1. GST on Advance Received from Customer if Turnover is more than Rs. 1.5 Crores

You need to pay GST for any advance received from Customer for supply of goods or services, if the supply is not fulfilled in the same period. Provided the Turnover of your business is over and above Rs. 1.5 Crores.

When a sales invoice is raised against an advance received in a different tax period, you need to track the sales against the advance received.

In this situation, first set the option Enable tax liability on advance receipts to Yes in the Company GST Details screen in F11: Statutory & Taxation Features to calculate tax liability on advance receipts.

The liability will be included in GSTR-1 and GSTR-3B returns.

Tally.ERP9 provides a detail transactions with all adjustments towards this GST on Advance Received with GST Compliance.

Example :

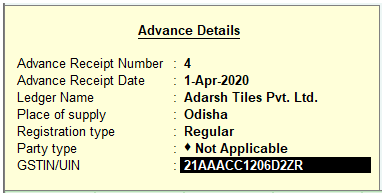

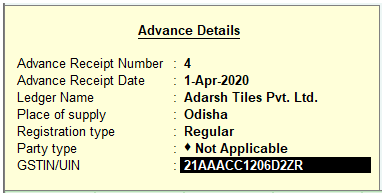

Received a cheque of Rs. 20,000 from Adarsh Tiles Pvt. Ltd. as an Advance against Sale of a ‘Laptop ACER 4720Z’ (GST @28%) in the month of April 2020.

In the same month, Laptop ACER 4720Z was sold to Adarsh Tiles Pvt. Ltd. for Rs. 35,000 with GST 28% on credit after adjusting the Advance amount of Rs. 20,000.

1. Go to Gateway of Tally > Accounting Vouchers > F6: Receipt .

2. Click N : Nature of Receipt > Advance Receipt to mark the voucher for advance receipt.

3. Account : Select the bank to which the payment will be made.

4. Select the Party ledger. Ensure the bill-wise details is enabled in the ledger master.

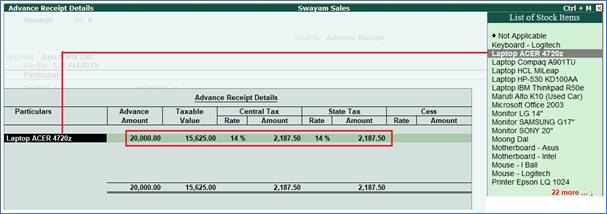

The Advance Receipt Details screen appears with the list of stock items.

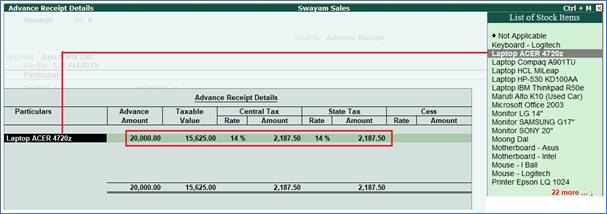

5. Select the stock item (goods enabled for GST) or ledger (services enabled for GST).

6. Enter the Advance Amount , which is inclusive of GST . You can adjust this against the sales invoice partially/fully, based on the sale value. At the end of the month, depending on the balance amount of the advance available, you can record a journal voucher to raise the liability.

Based on the amount entered, the break-up of the GST amount gets auto calculated for Central Tax , State Tax , and Cess , if applicable. The Advance Receipt Details screen appears as shown below:

7. Press Ctrl+A to accept the Advance Receipt Details screen and return to the receipt voucher.

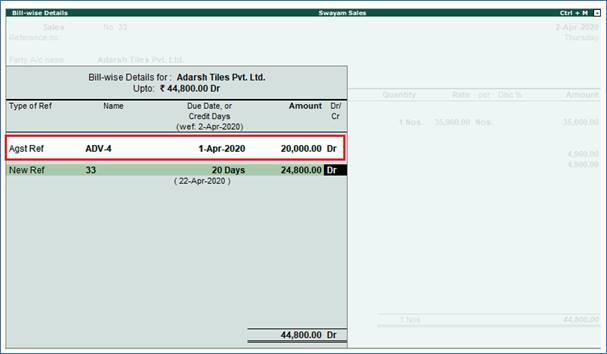

8. Select the type of reference as Advance and enter the reference details in the Bill-wise Details screen.

9. Accept the receipt voucher.

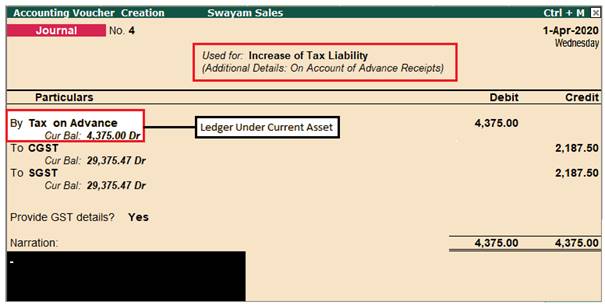

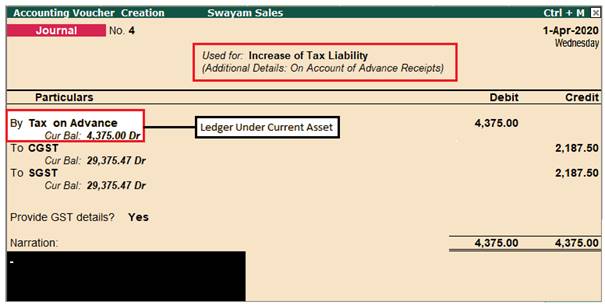

3. Journal Voucher to Raise GST Liability against Advance Received from Customer

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal .

2. Click J : Stat Adjustment .

3. Select the options as shown below:

4. Debit the ledger ‘ Tax on Advance’ grouped under Current Assets.

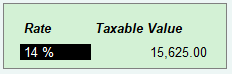

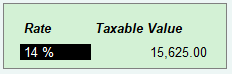

5. Credit the GST ledgers for the tax on advance receipt. Enter the tax Rate and Taxable Value in the GST Details screen displayed for each tax ledger.

6. Set the option Provide GST Details? to Yes .

7. In the Statutory Details screen, select the party ledger.

Note: Place of supply has to be entered. You need not provide the party details.

8. Press Enter to save.

9. Press Ctrl+A to accept the voucher.

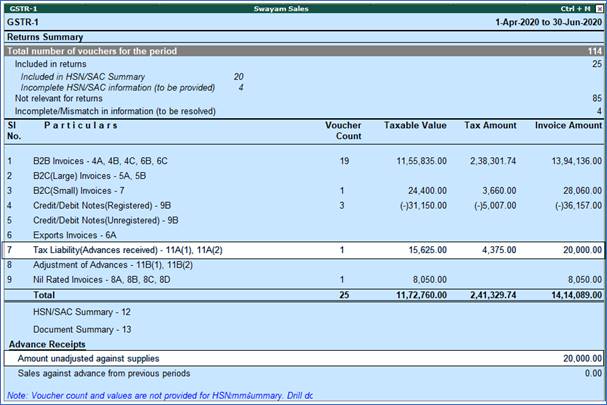

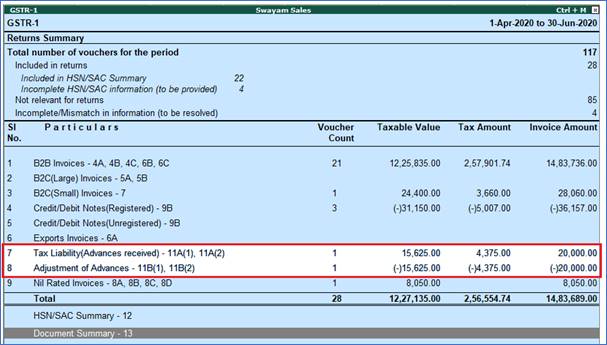

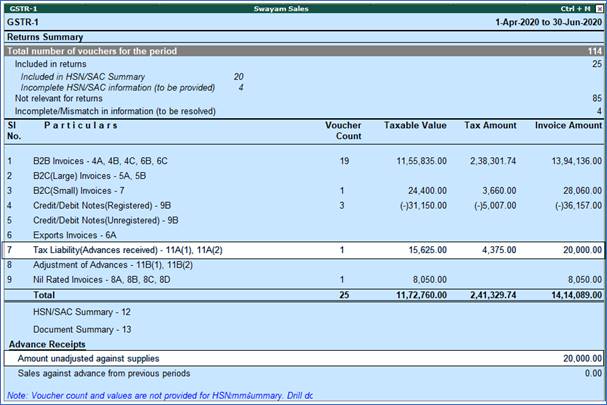

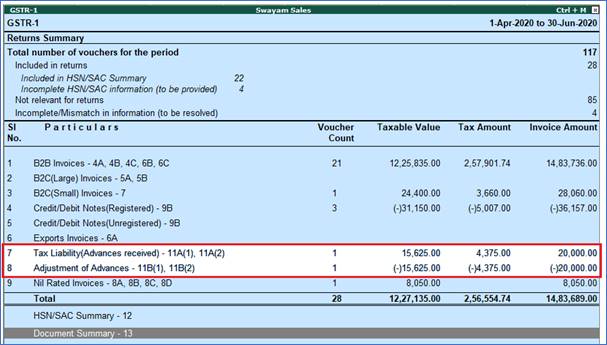

The tax liability raised on the advance amount appears in GSTR-1 , as shown below:

4. Reversing the GST Liability on Advance Receipt for Sales completed in the same month.

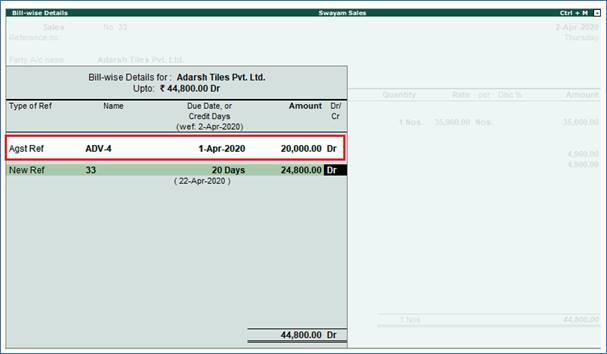

(A) Sales Invoice Linked to an Advance Receipt Voucher

When the sales invoice is recorded, the receipt voucher has to be linked to it by selecting the Type of Ref as Agst Ref in the Bill-wise Details screen of the sales invoice.

Note : Don’t forget to Set ‘No’ to “Use defaults for bill allocations” under F12 : Configure in Sales Invoice

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal .

Just reverse the entry made in Journal voucher at the time raise of Tax Liability against Advance Received from the Customer.

2. Click J : Stat Adjustment .

3. Select the options as shown below:

4. Debit the GST ledgers, and enter the tax Rate and Taxable Value in the GST Details screen displayed for each tax ledger.

5. Credit the expense ledger, or the ledger grouped under Current Assets for tax on advance receipt.

6. Set the option Provide GST Details to Yes . Enter the details of advance receipt and select the party ledger.

The GSTR-1 report appears as shown below:

|