Once you activate GST in your company, you can record the purchase of goods and services that attract GST using a purchase voucher. Ensure that you provide unique voucher numbers for your purchase vouchers, and use a new series of voucher numbering.

A. Local purchase

B. Interstate purchase

A. Local GST Purchase using Tally.ERP9

The purchase of goods or services from a supplier in the same state attracts central tax and state tax.

Method-1 : To Record a Local Purchase Transaction

[ Using Common Ledger Account for all items with same Tax Rate]

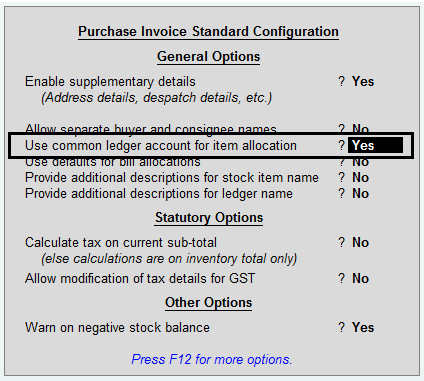

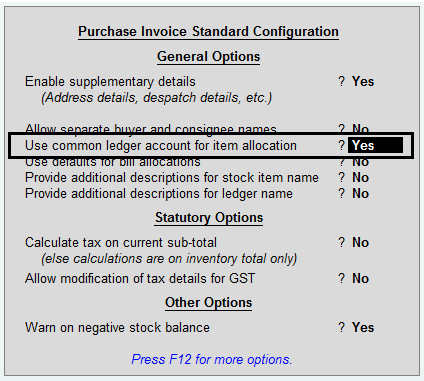

During Purchase Voucher (F9) Entry Press F12 and Set YES as below :

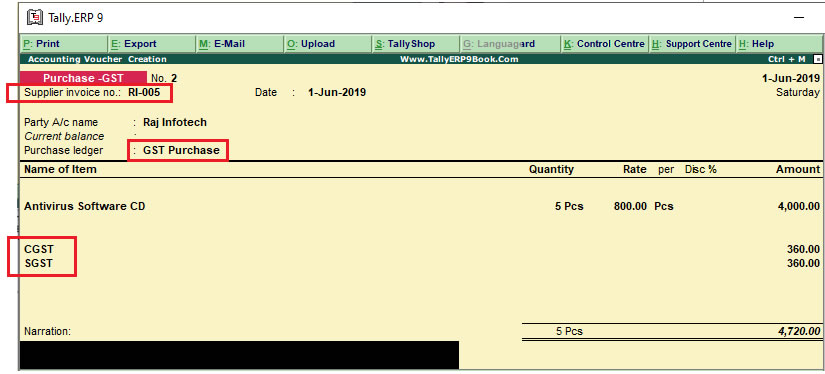

As per our Practical Example No.1

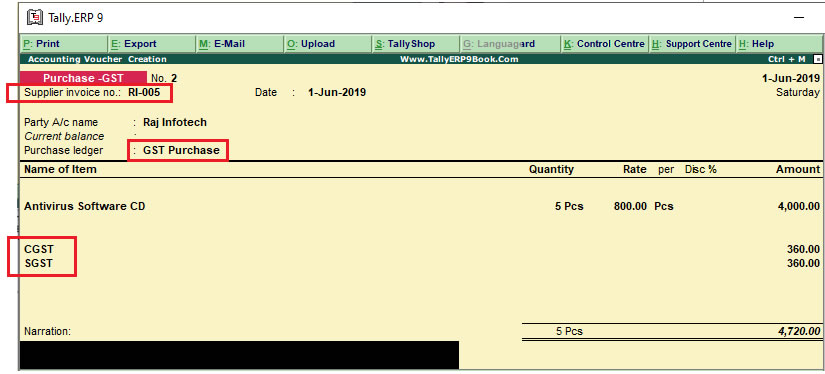

Purchase from Raj Infotech, 5 CDs of Antivirus Software @ Rs. 800 each, with Input GST rate @ 18%. i.e. Rs.. 720 - [ CGST (9%) Rs.360 and SGST (9%) Rs.360 ]

1. Go to Gateway of Tally > Accounting Vouchers > F9: Purchase.

Supplier invoice no.: Displays the sales invoice no. of the supplying party.

Date: Displays the date on which the sales invoice was passed by the supplier.

2. In Party A/c name, select the supplier's ledger i.e. Raj Infotech

3. Select the Purchase Ledger applicable for local taxable purchases i.e. GST Purchase (Local)

4. Select the required Items, and specify the Quantities and Rates.

5. Select the GST Tax Ledgers. As above i.e. Input CGST & Input SGST (for Local Purchase). GST

Calculation will be done automatically on the basis of Items GST Rate.

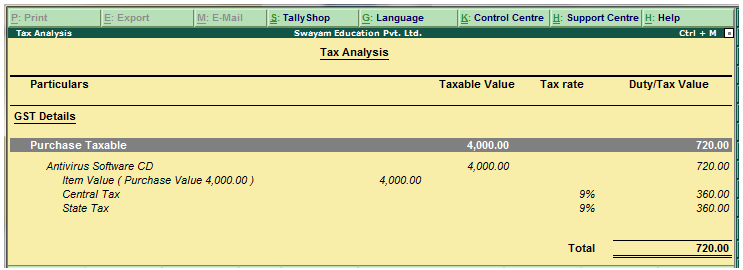

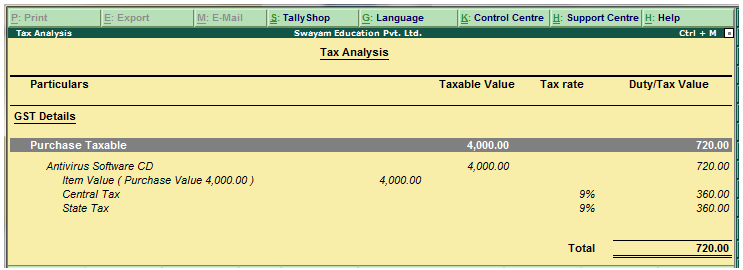

You can view the tax details by clicking A: Tax Analysis. Click F1: Detailed to view the tax break-up.

|