Answer

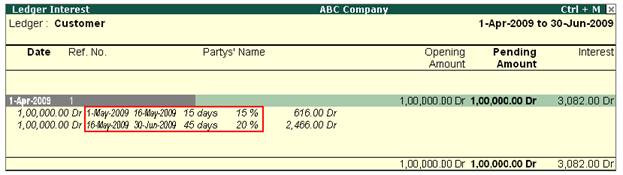

The interest amounts calculated in

different ways are shown in the Interest Calculation Report. However,

these have not been brought into books and they simply give you the interest

implications. You must book them if you want them to

be entered into the books.

Entering Calculated interest amount

The

calculated interest amounts are entered using the Debit and Credit

Notes with Voucher Classes.

The Debit

notes are used for the Interest receivable while the Credit

Notes are used for the Interest payable.

Interest

is calculated on a Simple or Compound basis and separate voucher classes should

be used for them.

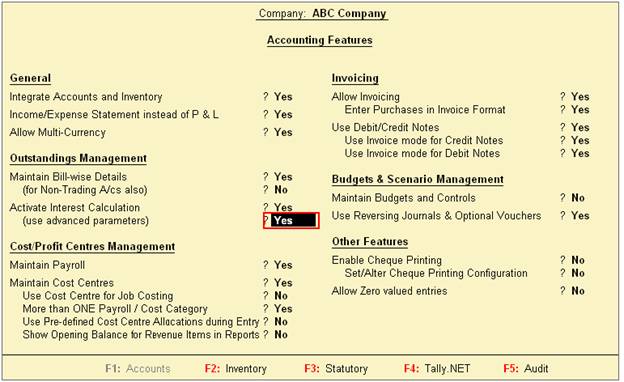

Set-up

Debit/Credit Note Classes for Interest entries

We

will now discuss the set up of Debit Notes, since the Credit Notes behave

in the same way (in the case of Interest payable).

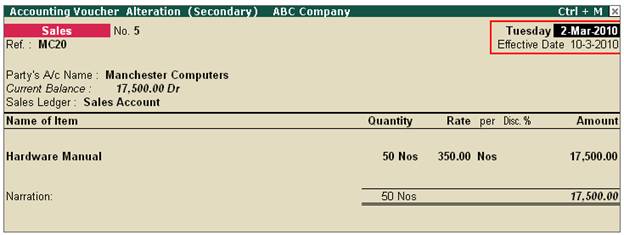

- Assume

you have raised an invoice to your debtor ‘M/s Blue Nile Stationeries for

Rs.44,200 on 1st Feb 2009 and have given a

Credit Days of 20, so the invoice would fall due on 21st Feb 2009. The Interest rate is set to 12% per 365-Day Year and is

calculated Transaction-by-Transaction, as shown below:

[5-1A]

Let

us see the accounting of interest amount for the above, if the same is treated

as:

(a)

Simple Interest

(b)

Compound Interest

In

case the interest amount is treated as Simple Interest

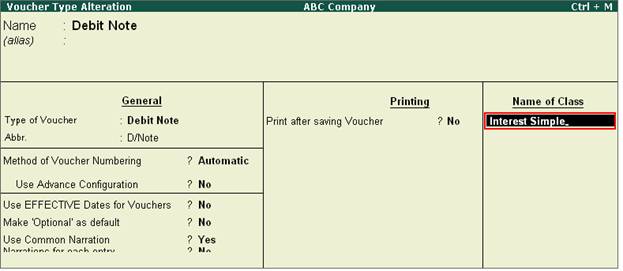

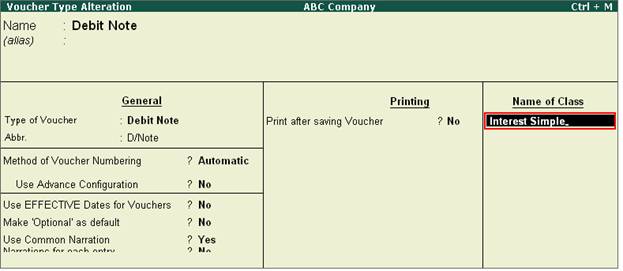

a) Alter the Voucher Type

Debit Note. Tab down to the field

Class and type a class name, for example Interest-Simple

[5-1B]

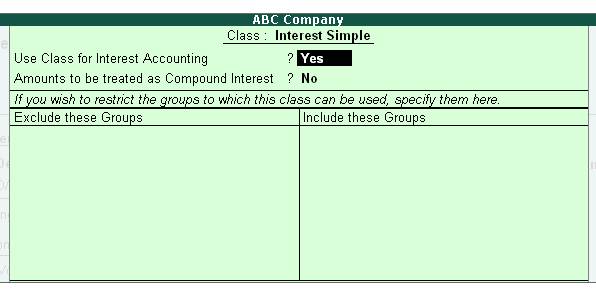

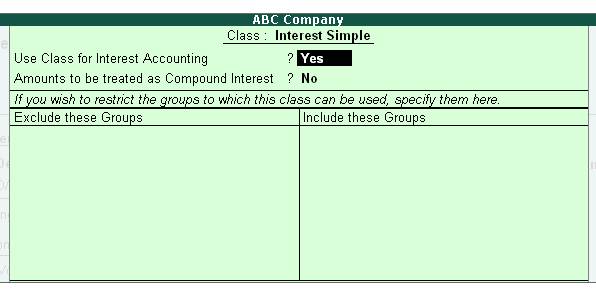

b) Set Yes to Use

Class for Interest Accounting? and save the voucher

type.

[5-1C]

c) Create a ledger Interest

Received under the group Indirect

Incomes

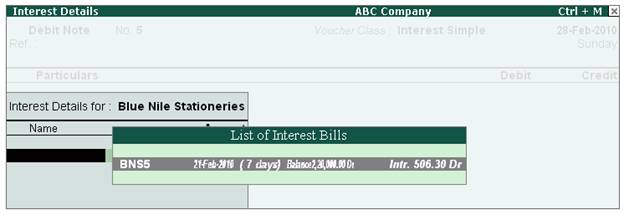

d) Debit Note Entry

Go to Accounting

Voucher > Debit Note (Ctrl+F9) > Select the Class Interest-Simple

[5-1D]

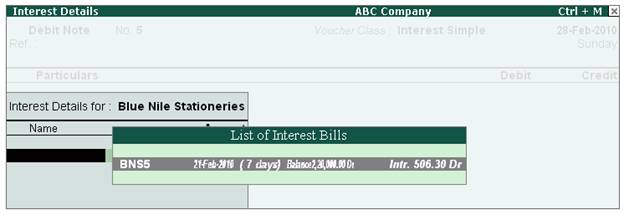

e) Say for instance, we are

passing the entry on 28th April 2009, so enter the

same. Debit Blue Nile Stationeries > it will

automatically display the List of Interest Bills under the Interest Details pop

up screen, the interest amount due as on the debit note entry date > Select

the particular interest reference > Credit Interest

Received and save the voucher.

[5-1E]

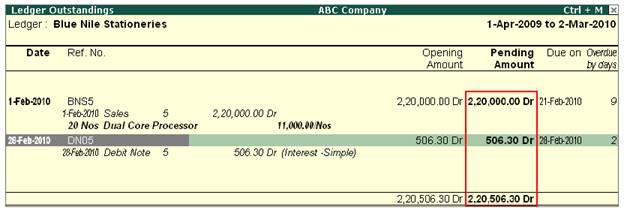

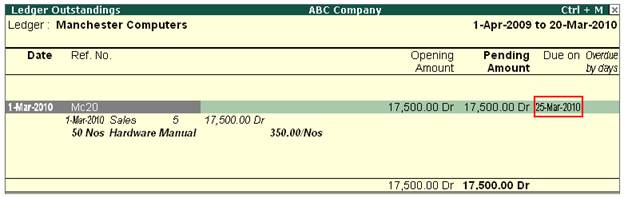

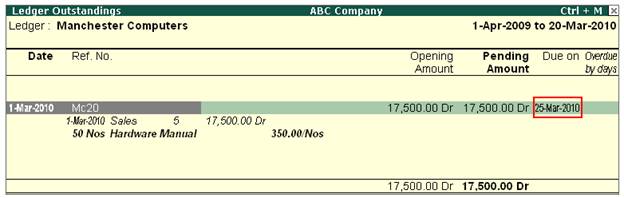

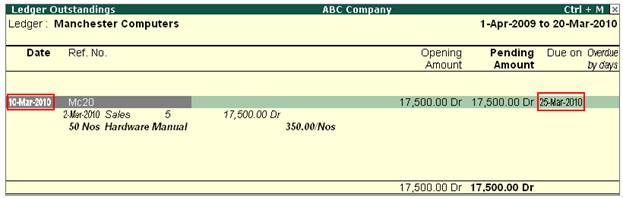

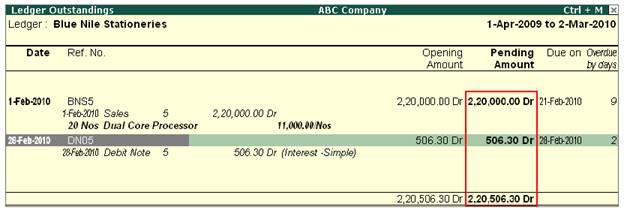

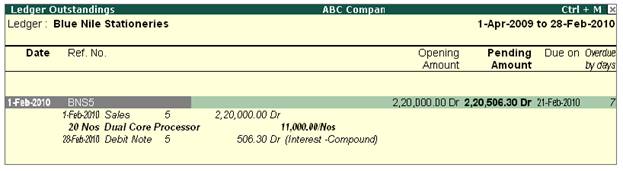

f) Outstanding Statement

Go to the Outstanding Statement ie, Display

> Statement of Accounts > Oustandings > Ledger > Blue

Nile Stationeries >

You will see interest amount also added in the outstanding statement in a

separate line showing the date and reference no. of the Debit Note entry

passed, which gives you the total outstanding amounting to Rs.2,20,506.30 (2,20,000 + 506.30) as

on 28th Feb 2009.

[5-1F]

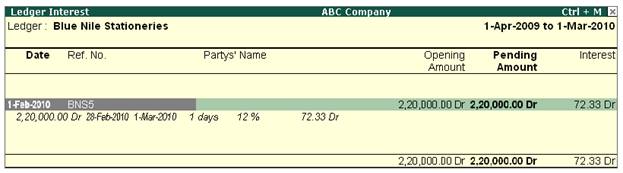

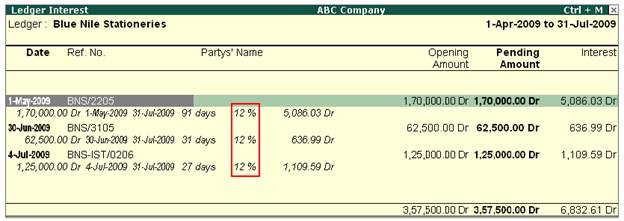

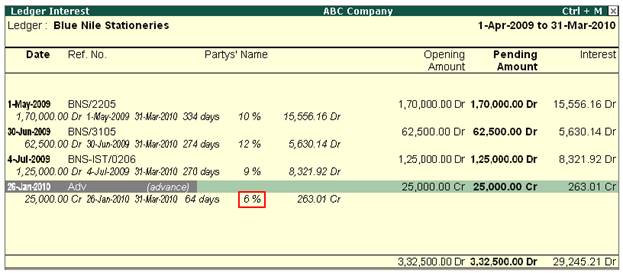

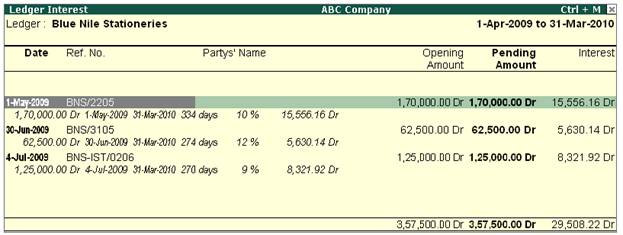

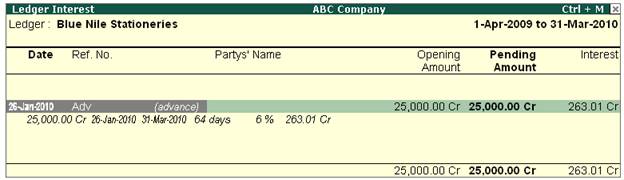

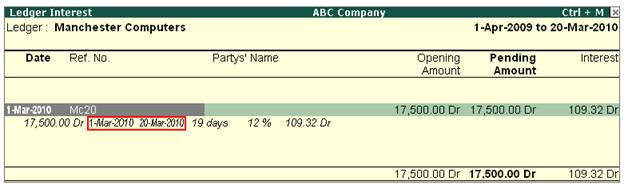

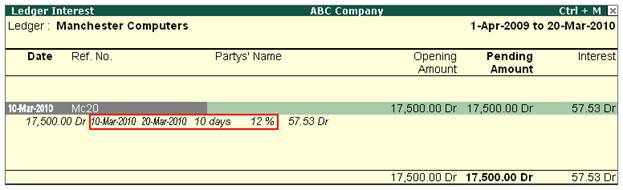

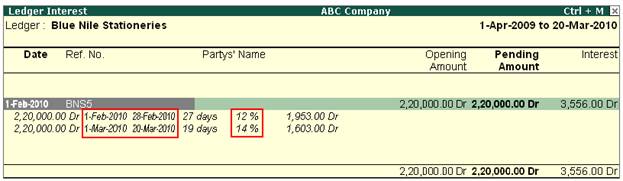

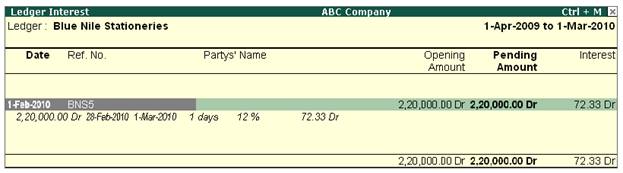

g) Interest Report

View the Interest calculation report as on 1st March 2009, ie, Go to Display

> Statement of Accounts > Interest Calculations > Ledger > Blue

Nile Stationeries > F2: Period = 1-4-2009 to 1-3-2010.

Since the interest amount was charged to the party on 28th Feb 2009, interest is

calculated for 1 Day and will show Rs. 72.33 as interest receivable (ie,

220,000 * 12/100/365*1 = Rs. 72.33)

[5-1G]

h) Pass the receipt entry

normally as usual ie, Cr. Dynamic

Computers > select the relevant pending references/bills,

Credit Cash/Bank Account.

In

case of interest amount treated as Compound Interest:

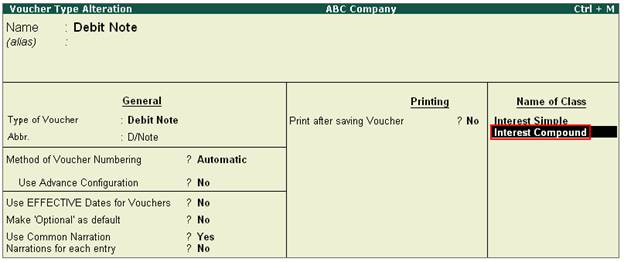

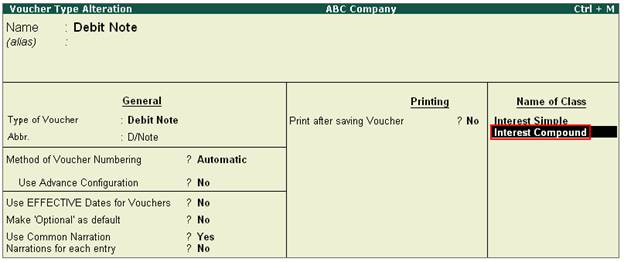

a) Alter the Voucher Type

Debit Note. Tab down to the field Class, and type a class name, for example Interest-Compound

[5-1H]

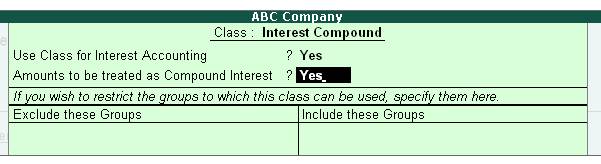

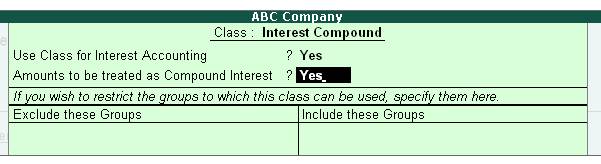

b) Set the option Use

Class for Interest Accounting? and Amounts

to be treated as Compound Interest? to 'Yes' and save the voucher

type.

[5-1I]

c) Create a ledger Interest

Received under the group Indirect

Incomes

d) Debit Note Entry

Go

to Accounting Voucher > Debit

Note (Ctrl+F9) > Select the Class Interest

- Compound

[5-1J]

e) Say for instance, we are

passing the entry on 28th April 2009, so enter the

same. Debit Blue Nile Stationeries > it will

automatically display List of Interest Bills under Interest Details pop up

screen, the interest amount due as on the debit note entry date > Select the

particular interest reference > Credit Interest

Received and save the voucher.

[5-1K]

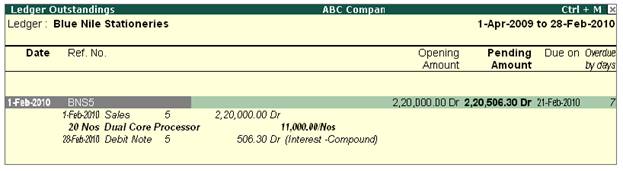

f) Outstanding Statement

Go to the Outstanding Statement ie, Display >

Statement of Accounts > Oustandings > Ledger > Blue Nile

Stationeries > You will see the interest amount also

added to the principal amount of the bill in the outstanding statement. The

Opening Amount of the bill is Rs.220000 and the Pending Amount as on 28th Feb 2009 is Rs.220506.30

(220000 + 506.30).

[5-1L]

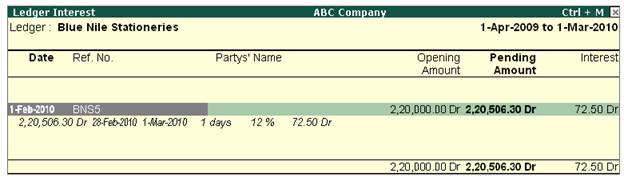

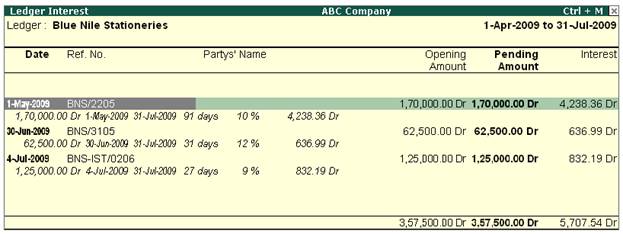

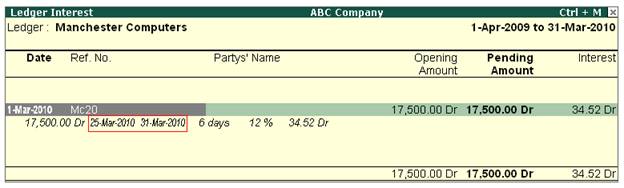

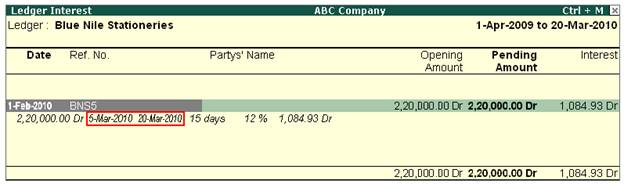

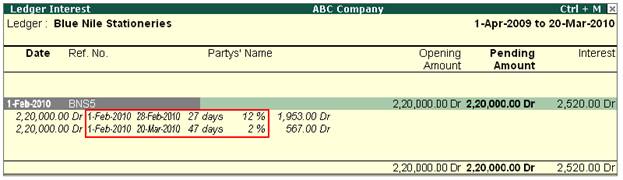

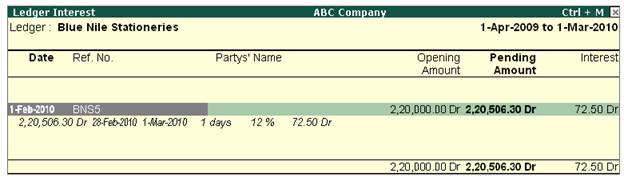

g) Interest Report

View the Interest calculation report as on 1st March 2009, ie, Go to Display

> Statement of Accounts > Interest Calculations > Ledger > Blue

Nile Stationeries > F2:

Period = 1-4-2009 to 1-3-2010.

Since the interest amount was charged to the party on 28th Feb 2009, interest is

calculated for 1 Day. It will calculate the interest on the compound value ie,

on Rs.220000 + 506.30 = 220506.30 and will show Rs.72.50 as the interest

receivable (ie, 220506.30 * 12/100/365*1 = Rs.72.50)

[5-1M]

h) Pass the receipt entry

normally as usual ie, Cr. Blue Nile

Stationeries > select the relevant pending

references/bills, Credit Cash/Bank Account.

|