To use Tally.ERP 9 for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

GST Registrations are of two types…

1. GST Regular Scheme ( for Regular Dealer)

The GST regular scheme is for the general taxpayers whose turnover is above the threshold limit.

Under the GST regular scheme, all individuals with turnover above 40 lacs are required to take GST Registration. They are required to pay GST on goods & services as per the applicable rates and do regular GST return filing

2. GST Composition Scheme ( for Composite Dealer)

The composition scheme is meant for small businesses whose turnover of taxable goods not more than ₹1.5 crores, where GST has to be borne by the seller @1% of such turnover by traders, @2% by manufacturers, 5% for Restaurants & 6% for Service Providers.

A Composition Dealer has to issue Bill of Supply. They cannot issue a Tax Invoice. This is because the tax has to be paid by the dealer out of pocket. A Composition Dealer is not allowed to recover the GST from the customers.

1. Activate GST for Regular Dealers

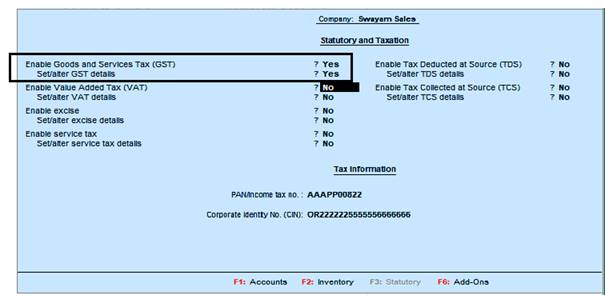

1. Open the company for which you need to activate GST.

2. Press F11 > F3 .

3. Enable Goods and Services Tax (GST) - Yes .

4. Set/alter GST details - Yes . The GST Details screen appears.

5. State - shows the State name as selected in the Company Creation screen. This helps in identifying local and interstate transactions according to the party's state.

6. Set the Registration type as Regular .

7. You can keep the rest default fields as same and don’t change ( but you can change as per your requirements)

2. Activate GST for Composition Dealers

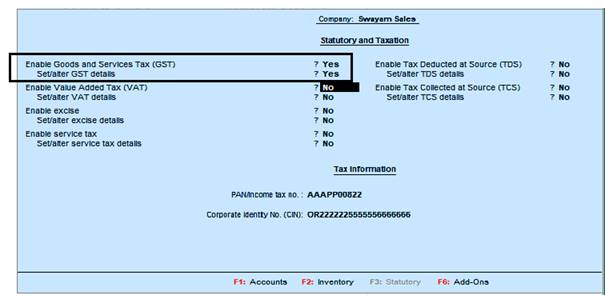

1. Open the company for which you need to activate GST.

2. Press F11 > F3 .

3. Enable Goods and Services Tax (GST) - Yes .

4. Set/alter GST details - Yes .

5. The State field helps in identifying local and interstate transactions according to the party's state. If you change the state here, the company details will get updated.

6. Set the Registration type as Composition .

7. Based on your business type, select the Basis for tax calculation .

[ For outward supplies, the total of taxable, exempt and nil rated will be considered as the Taxable Value .

For inward supplies, the total value of purchases made under reverse charge will be considered as the Taxable Value . ]

You can record transactions using the ledgers with GST details, and print invoices with GSTIN. |