When a company buys goods on credit or cash, Purchase voucher is used to record all the Purchase transactions of the company.

Once you activate GST in your company, you can record the purchase of goods and services (inward supply) that attract GST using a purchase voucher.

- Go to Gateway of Tally > Accounting Vouchers.

- Click on F9:Purchase on the Button Bar or press F9 .

To pass a Purchase entry in the Invoice mode, you need to enable the option Enable Invoicing in F11: Features (F1: Accounting or F2: Inventory Features) .

Account Invoice: You will be directly selecting/debiting the Ledger account in case you are passing an Account Invoice. This is useful especially when a Service Bill is entered and does not include Inventory.

Item Invoice: You will be first selecting the Inventory and then allocating the same to the relevant Ledger account. This is useful to record all the Inventory movements in books of account.

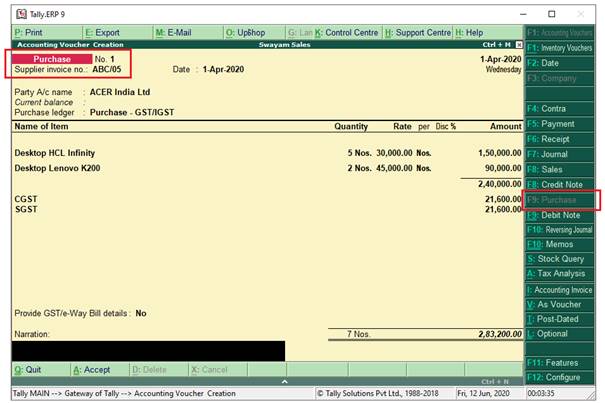

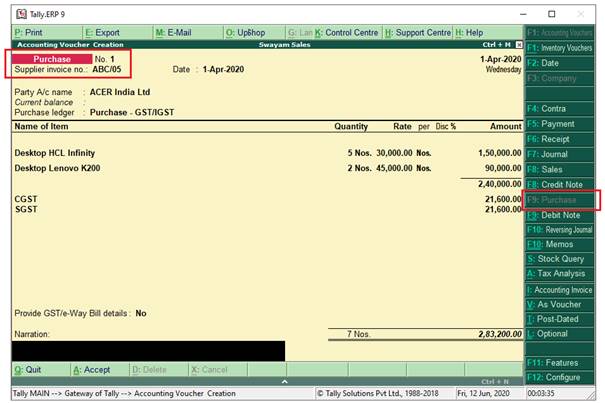

1. Local Purchase (within State)

The purchase of goods or services from a supplier in the same state attracts central tax and state tax.

To record a Local Purchase Transaction:

1. Go to Gateway of Tally > Accounting Vouchers > F9: Purchase.

Supplier invoice no.: Displays the sales invoice no. of the supplying party.

Date: Displays the date on which the sales invoice was passed by the supplier.

2. In Party A/c name, select the supplier's ledger or the cash ledger.

3. Select the purchase ledger applicable for local taxable purchases.

4. Select the required items, and specify the quantities and rates.

5. Select the central and state tax ledgers.

You can view the tax details by clicking A: Tax Analysis. Click F1: Detailed to view the tax break-up.

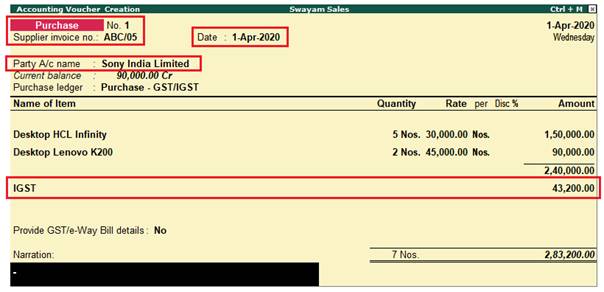

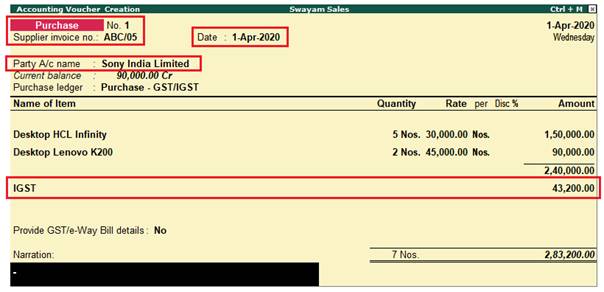

2. Interstate Purchase (outside State)

The purchase of goods or services from a supplier from another state attracts integrated tax.

To record an interstate purchase:

- Follow the steps used for recording a local purchase transaction as above, with the following changes:

- Select the purchase ledger ( you can use one ledger for both local and Interstate Purchase or you create separate Ledger ).

- Select the integrated tax ledger.

Depending on the location of the supplier i.e. State in address section, you can record a Local or Interstate Purchase transaction with the applicable GST rates.

3. Purchase Voucher with some Additional Charges/ Discount etc.

Some Purchase Voucher includes some Additional Charges like…Delivery Charges, Insurance Charges, Installation Charges, Rounded Off, Discount on Purchase etc.. etc..

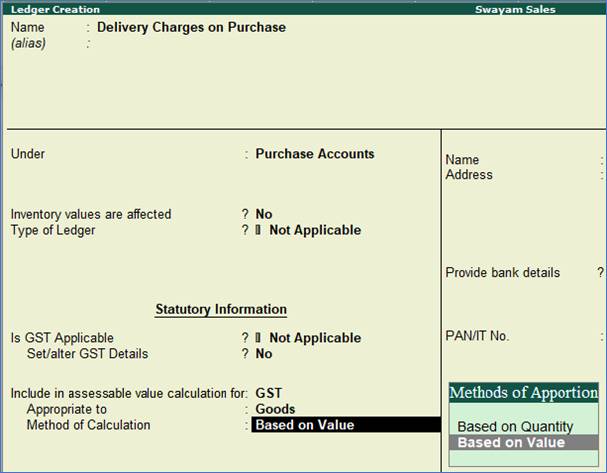

>> Additional Charges included before GST in Purchase Bill

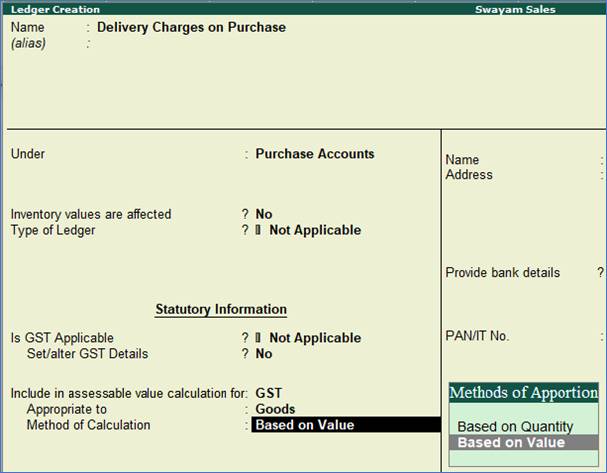

The main situation is that whether all those additional charges are charged before GST or after GST. If those Expenses charged before GST, then all those Expenses should be created under Purchase Group without affecting Inventory value, GST Not Applicable, but it must be include in assessable value calculation for GST with Appropriation to Goods & Method of valuation should be Based on Value.. as given below screen :

>> Additional Charges included after GST in Purchase Bill

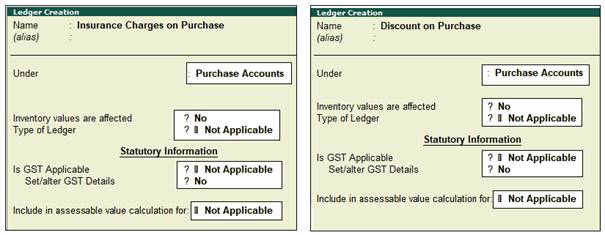

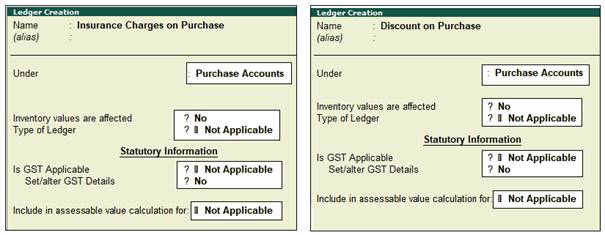

Ledger creation will be as below ( with Not applicable in all cases and should be under Purchase Account Group)

(A) Ledger Creation : ‘Insurance on Purchase’ & ‘Discount on Purchase’

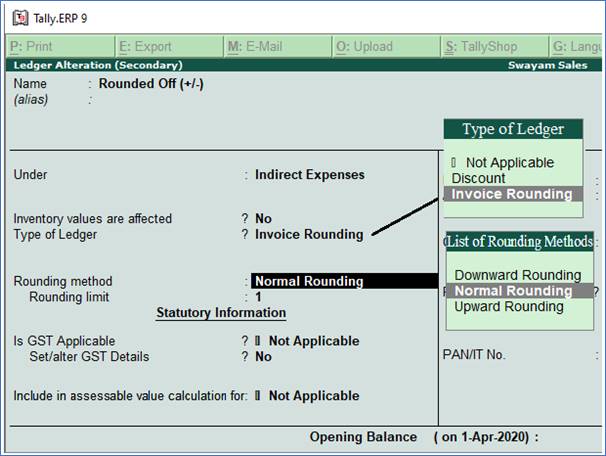

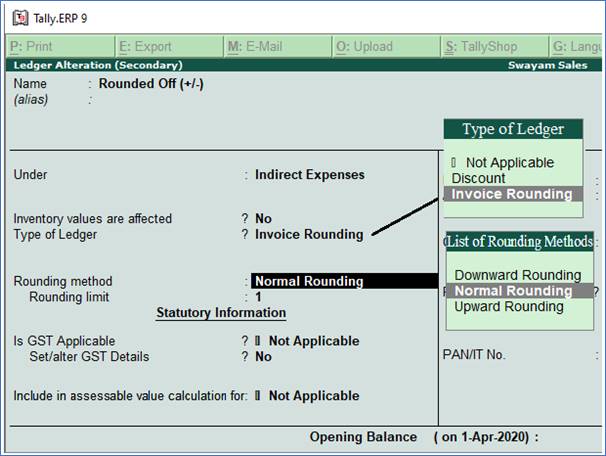

(B) Ledger Creation : ‘Rounded Off (+/-)’

You can create a Ledger ‘Rounded off (+/-)’ to round-off the invoice value automatically.

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create / Alter .

Note : If you already created the given Ledger Rounded Off (+/-), you can alter as below |

2. Set Type of Ledger? as Invoice Rounding .

3. Select the Rounding method as Normal Rounding and enter the Rounding limit to 1 .

4. Under Statutory Information, all options should be set to Not Applicable .

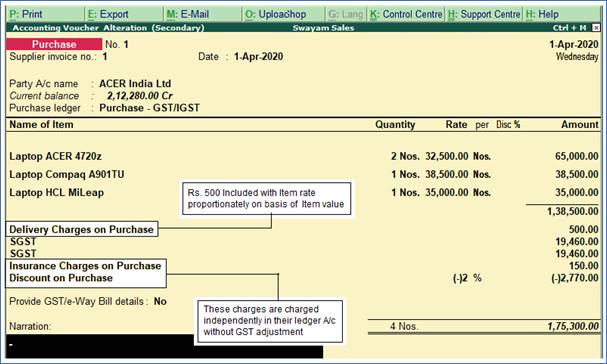

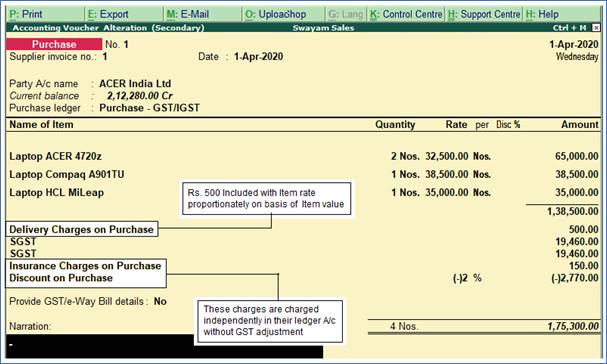

>> Purchase Bill with Additional Charges / Discount both before and after GST

Here we have one sample of Purchase Bill with Additional Charges or Discount on Purchase both Before and After GST :

Transactions:

Purchase the following Items from Acer India Ltd. with Delivery Charges of Rs.500 charged before GST and Insurance Charges on Purchase of Rs.150 charged and with a Discount on Purchase @2% received after charging GST .

| Laptop ACER 4720Z |

2 Nos. |

32500 |

| Laptop Compaq A901TU |

1 Nos. |

38500 |

| Laptop HCL MiLeap |

1 Nos. |

35000 |

Note :

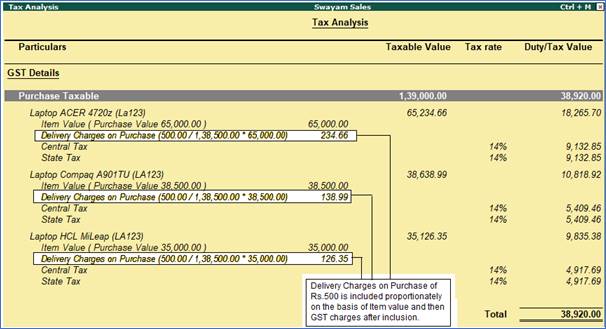

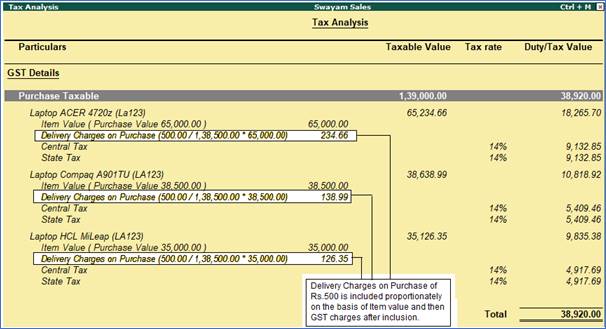

>> In above case, value of Delivery Charges on Purchase of Rs.500 charged before GST and thus this value has included with Item Rate proportionally on the basis of item value.

>> But the expenses Insurance Charges on Purchase as well as Discount on Purchase are included in Bill after GST and thus these expenses or Incomes are charged independently in their ledger without affecting item rate or value.

>> Discount on Purchase Value or % should be given with (-) symbol, to deduct from the Bill value.

>> These can be viewed in Tax Analysis ( Alt+A) in Purchase voucher wit Detailed (Alt+F1) as below:

|