Displays invoices that have e-Way Bill number and date.

- Go to Gateway of Tally > Display > Statutory Reports > GST > e-Way Bill > e-Way Bill Report .

Alternatively, you can press Ctrl+R from Export for e-Way Bill or Update e-Way Bill Information reports to view this report.

-

In this report, you can:

-

Click F4: party and select the required party ledger.

-

Press Ctrl+G for status-wise view of Export for e-Way Bill report.

-

Press Ctrl+I to enter the e-Way Bill number and date in the Update e-Way Bill Information report.

-

Press Ctrl+W to enter the e-Way Bill details for the invoice in Manage e-Way Bill screen (same as Statutory Details screen of the invoice).

Invoices with e-Way Bill Information

- The report displays invoice details as shown below:

In this report, you can click C : Consolidated to group the invoices based on mode, vehicle number, place and state.

Consolidated e-Way Bill View

- Click C : Consolidated to view the grouping based on mode, vehicle number, place and state.

In this report, you can:

- Click C : Invoice-wise to view the details of individual invoices.

- Press Ctrl+U to enter the consolidated e-Way Bill invoice number and date.

- Select more than one invoice (press Spacebar ), and press Ctrl+E to create JSON for consolidated invoices as shown below:

The options in Update Consolidated Details appear only when the details are not provided in the invoices selected for export. The Mode, Vehicle No. , From Place and State entered here, will be updated in the invoices.

Export Data to JSON Preparation Tool, and Create JSON

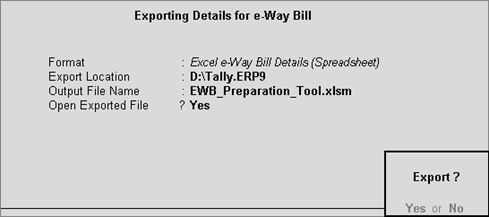

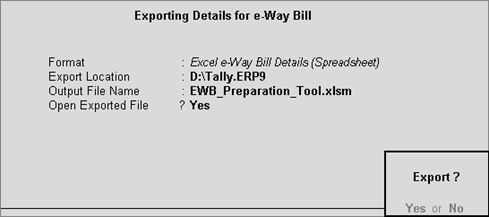

When you save the invoice enabled with the option to Export e-Way Bill details from invoice after saving , the Export Details for e-Way Bill screen appears. The default format is set to JSON e-Way Bill Details (Data Interchange) . To download the tool, and export:

-

Go to GST portal , click e-Way Bill System > Click here to go to e-Way Bill Portal .

-

In the e-Way Bill system , click HOW TO USE > Tools > Bulk Generation Tools .

-

Under JSON Preparation Tools , choose the required tool to download:

-

Copy the downloaded file to the Export Location of Tally.ERP 9.

In the Export Details for e-Way Bill screen, select the Format as Excel e-Way Bill Details (Spreadsheet)

-

Press Enter to export. The file opens.

-

Click Validate . On successful validation click Prepare JSON .

-

Upload the JSON to portal to generate the e-Way Bill

|