You need to create party ledgers to record business transactions with various parties such as suppliers, customers, and so on.

On this page as per our Practical Examples ….

>> Raj Infotech

>> Microtek India Ltd.

>> Rajib Roy & Sons

>> H. Goenka Traders

A- Creating Supplier Ledger for GST in Tally.ERP9

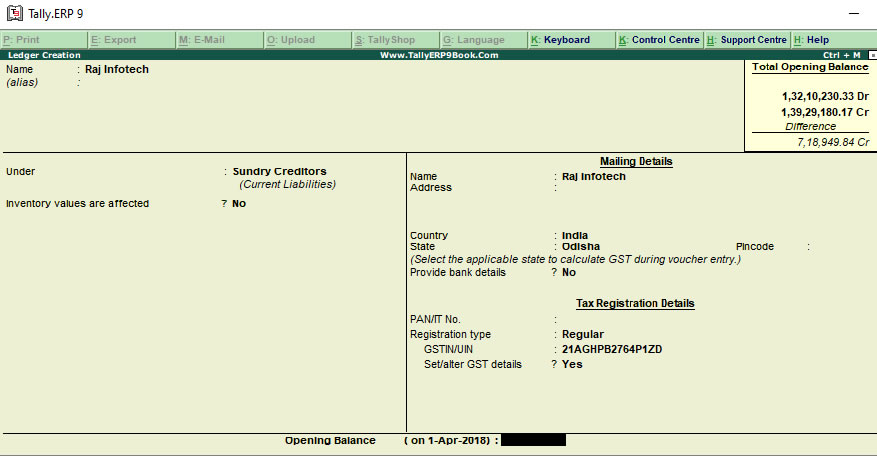

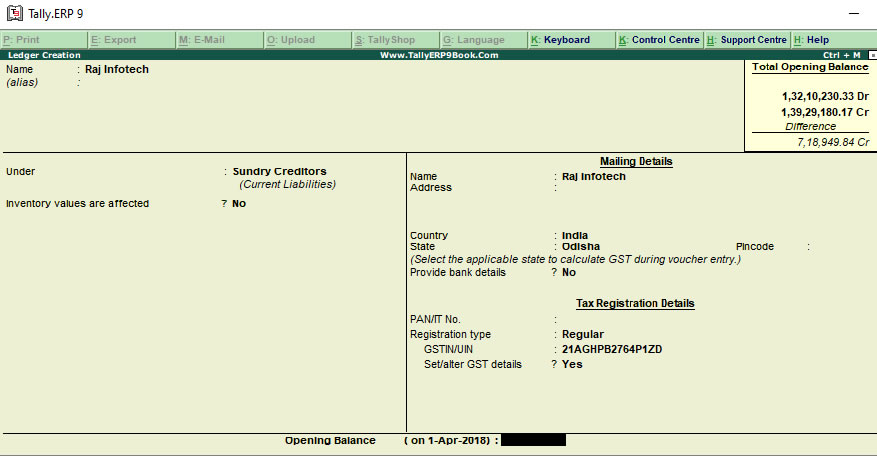

To create a supplier ledger i.e. Raj Infotech

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name of the supplier's ledger i.e. Raj Infotech .

3. Select Sundry Creditors from the List of Groups in the Under field.

4. Set the option Inventory values are affected? to No,.

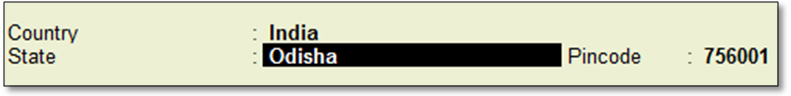

5. In Mailing details, the State is your default local State. You can change name of State from the State List if your Suppliers belongs to Outside State.

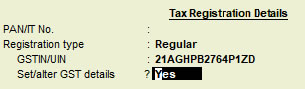

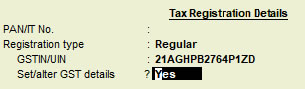

6. Enable the option Set/Alter GST Details? to open the GST Details screen.

-

Select the relevant Registration Type from the List of registration Types.

-

Enter the 15-digit GSTIN or UIN issued by the tax authority.

-

If the supplier is an e-commerce operator, then enable the option Behave as e-Commerce Operator?

The GST Details screen appears as shown below:

The Ledger Creation screen appears as shown below :

7. Press Enter to save.

Similarly…. Create the Supplier Ledger ‘ Microtek India Ltd. ‘ as per above |