When defining the price of the item you can include the tax rate. This inclusive Tax Rate can assign during sale under two ways..

1. Permanently at the time of Creating a Stock Items

2. In Sale Invoice, selecting the option – Allow inclusive of tax for stock items to YES in F12: Configuration.

1. Enable Item Rate (Inclusive of Tax) at the time of Item Creation / Alternation mode :

1. Go to Gateway of Tally > Inventory Info. > Stock Items > Create/Alter > F12: Configure .

2. Set Allow inclusive of tax for stock items to Yes .

3. Press Ctrl+A to go to the Stock Item Alteration screen.

4. Set Is inclusive of duties and taxes? to Yes .

5. Enter the Rate of Duty , as required.

6. Press Ctrl+A to save the ledger.

2. Activation of Item Rate Inclusive of Tax in F12: Configuration during Sale Entry.

1. Go to Gateway of Tally > Accounting Voucher Entry > F8:Sale .

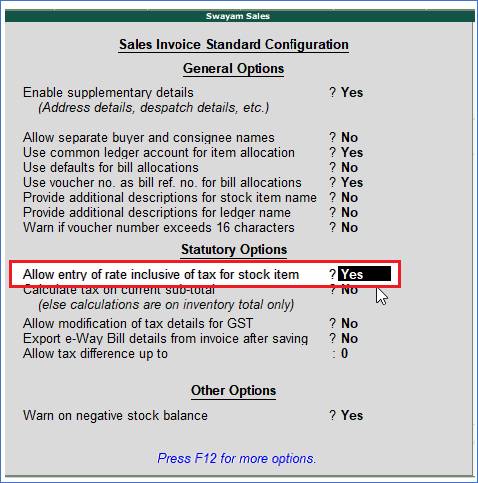

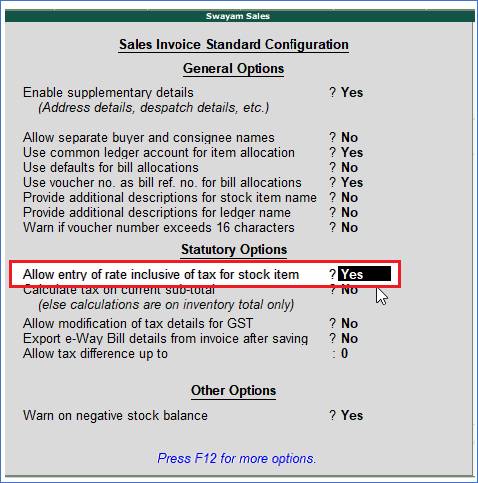

2. Press F12: Configuration and Set Allow inclusive of tax for stock items to Yes .

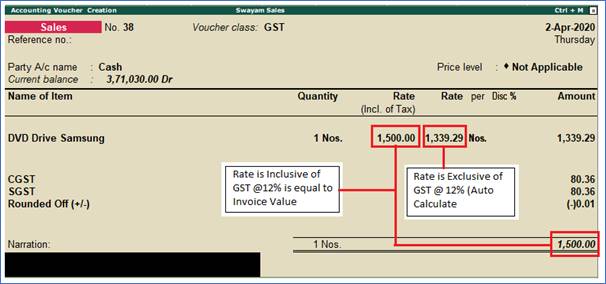

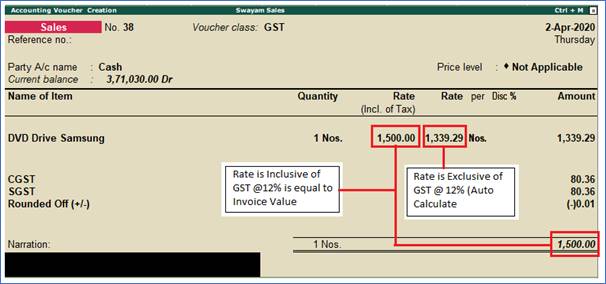

3. An extra Inclusive of Tax Rate column will be added with normal Rate column in Sale Voucher screen.

4. Assign Inclusive Tax Rate of the Item in Incl. of Tax Rate Column, Tally.ERP9 will automatically calculate the Items Value after deducting GST as per given Sale Invoice with example.

Example :

Sole 1 Nos. DVD Drive Samsung of Rs. 1500 (Inclusive of GST @ 12%) in cash.

Sale Invoice will be as below :

|