In Tally.ERP 9 you

can create

- Separate tax ledgers for each nature of payment

- A Common

tax Ledger for all the Nature of Payments

1. Create tax ledger with defined nature of payment

To create a Tax Ledger

Go to Gateway of

Tally> Accounts Info.> Ledgers> Create

- Enter the Name of

the Tax Ledger e.g. TDS

– Contractors

- Select Duties

& Taxes from the

List of Groups in the Under field.

- In Type

of Duty /Tax field

select TDS from the Types of Duty/Tax list

- In Nature

of Payment field, select Payment to Contractors

(Advertisement Contractors) from

the List

of TDS Nature of Payment.

- Set Inventory

values are affected to No

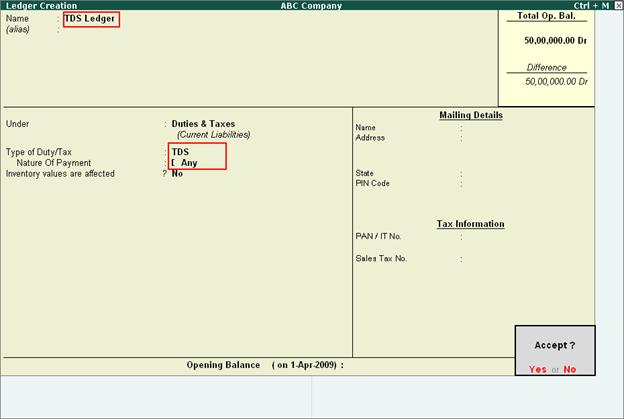

The completed tax ledger is displayed as shown

[13-5]

2. Create common tax ledger

- Enter the Name of

the Tax Ledger e.g. TDS Ledger

- Select Duties &

Taxes from the List of Groups in the Under field.

- In Type of Duty /Tax field

select TDS from the Types of Duty/Tax list

- In Nature of Payment field,

select Any from the List of

TDS Nature of Payment.

- Set Inventory values

are affected to No

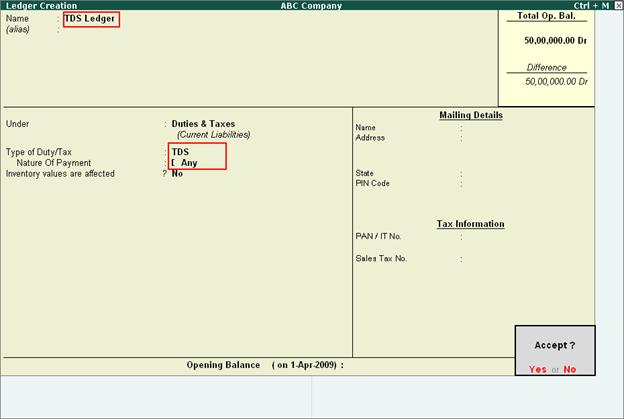

The completed tax ledger is displayed as shown

[13-6]

|