How to record TDS payment (to government) entry in Tally.ERP 9?

All the Tax deducted during a month is to be paid to the credit of Government on or before 7th of the next month. In case 7th of the month happens to be a Sunday or a bank holiday payment can be made on the next working day.

TDS amount shall be paid to the government account through any designated branches of the authorised banks, along with Income Tax Challan No.281.

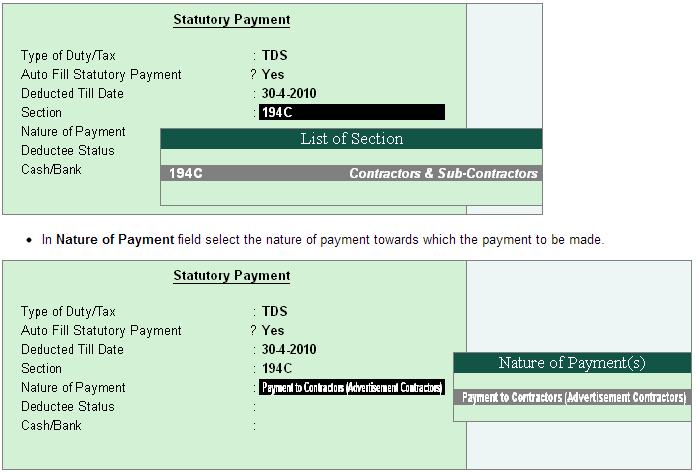

In Tally.ERP 9, from Release 2.0 all the Tax/Duty payments have to recorded using S: Stat Payment Button to auto compute or manually enter the TDS amount to the government.

Procedure to record TDS payment entry

Go to Gateway of Tally> Accounting Vouchers > F5: Payment

|