B. Inter-State Purchase (Outside State)

As per our Practical Example No.3

Purchase 2 ‘Hp-Laptop’ @ Rs. 45,000 with Input IGST @ 18% i.e. Rs. 16,200

and

2 Mi-Note 4 Mobiles @ Rs. 10,000 each with Input IGST 12% i.e. Rs.2,400 – in Cash from Outside State – West Bengal from Registered Shop.

In the above example…Purchase of Multiple Items GST Rates in one Purchase Bill.

1. Go to Gateway of Tally > Accounting Vouchers > F9: Purchase.

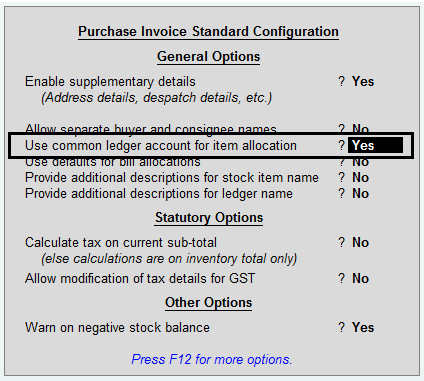

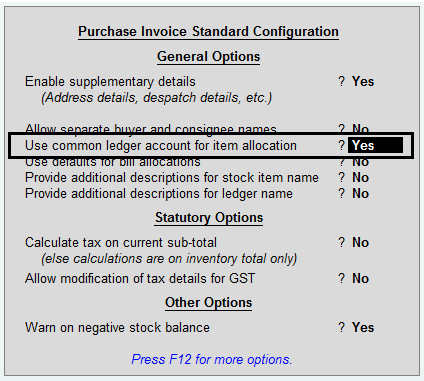

During Purchase Voucher (F9) Entry Press F12 and Set YES as below :

- Follow the steps used for recording a local purchase transaction, with the following changes:

- In Party A/c name, select Cash ledger i.e. Cash .

The Supplementary Details should be as below with Address, State, GST Registration Type , GSTIN/UIN & Type of Dealer :

Depending on the LOCATION of the Supplier, you can record a Local or Inter-State Purchase transaction with the applicable GST Rates assigned in Items and Goods.

You can view the tax details by clicking A: Tax Analysis. Click F1: Detailed to view the tax break-up.

|