This is called Recording Sales of Composite Supply under GST (Expenses Apportioning).

Composite supply means a supply is comprising two or more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately.

Illustration in Revised GST law : Where goods are packed, and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply. Insurance, transport cannot be done separately if there are no goods to supply. Thus, the supply of goods is the principal supply

You can record the sales of a composite supply using a sales invoice. The rate of tax applicable on the principal supply will be considered as the rate of tax for the composite supply.

Example:

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/04/2020 with Packing Charges of Rs.500, Delivery Charges with Rs.300 and there is a Discount of Rs.400 on total Sales value .

| Name of Product |

Qty. |

Rate |

Value |

Desktop HCL Infinity (GST-18%) |

1 Nos. |

30,000 |

30,000 |

Desktop Lenovo K200 (GST-18%) |

1 Nos. |

45,000 |

45,000 |

To create a ‘Discount on Sale’ / ‘Packing Charges’ & ‘Delivery Charges’ Ledger:

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name of the ledger ‘Discount on Sale’

3. Select Indirect Expenses as the group name in the Under field.

4. Set the option Inventory Values are affected to No.

5. Set the option Is GST Applicable? to Not Applicable.

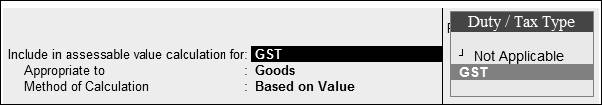

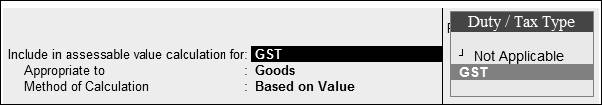

6. Select GST in the Include in assessable value calculation for: field.

7. Select Goods in the Appropriated to field.

8. Select Based on Value in the Method of Calculation field.

9. Press Enter to accept and save the ledger.

Note :

Like ‘Discount on Sale’ ledger as created above, you can create ‘‘Packing Charges’ & ‘Delivery Charges’ Ledger |

10. Example of GST Sales Invoice having Packaging Charges, Delivery Charges and Discount on Sale as below…

Note :

-

Remember, put the Discount on Sale Value with minus (-) symbol to deduct the amount form the invoice value.

-

All these Indirect Expenses can be given either in % or in Value

|

You can view the tax details by clicking Alt+A: Tax Analysis. Click Alt+F1: Detailed to view the tax break-up.

Note :

- Packing Charges, Delivery Charges and Discount on Sale is calculated Proportionately on the basis of Value of Goods.

|

|