With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. Let us take a look at what distinguishes each of them with some examples:

Supply |

GST Applicable |

Type of Supply |

Eligibility for ITC |

Examples |

Nil Rated |

0% |

Everyday items |

No |

Grains, Salt, Jaggery, etc. |

Exempted |

- |

Basic essentials |

No |

Bread, Fresh fruits, Fresh milk, Curd, etc. |

Zero Rated |

0% |

Overseas supplies, Supply to Special Economic Zones (SEZ) or SEZ Developers |

Yes |

- |

Non-GST |

- |

Supplies for which GST is not applicable but can attract other taxes |

No |

Petrol, Alcohol, etc. |

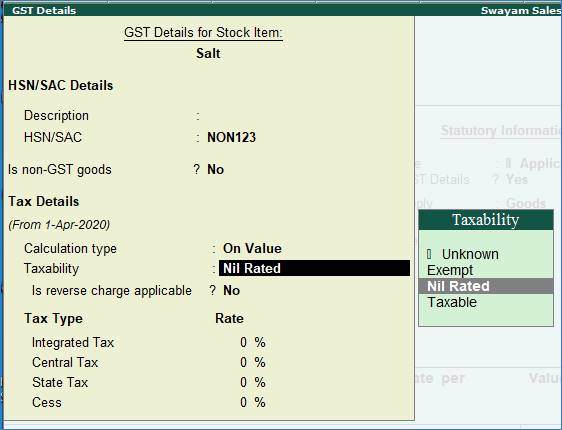

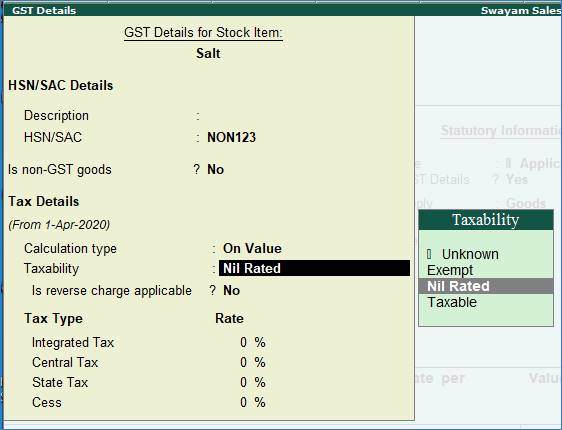

In case of above Items and Goods , the option Nil Rated / Exempt has to be selected as the Taxability in the GST Details screen of the item or item group master.

1. Creating ‘Nil-Rated’ , ‘Exempted’, ‘Zero Rated’ & ‘ Non-GST’ Items & Goods using Tally.ERP9

Stock items are goods that you manufacture or trade (sell and purchase). It is the primary inventory entity. Stock Items in the Inventory transactions are similar to ledgers being used in accounting transactions.

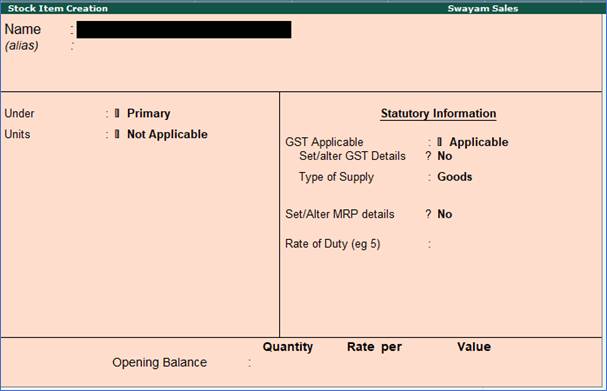

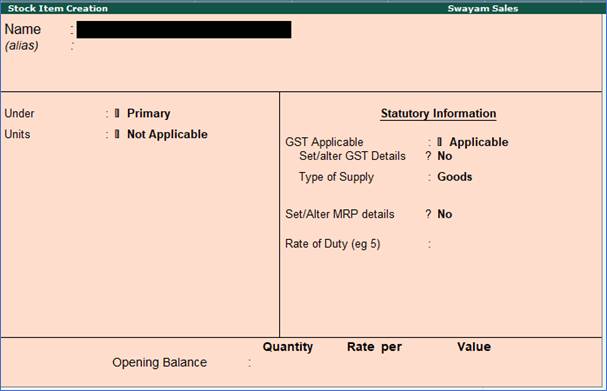

1. Go to Gateway of Tally > Inventory Info. > Stock Item > Create (under Single Stock Item ).

2. Enter the Name of the Stock Item.

3. Enter the Alias name of Stock Item (if required).

4. The field Under will show the List of Groups . Here you can select the Stock Group to which the Stock Item belongs. By default, Primary Stock Group appears in this field.

Note: You can create a new stock Group by pressing Alt+C at this field.

5. This field will show the Unit List . Here you can select the Unit of measure (UoM) applicable for the stock item. By default, Not Applicable appears in this field.

Note: You can create a new UoM by pressing Alt+C at this field. For stock items without UoM, the cursor will not move to the Quantity field during voucher entry.

2. Setting GST Details in Stock Item ( Tax On Value)

6. If GST is enabled, set GST Applicable to Applicable and enter the GST details by enabling the option Set/alter GST Details to Yes. You will get the window of GST Details for Stock Item as below:

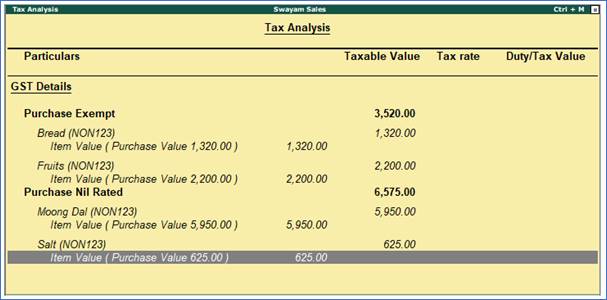

Transactions:

Purchase the following items in Cash from Registered Dealer which are Nil Rated and Exempted

Name of items |

Quantity |

Rate |

Value |

Moong Dal |

70 Kg. |

85 |

5950 |

Salt |

25 kg |

25 |

625 |

Bread |

60 Pcs. |

22 |

1320 |

Fruits |

20 Kg. |

110 |

2200 |

Purchase Invoice of above goods are given below :

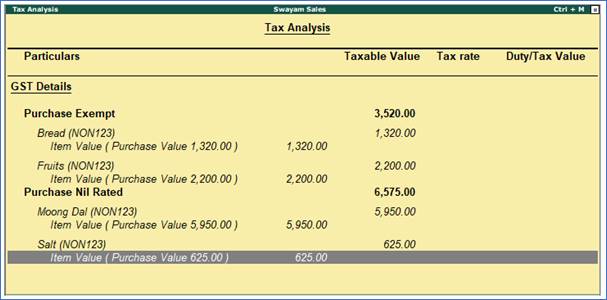

To see the Tax Analysis (Alt+A) with Details (Alt+F1) of the above invoice :

|