|

1. Go to Gateway of Tally > F11: Features > Statutory & Taxation

2. Set Enable Tax Deducted at Source (TDS) to Yes in the Company Operations Alteration screen as below :

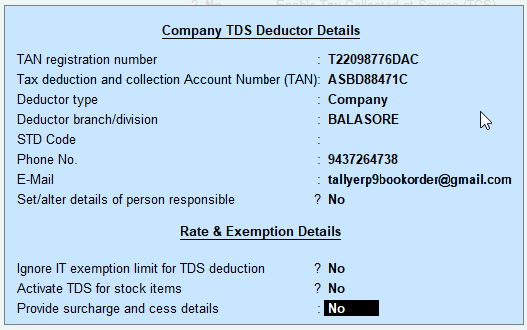

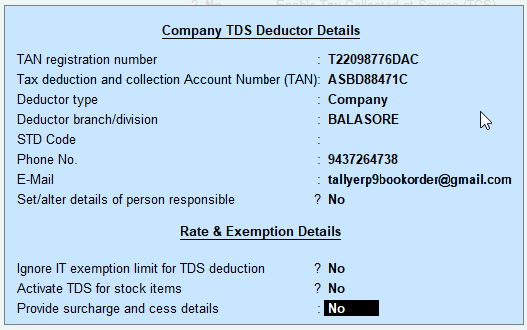

3. Enable the option Set/alter TDS details ? to display TDS Deductor Details screen as below :

Please enter all details in Company TDS Deductor Details as above.

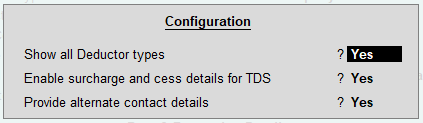

Press F12 : Advanced Configure in above Screen for Configure TDS as below :

>> All the organisation types will appear in the Collector/Deductor Type list for the option Deductor Type

>> All Surcharges details applicable to TDS will be enable in second option

>> The Third Option is to enable display of the alternate contact details of TDS

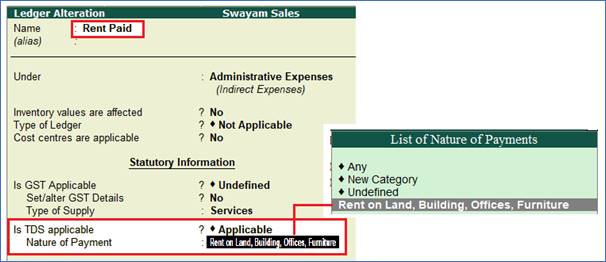

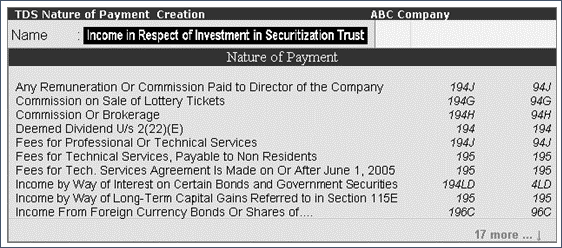

2. Creating TDS Nature of Payment

For payments attracting TDS, the relevant nature of payment is defined by the department with associated tax rate, section, payment code, and threshold limit. Few Examples are given below …

| Section |

Nature of Payment |

TDS Rate |

192 |

Salaries |

Average Rate Applicable |

194I |

Rent on Plant and Machinery |

2% |

194I |

Rent on Land, Building, Houses, Offices etc. |

10% by Company in excess of Rs.2,40,000

5% by Individual . HUF, Businessman in excess of Rs.50,000 |

194C |

Payment to Contractor / Sub-contractor |

1% |

194D |

Insurance Commission |

5% |

194DA |

Payment in respect of life insurance policy |

1% |

194EE |

Payment in respect of Deposit under NSS |

10% |

194H |

Commission or Brokerage |

5% |

194J |

Sum paid by way of Fees for Professional Services |

10% |

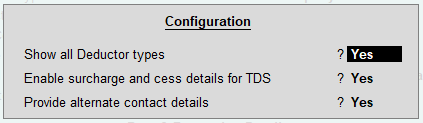

While creating a TDS Nature of Payment, you can press Ctrl+C to select the required nature of payment.

1. Go to Gateway of Tally > Accounts Info. > Statutory Info. > TDS Nature of Pymts > Create

2. Press F12. Set Allow to PAN tax rate to Yes, to enter the tax rates for Individual / HUF for each nature of payment.

3. Press Ctrl+C to view the list of Nature of Payment and Select the required Nature of Payment.

4. Enter the Rate of TDS for With PAN and Without PAN . The same appears in Rate for other deductee types .

5. Enter the Threshold/exemption limit as applicable .

6. Press Enter to save the details.

3. Creating Master Ledger with TDS Transaction i.e. Expenses, Party Ledger, TDS Ledger

You can create or alter an Ledger for your business expenses, along with the applicable TDS.

Example :

On 1.4.2020, Swayam Sales paid to N. Jatania & Co Rs.5,00,000 as Rent

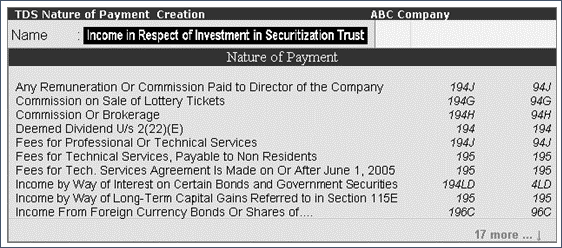

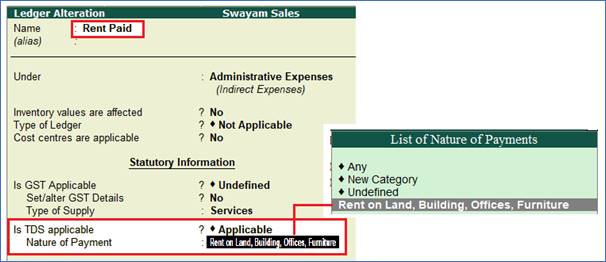

Step-1: Alter Expenses Ledger i.e. Rent Paid

Enable the option Is TDS Applicable ? and also Select the Nature of Payment from the List of Nature of Payments

The Ledger Alternation screen appears as shown below:

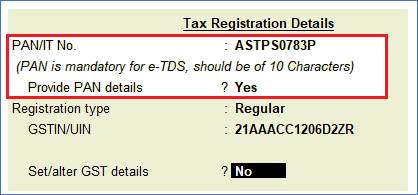

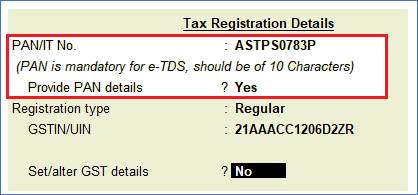

Step-2: Alter Party Ledger i.e. N. Jatania & Co ( Under Sundry Creditor) as below :

>> Enable the option Is TDS Deductible ? and Select a Deductee Type from the List and also Enable Deduct TDS in Same Voucher , if required

Note: TDS Rate will be 10% due to PAN is available and mention here, otherwise 20% will be calculated.

Step-3 : Create TDS Ledger i.e. TDS on Rent

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name and Select Duties and Taxes as the group name in the Under field, then Select TDS as the Type of Duty/Tax.

3. Select a Nature of Payment from the List of Nature of Payments.

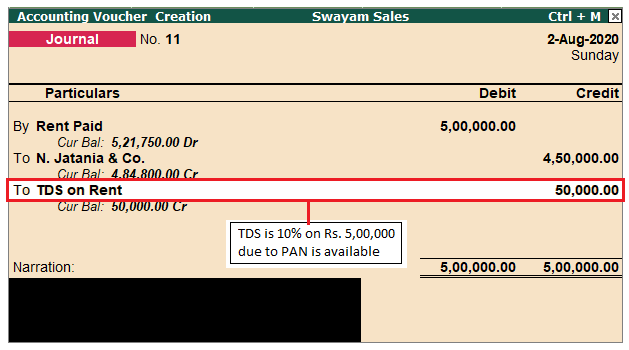

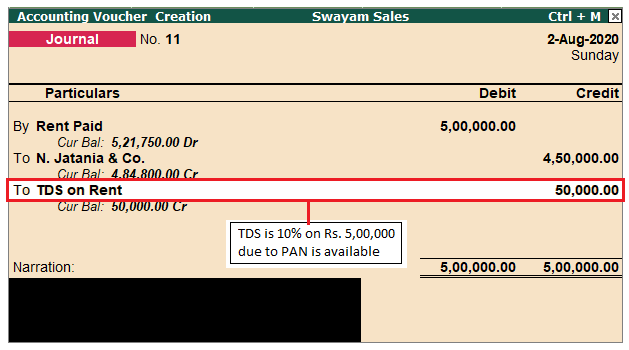

Step-4: TDS Transaction (Accounting for TDS on Expenses)

Go to Gateway of Tally > Accounting Voucher > F7: Journal and pass the Journal Entry as below :

Note : Out of Rs.5,00,000 towards Rent Paid to N. Jatania & Co, only Rs.4,50,000 is credited to party account and Rs. 50,000 ( i.e. 10% TDS) is transferred to TDS on Rent automatically and which is payable under Duties & Taxes.

4. TDS on Advance Payment against Expenses

You can create an accounting voucher for advance payments made directly or by a third-party, along with the applicable TDS.

Example :

On 01-08-2020, Swayam Sales paid an Advance of Rs. 1,00,000 on Rent to N. Jatania & Co. by cheque of Axis Bank Ltd.

Go to Gateway of Tally > Accounting Voucher > F5: Payment

Payment Voucher appears as shown below :

Note : When selecting TDS tax ledger, the TDS amount will automatically filled in the Amount field with Minus symbol (-) to deduct from the Advance amount i.e. 10% on Amount paid.

5. Recording Payment Transaction (TDS)

You can record a payment transaction with inclusion of the necessary TDS to be paid to the government.

Example :

On 1-9-2020, Swayam Sales paid TDS deducted in the month of August 2020 of Rs.60,000 to the Government directly by cheque of Axis Bank Ltd.

1. Go to Gateway of Tally > Accounting Vouchers > F5: Payment .

2. Click S : Stat Payment .

3. Select TDS as the Tax Type .

4. Enter the Period From and To dates.

5. Enter the Deducted Till Date .

6. Select the Section from the List of Section .

7. Select the required Nature of Payment .

8. Select the Deductee Status .

9. Select the Residential Status .

10. Select either bank or cash ledger in the Cash/Bank field. The payment voucher will be automatically filled with the relevant values. The Statutory Payment Details screen appears as shown below:

The Payment invoice appears as shown below automatically:

14. Press Enter or Press Ctrl+A to save the invoice.

|