Query

How to account Sales Commission and deduct TDS in the same voucher?

Solution

In Tally.ERP 9, from release 1.8 you can record sales commission transactions in Credit Note and Deduct

TDS on Commission

Example:

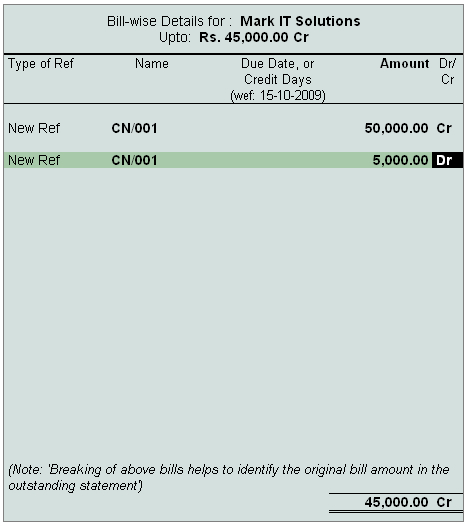

ABC Company sells the goods to partners on a condition that, on each sales Rs.100 will be paid as sales commission. To account sales commission separate expense entry is not booked in Journal but directly a credit note is raised in favour of the partner (to reduce party outstandings) and TDS is deducted on commission. As on 15-10-2009 ABC Company has to pay Rs. 50,000 commission (sales) to partner Mark IT Solutions.

1. Record the transaction in Credit Note

Set up: Ensure in F11: Features (F1: Accounting Features) following options are set to Yes

Go to Gateway of Tally > Accounting Vouchers > Ctrl + F8: Credit Note (Account Invoice Mode)

-

In Party A/c Name field select Mark IT Solutions

-

Under Particulars field select Commission Charges Ledger to account commission expenses

-

In Amount field enter Rs.50,000 (total commission due for the party)

-

Under Particulars select TDS - Commission Or Brokerage ledger to deduct TDS on the payment of commission.

-

In TDS Details screen

-

In Type of Ref field select New Ref

-

In Name field accept the default Reference Number –CNote/ 3-1

-

In Nature of Payment field select Commission Or Brokerage will be defaulted automatically

-

Assessable Amount and TDS Amount field details are defaulted automatically, based on the information provided in the voucher

|