Tally.ERP9 provides various GST Reports to File GST Returns very smoothly with 100% accuracy.

GST Return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

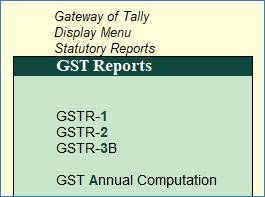

Here is a list of all the GST Reports required to file GST Returns as prescribed under the GST Law which Tally.ERP9 provides.

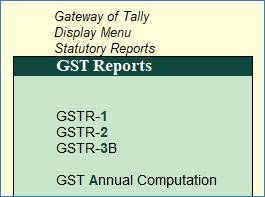

Go to Gateway of Tally → Display → Statutory Report → GST ( Press DOG in Gateway of Tally)

GSTR-1

GSTR-1 is the return to be furnished for reporting details of all outward supplies of goods and services made, or in other words, sales transactions made during a tax period, and also for reporting debit and credit notes issued. Any amendments to sales invoices made, even pertaining to previous tax periods, should be reported in the GSTR-1 return.

GSTR-1 is to be filed by all normal taxpayers who are registered under GST. It is to be filed monthly, except in the case of small taxpayers with turnover up to Rs.1.5 crore in the previous financial year, who can file the same on a quarterly basis.

GSTR-2

GSTR-2 is the return for reporting the inward supplies of goods and services i.e. the purchases made during a tax period.

GSTR-2 is to be filed by all normal taxpayers registered under GST, however, the filing of the same has been suspended ever since the inception of GST.

GSTR-3B

GSTR-3B is a monthly self-declaration to be filed, for furnishing summarized details of all outward supplies made, input tax credit claimed, tax liability ascertained and taxes paid.

GSTR-3B is to be filed by all normal taxpayers registered under GST.

GSTR-9 ( GST Annual Computation)

GSTR-9 is the annual return to be filed by taxpayers registered under GST. It will contain details of all outward supplies made, inward supplies received during the relevant previous year under different tax heads i.e. CGST, SGST & IGST and HSN codes, along with details of taxes payable and paid. It is a consolidation of all the monthly or quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed during that year.

GSTR-9 is required to be filed by all taxpayers registered under GST, except taxpayers who have opted for the Composition Scheme.

GSTR-9 cannot be filed unless GSTR-3B and GSTR-1 are filed. Currently GSTR-9 does not allow any revision after filing.

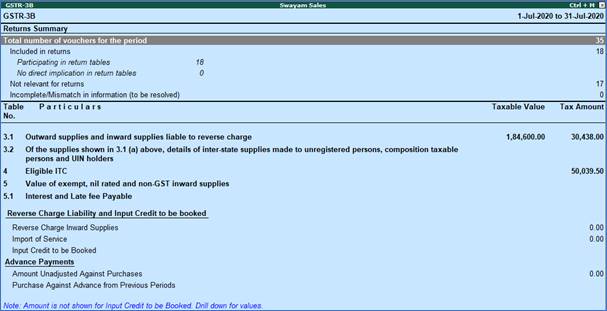

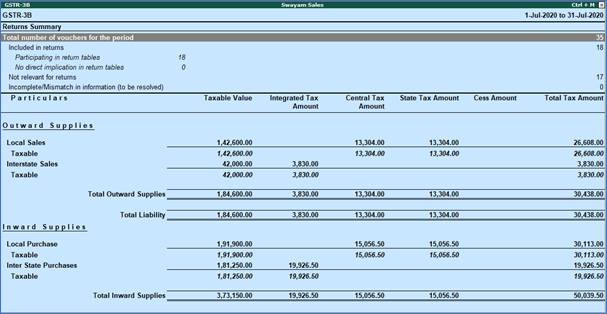

1. View GSTR-3B Report in Tally.ERP9

GSTR -3B must be filed by everyone who has registered for GST. In Tally.ERP 9, you can view GSTR-3B in the report format with tax computation details. Also you can generate GSTR-3B, export the data in the JSON format, and upload it to the portal to file the returns.

Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

Tally.ERP9 provides two views of GSTR- 3B Report which can be viewed by pressing Alt+V :

Return Format View : It displays the values in the actual Form GSTR-3B format.

Summary View : It provides the tax computation details with the taxable value and tax break-up for local and interstate supplies under taxable, exempt, and nil-rated categories.

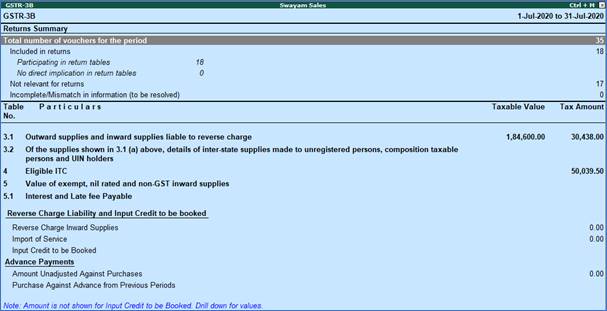

2. Return Format View of GSTR-3B Report

Click V : View Return Format . The Return Format View displays the values in the actual Form GSTR-3B format. The values are captured under different sections of the form.

Specify the required reporting period by pressing F2 .

This Report has two sections…

- Return Summary and

- Table Particulars

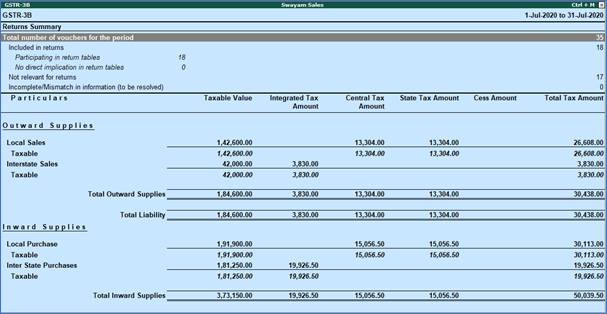

(S-1). Return Summary of GSTR-3B Report

This section displays a snapshot of business operations in the given period.

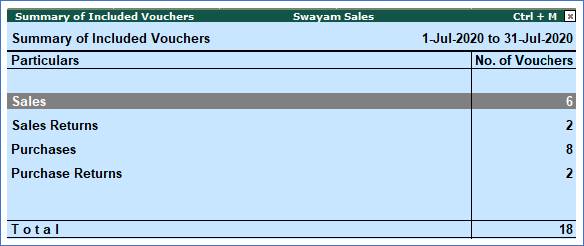

Total number of vouchers for the period

Displays the total number of vouchers. Drill down to view the Statistics report.

Included in returns

Displays the number of vouchers that are:

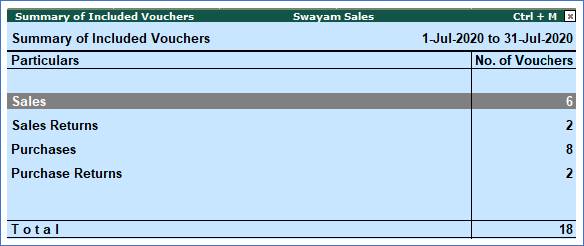

- Participating in return table : Displays the number of vouchers that are part of the return tables. Drill down to view the Summary of Included Vouchers .

- No direct implication in return tables : Displays the number of vouchers recorded as book entries that do not have an impact on the GSTR-3B returns. Drill down to view the Summary of Included Vouchers .

Not relevant for returns

Displays the number of transactions that are excluded from the returns. Drill down to view the Summary of Excluded Vouchers .

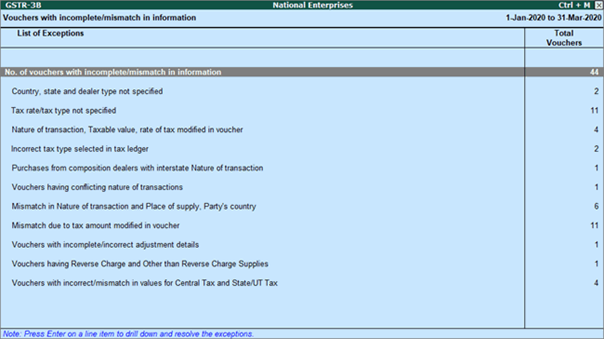

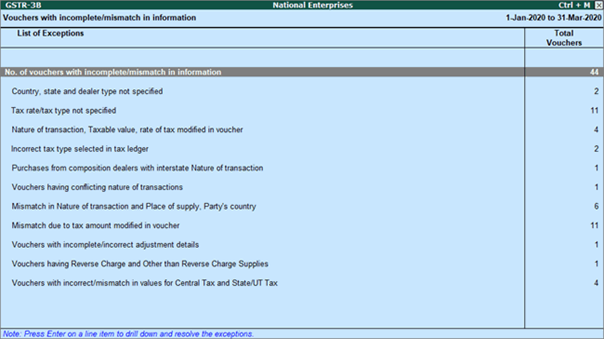

Incomplete/mismatch in information (to be resolved) – GSRT-3B

Displays the count of all vouchers with insufficient GST-related information. You can correct exceptions in the vouchers before exporting GST returns. If the computed tax is not equal to the tax entered in the invoice, the transaction appears under Incomplete/Mismatch in information (to be resolved) . You need to update the missing information and resolve the mismatches to include these in the returns.

Drill down on No. of voucher with incomplete/mismatch in information as shown below:

>> Country, state and dealer type not specified :

Drill down from this line to view the vouchers of dealers with no information of country, state, dealer type or GSTIN.

>> Tax rate/tax type not specified :

Drill down from this line to view the vouchers where tax type or rate of tax is missing.

>> Nature of transaction, Taxable value, rate of tax modified in voucher :

Drill down from this line to view vouchers in which nature of transaction, assessable value or rate of tax defined in the ledger master was changed during recording of the transaction.

>> Incorrect tax type selected in tax ledger :

Drill down from this line to view the vouchers in which tax ledgers are not selected or are incorrectly selected.

>> Purchases from composition dealers with interstate Nature of transaction

Displays the count of transactions of interstate purchases from composition dealers.

>> Vouchers having conflicting nature of transactions :

Drill down from this line to view the vouchers that have two or more nature of transactions in which interstate and intrastate natures of transactions are selected in the same voucher.

>> Mismatch in Nature of transaction and Place of supply, Party's country :

Drill down from this line to view the transactions having mismatch in the nature of transaction, place of supply and party's country.

>> Mismatch due to tax amount modified in voucher

Displays the count of transactions in which difference is found between the calculated and entered tax amount.

>> Vouchers with incomplete/incorrect adjustment details :

Drill down from this line to view the journal vouchers with incorrect or incomplete adjustment details.

>> Vouchers having Reverse Charge and Other than Reverse Charge Supplies :

Drill down from this line to view vouchers that contain both reverse charge and other than reverse charge supplies. It Displays the count of transactions that have stock items that attract regular tax rates and are taxed under reverse charge.

>> Vouchers with incorrect/mismatch in values for Central Tax and State/UT Tax

Displays the count of vouchers in which there is difference in values of Central Tax and State/UT Tax.

(S-2). Table Particulars (Computation details) as per GST Format of GSTR-3B Report

This section displays the taxable value and tax amount from outward supplies and inward supplies considered in the returns.

3.1. Details of Outward Supplies and inward supplies liable to reverse charge

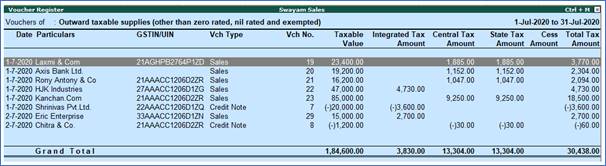

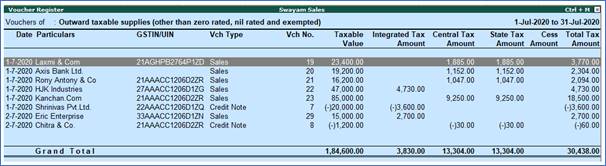

(a) Outward taxable supplies (other than zero rated, nil rated and exempted):

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from sales and sales-related transactions with or without reverse charge applicability with given format.

(b) Outward taxable supplies (zero rated) :

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from sales and sales-related transactions with given format.

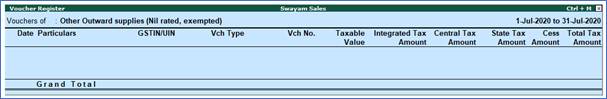

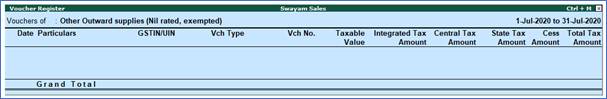

(c) Other outward supplies (Nil rated, exempted) :

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from sales and sales related transactions with given format.

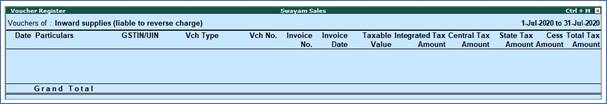

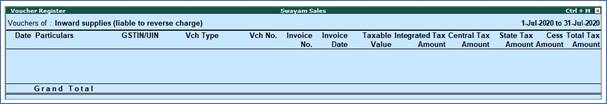

(d) Inward supplies (liable to reverse charge):

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns for purchase or purchase-related transactions with given format.

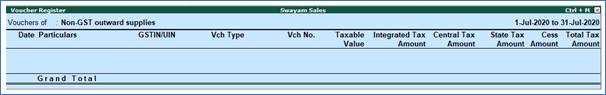

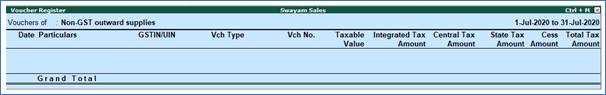

(e) Non-GST outward supplies :

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with masters created by setting the option Is non-GST goods? to Yes . The given Format is below :

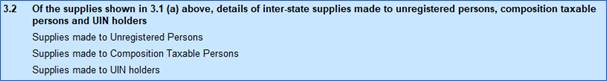

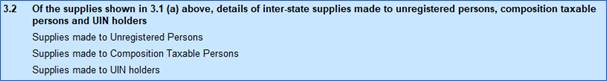

3.2. Of the supplies shown in 3.1. (a) above, details of inter-Sate supplies made to unregistered persons, composition taxable persons and UIN holders

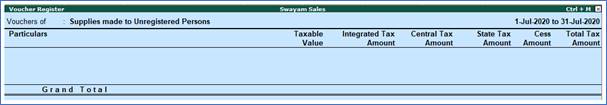

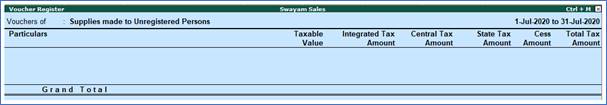

>> Supplies made to Unregistered Persons

Displays the Place of Supply , Total Taxable value , and Amount of Integrated Tax in separate columns from sales and sales-related transaction with given format.

>> Supplies made to Composition taxable persons

Displays the Place of Supply , Total Taxable value , and Amount of Integrated Tax in separate columns from sales and sales-related transaction with given format.

>> Supplies made to UIN holders

Displays the Place of Supply , Total Taxable value , and Amount of Integrated Tax in separate columns from sales and sales-related transaction with given format.

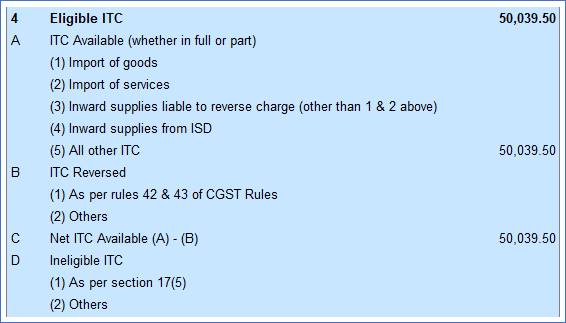

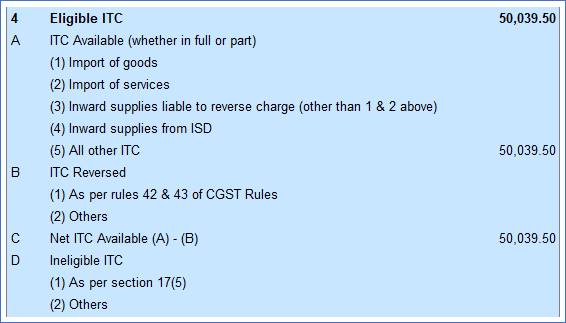

4. Eligible ITC

(A) ITC Available (whether in full or part)

(1) Import of goods :

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns with Nature of transaction as per given format.

(2) Import of services:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns with Nature of transaction as Imports Taxable with Type of Supply as Services as per given format.

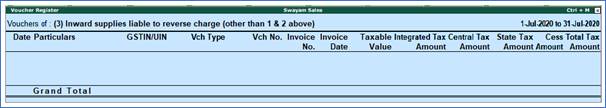

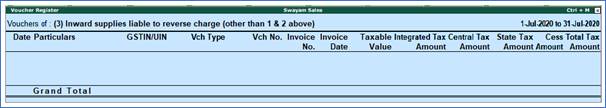

(3) Inward supplies liable to reverse charge (other than 1 & 2 above):

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns as per given format.

(4) Inward supplies form ISD:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with given format.

(5). All other ITC :

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from purchase transactions recorded with given format.

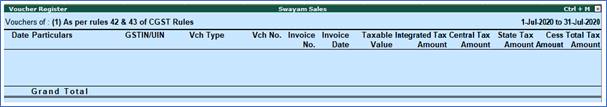

(B) ITC Reversed

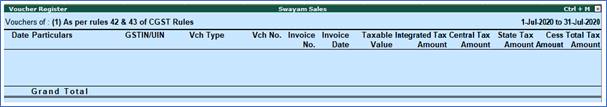

(1) As per rules 42 & 43 of CGST Rules:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with given format.

(2) Others:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with given format.

(C) Net ITC Available (A)-(B)

Displays the auto calculated values.

(D) Ineligible ITC

(1) As per section 17(5):

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from purchase and purchase-related transaction with given format.

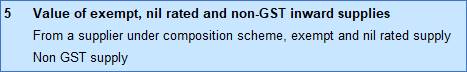

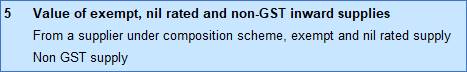

5. Values of Exempt, Nil-Rated and Non-GST inward supplies

>> From a supplier under composition scheme, exempt and nil rated supply:

Displays the taxable value from all purchase and purchase-related transactions as given format.

>> Non GST supply:

Displays invoice value from a transaction recorded with ledgers or items created by setting the option Is non-GST goods? to Yes . The value is displayed in Inter-State supplies column if the supplier is from a different state and in the Intra-State supplies column if the purchases are made from a local supplier. The given format is..

5.1 Interest and Late Fees Payable

>> Interest:

Displays the value of the journal voucher recorded with Nature of adjustment as Increase of Tax Liability , and Additional Details as Interest .

>> Late Fees:

Displays the value of the journal voucher recorded with Nature of adjustment as Increase of Tax Liability , and Additional Details as Late Fees .

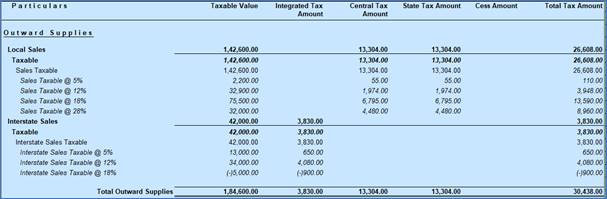

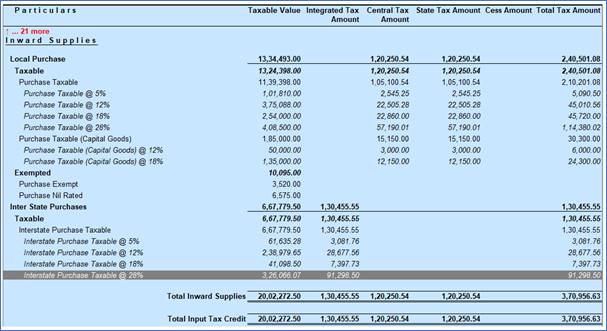

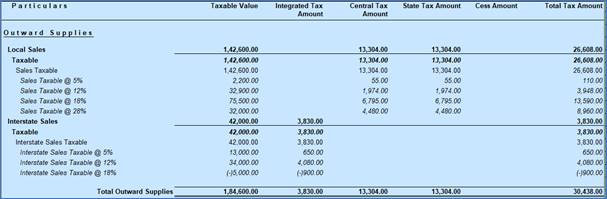

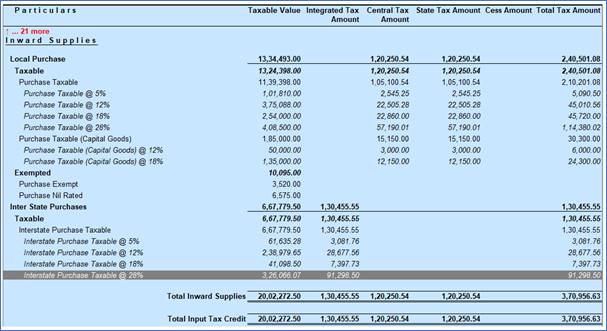

3. Summary View of GSTR-3B Report

Click V : View Summary . The Summary View provides the tax computation details with the taxable value and tax break-up for local and interstate supplies under taxable, exempt, and nil-rated categories.

Press F1-Details to view in details with Taxable in Rates as given below :

Outward Supplies (Sales):

Press Enter key, Drill down to view the Summary of Sales of Local Sales or Interstate Sales as per GST Rate wise..

Local Taxable Sale @ 5% as Voucher Register:

Similarly, you can view and drill down Sales @ 12%, Sales @ 18% , Sale @ 28% both Local and Interstate Sales.

Inward Supplies (Purchases):

Similarly, Press Enter key, Drill down to view the Summary of Purchase of Local or Interstate Purchase as per GST Rate wise..

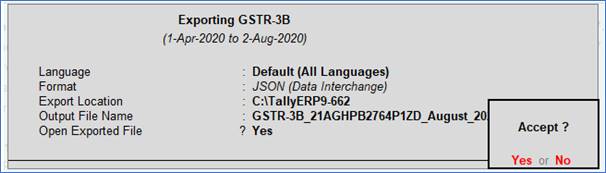

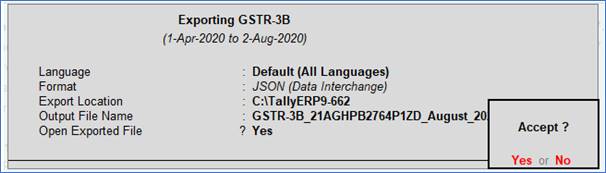

4. Generate GSTR-3B Returns in the JSON Format to File from Tally.ERP9

In Tally.ERP 9, you can export data in the JSON format and upload it to the portal for filing the returns.

Ensure that all exceptions regarding incomplete/mismatch in information are resolved before printing or exporting the GSTR-3B report.

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

2. F2: Period - select the period for which returns need to be filed.

3. Press Ctrl+E ( Export Return).

4. Select JSON (Data Interchange) as the Format .

5. Press Enter to export. The negative net values will be exported with a negative sign, as per the e-filing requirements.

Upload the JSON file to the portal for filing returns.

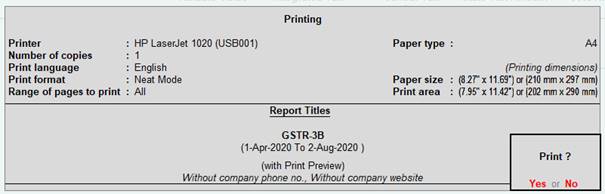

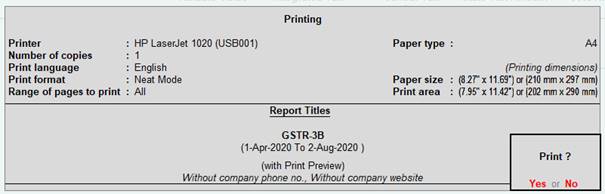

Print GSTR-3B Return in Word Format :

Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B

Press Ctrl + P, then Enter.

GSTR-3B Form in word format will be open.

|