoice value is captured here.

2. B2BUR Invoices - 4B

Displays the details of journal vouchers recorded by debiting and crediting tax ledgers with:

- Nature of Adjustment - Increase of Tax Liability & Input Tax Credit

- Additional Details - Purchase From Unregistered dealer .

Note:

You can set this as additional details only if you have set Enable tax liability on reverse charge (Purchase from unregistered dealer)? to Yes in the Company GST Details screen.

3. Import of Services - 4C

Inward supply of services as imports and purchase from SEZs.

4. Import of Goods - 5

Inward supply of goods as imports and purchase from SEZs.

5. Credit/Debit Notes Regular - 6C

Credit and debit notes, recorded by selecting dealers having GSTIN in the reporting period.

6. Credit/Debit Notes Unregistered - 6C

Credit and debit notes of imports, and journal vouchers recorded for cancellation of advance payments under reverse charge in the reporting period.

7. Nil Rated Invoices - 7

Displays the exempt, nil rated and non-GST supplies from composition dealers.

The purchases made from unregistered dealers will appear in this table, if the option Enable tax liability on reverse charge (Purchase from unregistered dealer)? is set to No in the Company GST Details screen.

8. Advance Paid - 10A

Journal voucher recorded by crediting tax ledgers and debiting expenses/current assets ledger, with:

Nature of Adjustment - Increase of Tax Liability

Additional Details - Advances Paid under Reverse Charge

9. Adjustment of advance - 10B

Journal voucher recorded by debiting tax ledgers and crediting expenses/current assets ledger, with:

Nature of Adjustment - Decrease of Tax Liability

Additional Details - Purchase against Advance Payment

10. ITC Reversal/Reclaim - 11

Journal vouchers recorded to reverse input tax credit are considered.

11. HSN Summary of inward supplies - 13

Provides the details of HSN/SAC-wise taxable value and tax amount of all inward supplies.

|