In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc.. they provide Service to the customer and provide Bill / Invoice with GST Compliance. So in this case, TallyPrime provides Accounting Invoice with auto GST Calculations, provided all Service Ledgers has to be created with GST Rate ( as applicable).

For Example:

Create a Ledger – Audit Fee with GST 28%

Setup:

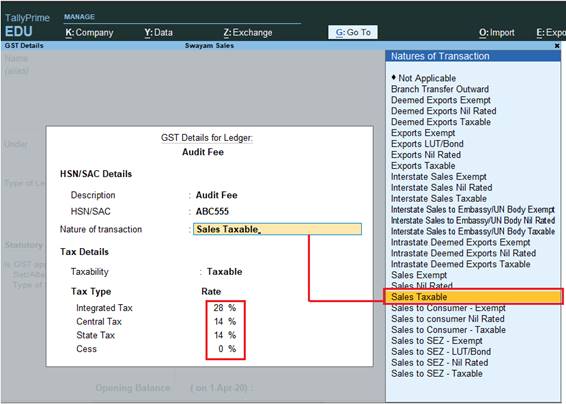

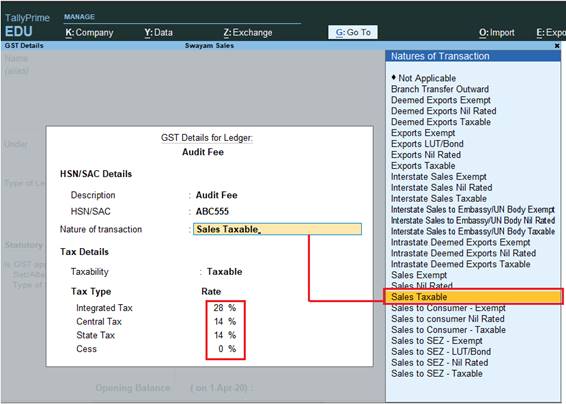

Create a Ledger, ‘Audit Fee’ under Direct Income with GST Applicable and Set/Alter GST Details – YES , with Type of Supply – Service as per screen below:

64 64

1. Set/alter GST Details - Yes , specify the details in the GST Details screen below, and save.

65 65

Nature of transaction : Select Sales Taxable from the Natures of Transactions List as above.

[Select Sales Exempt , if the type of supply is exempted from tax under GST, or select Sales Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.]

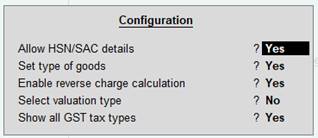

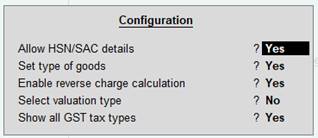

To specify further GST-related details , click F12: Configure .

66 66

2. Type of supply - Services .

3. Press Ctrl + A to save.

[Practical Assignment-7]

Create the following Service Ledger under Direct Income with GST Compliance :

Direct Income |

GST Rate |

Service Charges (12%) |

12% |

Installation Charges (5%) |

5% |

AMC Charges (15%) |

18% |

|

64

64 65

65 66

66