GSTR -3B must be filed by everyone who has registered for GST. In TallyPrime, you can view GSTR-3B in the report format with tax computation details. Also you can generate GSTR-3B, export the data in the JSON format, and upload it to the portal to file the returns.

- Gateway of Tally > Display More Reports > Statutory Reports > GST > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or select GSTR-3B > and press Enter.

Press F5 to switch between Return View and Nature View :

Return View : It displays the values in the actual Form GSTR-3B format.

Nature View : It provides the tax computation details with the taxable value and tax break-up for local and interstate supplies under taxable, exempt, and nil-rated categories.

1. Return View of GSTR-3B Report

Click F5 : Return View Format . The Return Format View displays the values in the actual Form GSTR-3B format. The values are captured under different sections of the form.

225 225

Specify the required reporting period by pressing F2 .

This Report has two sections…

- Return Summary and

- Table Particulars

1.1. Return Summary of GSTR-3B Report

This section displays a snapshot of business operations in the given period.

226 226

Displays the total number of vouchers. Drill down to view the Statistics report.

227 227

Displays the number of vouchers that are:

- Participating in return table : Displays the number of vouchers that are part of the return tables. Drill down to view the Summary of Included Vouchers .

228 228

- No direct implication in return tables : Displays the number of vouchers recorded as book entries that do not have an impact on the GSTR-3B returns. Drill down to view the Summary of Included Vouchers .

Displays the number of transactions that are excluded from the returns. Drill down to view the Summary of Excluded Vouchers .

229 229

Displays the count of all vouchers with insufficient GST-related information. You can correct exceptions in the vouchers before exporting GST returns. If the computed tax is not equal to the tax entered in the invoice, the transaction appears under Uncertain Transactions (Correction needed) . You need to update the missing information and resolve the mismatches to include these in the returns.

1. Drill down on No. of voucher with incomplete / mismatch in information. The Uncertain Resolution screen appears as shown below:

230 230

2. Select any transaction and press Enter.

3. Select or enter required information for the first exception type.

4. Correct the details and accept the screen. As always, you can press Ctrl+A to save.

>> Country, state and dealer type not specified :

Drill down from this line to view the vouchers of dealers with no information of country, state, dealer type or GSTIN.

>> Tax rate/tax type not specified :

Drill down from this line to view the vouchers where tax type or rate of tax is missing.

>> Nature of transaction, Taxable value, rate of tax modified in voucher :

Drill down from this line to view vouchers in which nature of transaction, assessable value or rate of tax defined in the ledger master was changed during recording of the transaction.

>> Incorrect tax type selected in tax ledger :

Drill down from this line to view the vouchers in which tax ledgers are not selected or are incorrectly selected.

>> Purchases from composition dealers with interstate Nature of transaction

Displays the count of transactions of interstate purchases from composition dealers.

>> Vouchers having conflicting nature of transactions :

Drill down from this line to view the vouchers that have two or more nature of transactions in which interstate and intrastate natures of transactions are selected in the same voucher.

>> Mismatch in Nature of transaction and Place of supply, Party's country :

Drill down from this line to view the transactions having mismatch in the nature of transaction, place of supply and party's country.

>> Mismatch due to tax amount modified in voucher

Displays the count of transactions in which difference is found between the calculated and entered tax amount.

>> Vouchers with incomplete/incorrect adjustment details :

Drill down from this line to view the journal vouchers with incorrect or incomplete adjustment details.

>> Vouchers having Reverse Charge and Other than Reverse Charge Supplies :

Drill down from this line to view vouchers that contain both reverse charge and other than reverse charge supplies. It Displays the count of transactions that have stock items that attract regular tax rates and are taxed under reverse charge.

>> Vouchers with incorrect/mismatch in values for Central Tax and State/UT Tax

Displays the count of vouchers in which there is difference in values of Central Tax and State/UT Tax.

2. Table Particulars (Computation details) as per GST Format of GSTR-3B Report

This section displays the taxable value and tax amount from outward supplies and inward supplies considered in the returns.

231 231

232 232

(a) Outward taxable supplies (other than zero rated, nil rated and exempted):

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from sales and sales-related transactions with or without reverse charge applicability with given format.

233 233

(b) Outward taxable supplies (zero rated) :

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from sales and sales-related transactions with given format.

234 234

(c) Other outward supplies (Nil rated, exempted) :

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from sales and sales related transactions with given format.

235 235

(d) Inward supplies (liable to reverse charge):

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns for purchase or purchase-related transactions with given format.

236 236

(e) Non-GST outward supplies :

Displays the Total Taxable value , Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with masters created by setting the option Is non-GST goods? to Yes . The given Format is below :

237 237

238 238

>> Supplies made to Unregistered Persons

Displays the Place of Supply , Total Taxable value , and Amount of Integrated Tax in separate columns from sales and sales-related transaction with given format.

239 239

>> Supplies made to Composition taxable persons

Displays the Place of Supply , Total Taxable value , and Amount of Integrated Tax in separate columns from sales and sales-related transaction with given format.

240 240

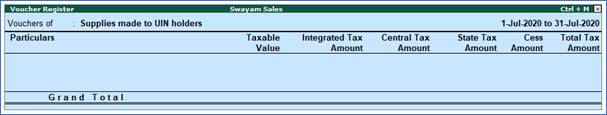

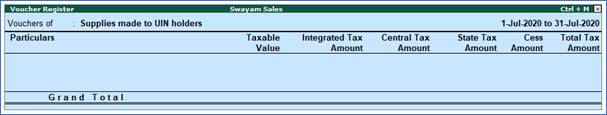

>> Supplies made to UIN holders

Displays the Place of Supply , Total Taxable value , and Amount of Integrated Tax in separate columns from sales and sales-related transaction with given format.

241 241

242 242

(A) ITC Available (whether in full or part)

243 243

(1) Import of goods :

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns with Nature of transaction as per given format.

244 244

(2) Import of services:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns with Nature of transaction as Imports Taxable with Type of Supply as Services as per given format.

245 245

(3) Inward supplies liable to reverse charge (other than 1 & 2 above):

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns as per given format.

246 246

(4) Inward supplies form ISD:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with given format.

247 247

(5) All other ITC :

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from purchase transactions recorded with given format.

248 248

(B) ITC Reversed

249 249

(1) As per rules 42 & 43 of CGST Rules:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with given format.

250 250

(2) Others:

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from journal transactions recorded with given format.

251 251

(C) Net ITC Available (A)-(B)

Displays the auto calculated values.

(D) Ineligible ITC

(1) As per section 17(5):

Displays the Integrated Tax , Central Tax , State/UT Tax , and Cess in separate columns from purchase and purchase-related transaction with given format.

252 252

253 253

>> From a supplier under composition scheme, exempt and nil rated supply:

Displays the taxable value from all purchase and purchase-related transactions as given format.

254 254

>> Non GST supply:

Displays invoice value from a transaction recorded with ledgers or items created by setting the option Is non-GST goods? to Yes . The value is displayed in Inter-State supplies column if the supplier is from a different state and in the Intra-State supplies column if the purchases are made from a local supplier. The given format is..

255 255

>> Interest:

Displays the value of the journal voucher recorded with Nature of adjustment as Increase of Tax Liability , and Additional Details as Interest .

>> Late Fees:

Displays the value of the journal voucher recorded with Nature of adjustment as Increase of Tax Liability , and Additional Details as Late Fees .

2. Nature View of GSTR-3B Report

Click F5 : Nature View Summary .

256 256

The Nature View provides the tax computation details with the taxable value and tax break-up for local and interstate supplies under taxable, exempt, and nil-rated categories.

Press Alt+F1-Details to view in details with Taxable in Rates as given below :

257 257

Outward Supplies (Sales):

258 258

Press Enter key, Drill down to view the Summary of Sales of Local Sales or Interstate Sales as per GST Rate wise..

Local Taxable Sale @ 5% as Voucher Register:

259 259

Similarly, you can view and drill down Sales @ 12%, Sales @ 18% , Sale @ 28% both Local and Interstate Sales.

Inward Supplies (Purchases):

260 260

Similarly, Press Enter key, Drill down to view the Summary of Purchase of Local or Interstate Purchase as per GST Rate wise.

3. Generate GSTR-3B Returns in the JSON Format from TallyPrime to Upload in GST Portal

In TallyPrime, you can export data in the JSON format and upload it to the portal for filing the returns.

Ensure that all exceptions regarding incomplete/mismatch in information are resolved before printing or exporting the GSTR-3B report.

1. Gateway of Tally > Display > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or search GSTR-3B > press Enter.

2. F2: Period – select the period for which returns need to be filed.

3. Press Alt+E (Export) and select E-Return from the menu.

4. Select JSON (Data Interchange) as the File Format.

5. Enter the export location in the Folder path field.

6. Retain the File Name of the GSTR-3B JSON file.

7. Press Enter.

261 261

8. Click Send to Export.

Upload the JSON file to the portal for filing returns.

Ensure the MS Word application is available in your computer to view the form.

1. Gateway of Tally > Display > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or search GSTR-3B > press Enter.

Press Alt+P (Print) and select Return Form from the menu.

If negative net values exist in any of the tables, the same will be printed as per the e-filing requirements.

262 262

In the Print Report screen, press Enter or click Print button. GSTR-3B is created in the word format.

263 263

Press Ctrl+S to save the word file.

You can print the word file and use the hard copy to fill information online or directly copy and paste the values from the MS Word file to the online form. |

225

225 226

226 227

227 228

228 229

229 230

230 231

231 232

232 233

233 234

234 235

235 236

236 237

237 238

238 239

239 240

240 241

241 242

242 243

243 244

244 245

245 246

246 247

247 248

248 249

249 250

250 251

251 252

252 253

253 254

254 255

255 256

256 257

257 258

258 259

259 260

260 261

261 262

262  263

263