Voucher Classes is the best way of Automating Allocations during Invoice Entry. It is a table for predefining the entries that we wish to Automate to make Invoice Creation a breezy task. This particularly useful for Sales Invoicing where we can define once, the nominal ledger account to be credited to each item of sale. Then during voucher entry, the accounting credits for items sold are done automatically.

Classes can also be used to automate the rounding off values. Rounding method can be preset when defining a class for a single line or for the entire Voucher or Invoice.

Voucher Classes are available for all major voucher types like Contra, Payment, Receipt, Journal, Sales, Credit Note, Purchases, Debit Note, Sales Order, Purchase Order, Delivery Note, and Stock Journal.

Here we have to create a Voucher Class with a name ‘GST’ in case of Sale Voucher where we will fix the Sale Account (Sale-GST/IGST), GST Ledger i.e. CGST & SGST, Automated Rounding Off with assigning a Ledger i.e. Rounded off Exp. Ledger.

Example :

Swayam Sales sold the following items to Chitra & Co. on Credit

Item |

Qty |

Rate |

Value |

CGST |

SGST |

Total Value |

Desktop HCL Infinity |

2 |

13,500 |

27,000 |

9% |

9% |

31,860 |

Desktop Lenovo K200 |

1 |

47,560 |

47,560 |

9% |

9% |

56,120.80 |

Gross Total |

87,980.80 |

Note : Alter Voucher Type – ‘Sale’ with Voucher Class – GST. Record the Sales transactions using the corresponding Voucher Classes i.e. GST.

Solutions :

Step 1 :

Alter the Sales Voucher Type

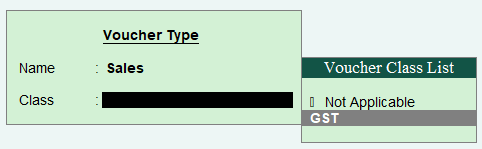

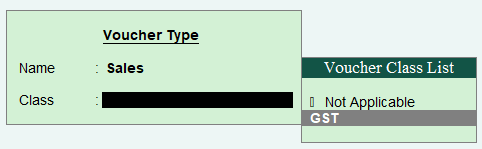

1. Go to Gateway of Tally.ERP9 à Accounts Info à Voucher Type à Alter Sales

2. Select Sale Voucher

3. Retain the rest of the fields as they are.

4. In the Voucher Type alternation screen, write ‘GST’ in the Name of Class field.

Ensure that voucher type class is defined as shown in figure.

Note:

- Since Sale can be made under 3 types…Cash, Bank & Credit Sales, So under Include Groups section select only Bank Accounts, Cash-in-hand, Sundry Debtor Groups only.

- Select the Sale Ledger (I.e. Sale-GST/IGST) to be credited by default of all invoice value. So Selection of Ledger is not required at the time of Sale Voucher entry.

- In third section, select local CGST , SGST Ledger with ledger Rounded off(+/-) for auto Rounding as per Type of Calculation selected in figure above.

- You can also select IGST ledger for Outside State sale in third section instead CGST & SGST and given the image in last.

Step 2 :

Make an entry of the transaction in a Sales Voucher – Voucher Class GST

Go to Gateway of Tally.ERP 9 à Accounting Vouchers à F8 : Sales àSelect ‘GST’ under Voucher Class List

Ensure that the Sales Invoice entries are as given in the Figure and accept the Sales Invoice Entries.:

Note :

- In this case, No Sale Ledger, No GST Ledger, No Rounded Off Ledger has to be select at the time of Sale Voucher Entry.

- The Rounded Off (+/-) Expenses Ledger should not be linked with GST Applicable at the time of creation.

Similarly, you can create a another Voucher Class – IGST ( for Outside State Sale) in Sale Voucher as shown in figure :

|