In

Tally.ERP 9 you can record TDS transactions through Journal Voucher or Purchase

Voucher (Account

/Item Invoice Mode)

Note: Recording TDS transactions

in Purchase Voucher in Voucher Mode is not supported.

Example: On 10-4-2009, ABC Company received bill

from Mark IT

solutions for Rs. 1,50,000 towards the Advertisement services provided.

Ensure

the required ledger masters are created before recording the transaction

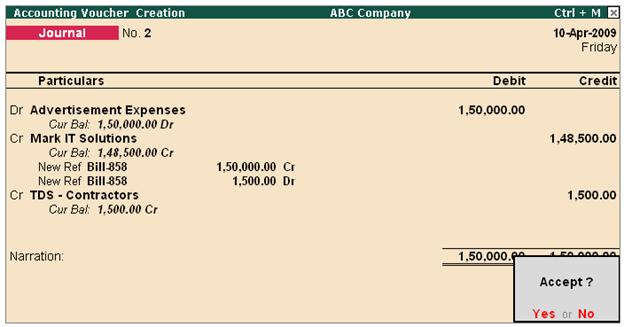

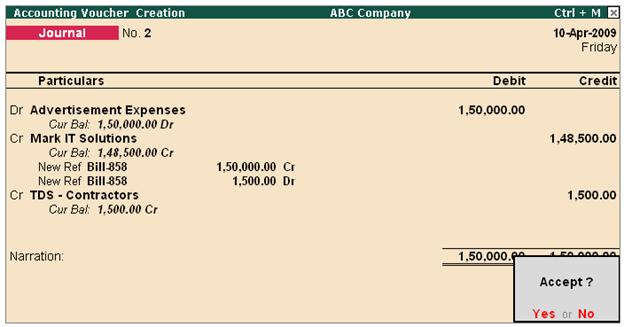

Case 1: Record the transaction in Journal Voucher

1.

In Debit field select the expense ledger - Advertisement Expenses and mention the transaction amount of Rs. 1,50,000 in Amount - field.

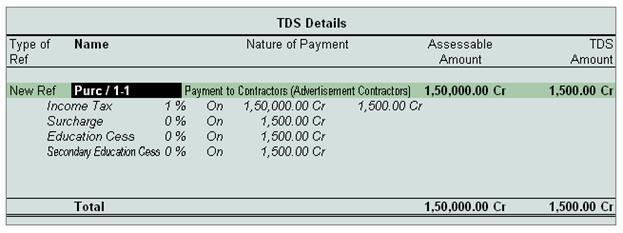

2.

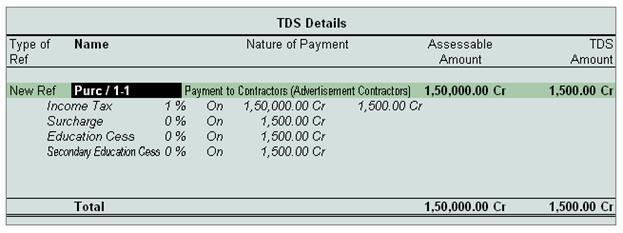

In Credit field select the party ledger - Mark IT Solutions and enter the TDS Details as shown

[13-7]

Note: In this transaction we are deducting TDS in the same voucher.

3. In the Bill-wise

Details screen provide the bill

details as shown

[13-8]

4. In Credit field select the TDS ledger - TDS Contractors to account the TDS deducted.

The completed Journal Voucher is displayed as shown

[13-9]

Case 2: Record the transaction in Purchase Voucher

1.

In Party A/c

Name field

select the party ledger - Mark It

Solutions

2.

Under Particulars select the expenses ledger - Advertisement Expenses and specify the expense amount - Rs. 1,50,000 in Amount filed

3.

Under Particulars select TDS ledger- TDS- Contractors and enter TDS Details as

shown

[13-10]

Note: TDS amount will be displayed

with negative sign

4.

In the Bill-wise

Details screen

enter the details as shown

[13-11]

The

completed Purchase Voucher is displayed as shown

[13-12]

|