Creating Master Ledger with TDS Transaction i.e. Expenses, Party Ledger, TDS Ledger

You can create or alter an Ledger for your business expenses, along with the applicable TDS.

Example :

On 1.4.2020, Swayam Sales paid to N. Jatania & Co Rs.5,00,000 as Rent

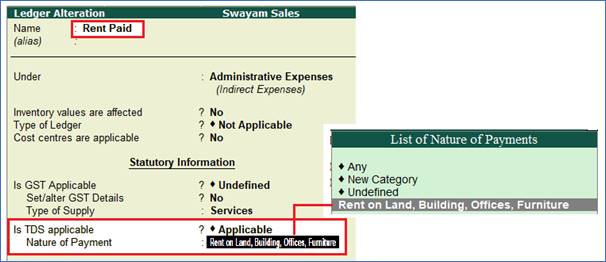

Step-1: Alter Expenses Ledger i.e. Rent Paid

Enable the option Is TDS Applicable ? and also Select the Nature of Payment from the List of Nature of Payments

The Ledger Alternation screen appears as shown below:

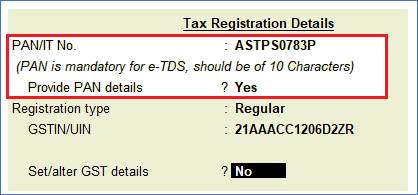

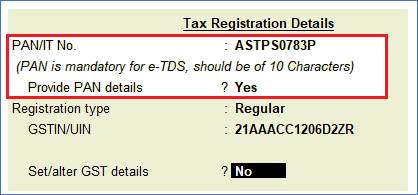

Step-2: Alter Party Ledger i.e. N. Jatania & Co ( Under Sundry Creditor) as below :

>> Enable the option Is TDS Deductible ? and Select a Deductee Type from the List and also Enable Deduct TDS in Same Voucher , if required

Note: TDS Rate will be 10% due to PAN is available and mention here, otherwise 20% will be calculated.

Step-3 : Create TDS Ledger i.e. TDS on Rent

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name and Select Duties and Taxes as the group name in the Under field, then Select TDS as the Type of Duty/Tax.

3. Select a Nature of Payment from the List of Nature of Payments.

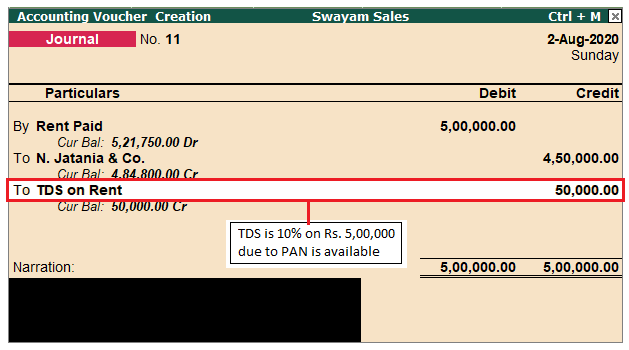

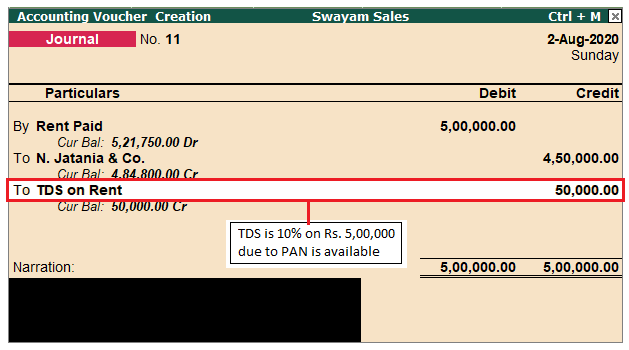

Step-4: TDS Transaction (Accounting for TDS on Expenses)

Go to Gateway of Tally > Accounting Voucher > F7: Journal and pass the Journal Entry as below :

Note : Out of Rs.5,00,000 towards Rent Paid to N. Jatania & Co, only Rs.4,50,000 is credited to party account and Rs. 50,000 ( i.e. 10% TDS) is transferred to TDS on Rent automatically and which is payable under Duties & Taxes.

|