The main concept of Trading activities are receipt of goods and delivery of goods. We generally call them PURCHASE or SALE activities. The trading items can be RAW MATERIAL, FINISHED GOODS, SEMI-FINISHED GOODS, etc. For better Organization you can use the group and sub-group for classification of the trading item.

Inventory Info Menu

You can create the inventory from this menu, which contains the following options :

-

Stock Group : Create your group here, for example, Raw Materials, Work-in-progress, Finished Goods, etc.

-

Stock Items : Create your Stock Items here, for example, TV, Sound System, VCD, etc.

-

Voucher Types

-

Unit of Measurement : Create your measurement Unit for Items, for example, LTR. MTR, PCS, BOX etc.

-

Quit : Exit from the menu.

Before creating the Inventory info menu we should know what stock groups, stock items and units of measurement are.

What are Items, Groups and Units ?

Definitions:

Stock Items :

Stock items are the primary inventory entity, like Ledgers. Usually it means Item or Product, which can be buying, selling or issue for production purpose. Each item is required to be accounted for, and receipt or issue needs to be created. In fact, you will create a stock ledger account for each item and Tally.ERP9 calls this account “Stock Item”.

Stock Units of Measure:

Stock Items are mainly purchased and sold on the basis of quantity. The quantity in turn is measured by units. You can measure the Stock Item by Units, like money is measured in Currency. For example, Liters, Meters, Kilograms, Pieces, Box, Dozen, etc. Units can be classified under the following types :

-

Single / Simple Units : When only one Unit is used for receipt and issue of stock items. Above-mentioned are all example of Single Units.

-

Compound Units: When two different types of Units can be used for receipt and issue of the Stock item is called compound unit. For example :

First Unit |

Conversion Factor |

Second Unit |

Dozen |

12 |

Pcs. |

Meter |

1000 |

Millimetres |

Box |

30 |

Pcs. |

Stock Group :

Stock Groups in Inventory are similar to Groups in Accounting Masters. They are helpful in the classification of Stock Items.

As per requirement of the business numerous items can be created, but to generate a report on similar types of stock items you need the classification of stock items. This classification will help you to get stock report in an organized manner. For example, Raw Material, WIP, Finished Goods, Hardware, Software, Electrical, Electronics, etc.

Grouping enables you to locate Stock Items easily and report their details in statements.

1. Creation of Single Stock Items one-by-one

Stock items are goods that you manufacture or trade (sell and purchase). It is the primary inventory entity. Stock Items in the Inventory transactions are similar to ledgers being used in accounting transactions.

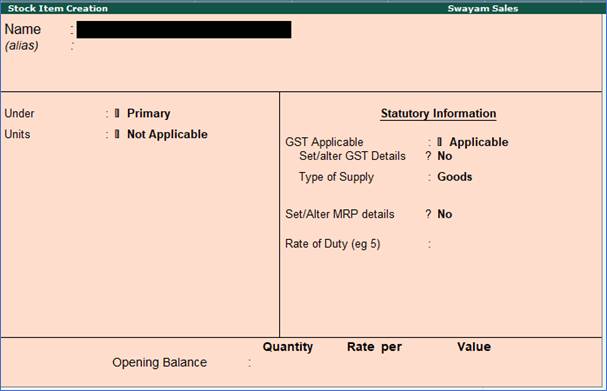

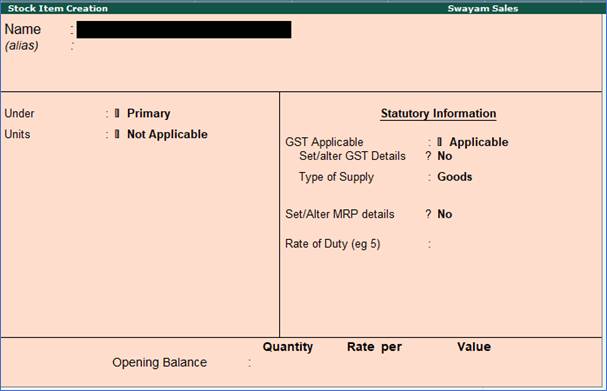

1. Go to Gateway of Tally > Inventory Info. > Stock Item > Create (under Single Stock Item ).

2. Enter the Name of the Stock Item.

3. Enter the Alias name of Stock Item (if required).

4. The field Under will show the List of Groups . Here you can select the Stock Group to which the Stock Item belongs. By default, Primary Stock Group appears in this field.

Note: You can create a new stock Group by pressing Alt+C at this field.

5. This field will show the Unit List . Here you can select the Unit of measure (UoM) applicable for the stock item. By default, Not Applicable appears in this field.

Note: You can create a new UoM by pressing Alt+C at this field. For stock items without UoM, the cursor will not move to the Quantity field during voucher entry.

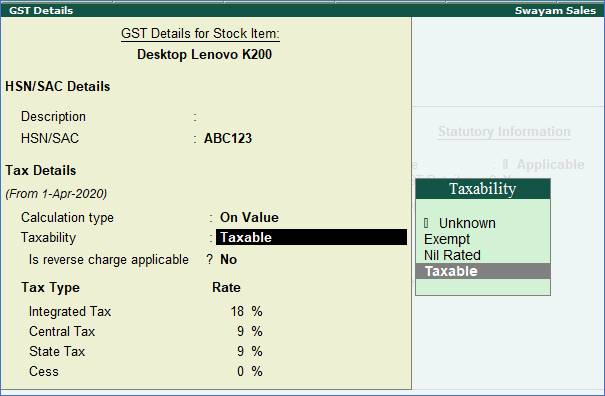

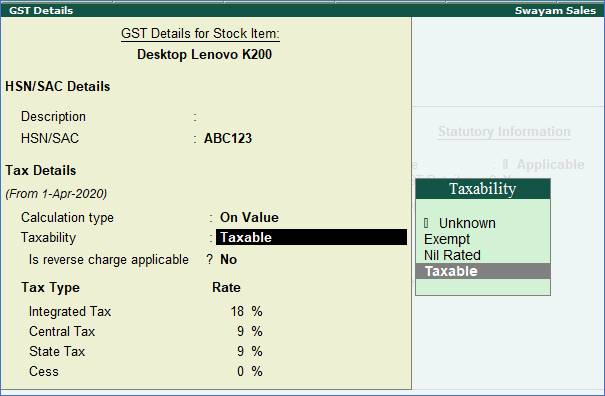

2. Setting GST Details in Stock Item ( Tax On Value)

6. If GST is enabled, set GST Applicable to Applicable and enter the GST details by enabling the option Set/alter GST Details to Yes. You will get the window of GST Details for Stock Item as below:

Taxability :

Select Taxable for goods and services that are classified as taxable type of supply under GST. Select Exempt , if the type of supply is exempted from tax under GST, or select Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.

Integrated Tax :

When you enter the integrated tax, state tax and central tax are calculated as half of the integrated tax specified. You can change state tax or central tax, and manage other GST details by using F12

configuration.

Press Ctrl+A to save.

7. Specify the details of Opening Balance , if any, for the Stock Item as on the date of Beginning of Books.

-

In the Quantity Field, specify the stock item Quantity.

-

In the Rate field, specify the stock item Rate.

-

In the Value field, Tally.ERP 9 automatically calculates the value by multiplying the Quantity and Rate. You can also edit the value, Tally.ERP 9 automatically refreshes the Rate field accordingly.

The Stock Item Creation screen appears as shown:

3. Setting Slab-wise GST Details in Stock Item (Tax On Item Rate)

1. Go to Gateway of Tally > Inventory Info. > Stock Items > Alter > select the item.

2. Set/Alter GST Details - Yes .

3. Calculation type - On Item Rate .

The Tax on Item Rates screen appears.

-

Consider additional expense/income ledger for slab rate calculation - Set this option to Yes when you want to apportion additional expenses in slab rate calculation for a stock item.

-

Under Rate , set the slab rates in Greater than and Up to .

-

Set the Tax Type and Integrated Tax Rate . The Central Tax Rate and State Tax Rate will get automatically calculated.

4. Press Ctrl+A to accept the GST Details screen.

5. Save the details in the Stock Item Alteration screen.

|