With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. Let us take a look at what distinguishes each of them with some examples:

Supply |

GST Applicable |

Type of Supply |

Eligibility for ITC |

Examples |

NIL Rated |

0% |

Everyday items |

No |

Grains, Salt, Jaggery, etc. |

Exempted |

- |

Basis essentials |

No |

Bread, Fresh Fruits, Fresh Milk, Curd etc. |

Zero Rated |

0% |

Overseas supplies, Supply to Special Economic Zones (SEZ) or SEZ Developers |

Yes |

- |

Non- GST |

- |

Supplies for which GST is not applicable but can attract other taxes |

No |

Petrol, Alcohol etc. |

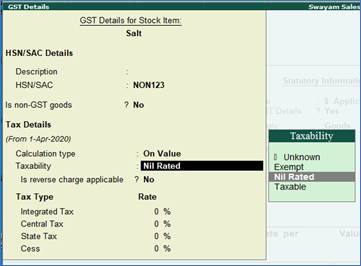

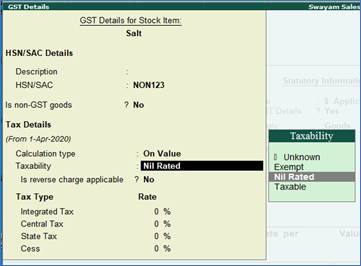

In case of above Items and Goods , the option Nil Rated / Exempt has to be selected as the Taxability in the GST Details screen of the item or item group master.

Setting Nil-Rated & Exempted items and Goods :

85 85

Transactions:

Purchase the following items in Cash from Registered Dealer which are Nil Rated and Exempted

Name of items |

Quantity |

Rate |

Value |

Moong Dal |

70 Kg. |

85 |

5950 |

Salt |

25 kg. |

25 |

625 |

Bread |

60 Pcs. |

22 |

1320 |

Fruits |

20 Kg. |

110 |

2200 |

|

|

Total |

10,095 |

Purchase Invoice of above goods are given below :

86 86 |

85

85 86

86