Query

Is it possible to account Advance payments to party and deduct TDS on such advances? How to adjust the advances paid to the party towards the Bill?

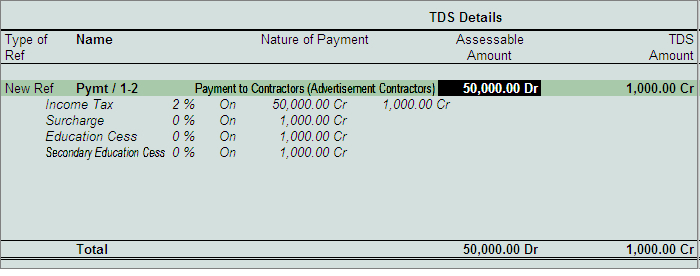

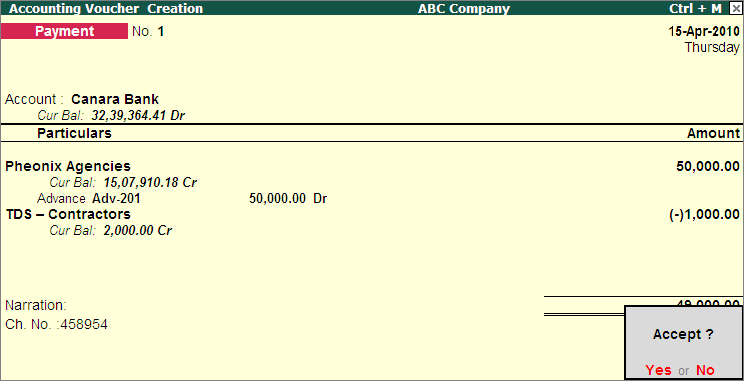

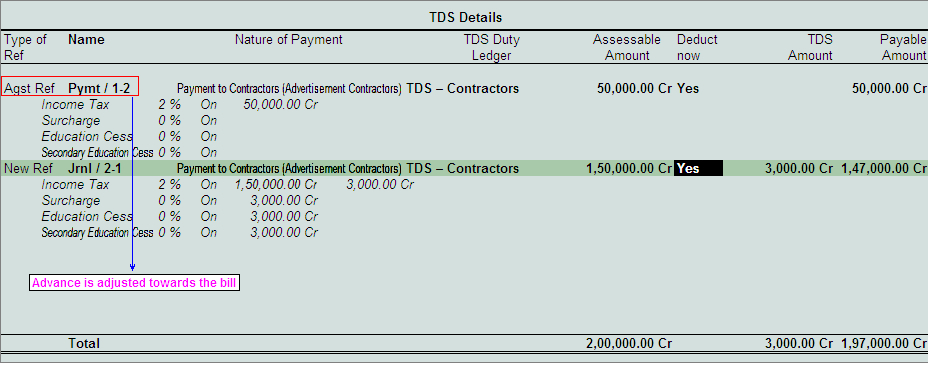

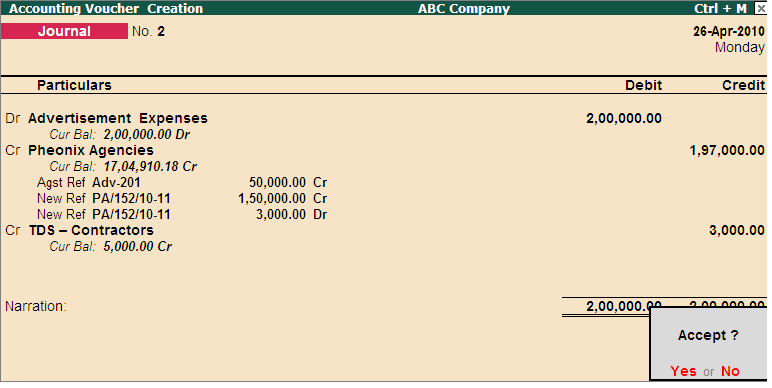

Example: On 15-04-2010, ABC Company made an advance payment of Rs.50,000 to Pheonix Agencies towards Advertisement Expenses. While making payment tax was deducted form the Source. Advances were adjusted towards the bill of Rs.2,00,000 dated 26-04-2010.

Solution

Tally.ERP 9 allows accounting advance payments to party and deduct TDS on the advances and later adjust the advance paid towards the Bill.

Follow the given procedure to account advances and adjust the advances towards the Bill

Step 1: Record a Payment Voucher (to account advances)

To create a Payment Voucher

Go to Gateway of Tally > Accounting Vouchers > F5: Payment.

Set up

In F12: configure (Payment Configuration)

1. In Account field select the Bank Ledger. E.g. Canara Bank

2. Under Particulars select the party ledger Pheonix Agencies. In Amount field enter the amount paid as advance and press enter to view Bill-wise Details screen

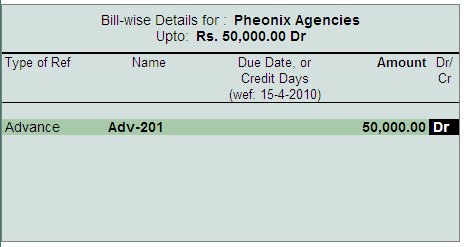

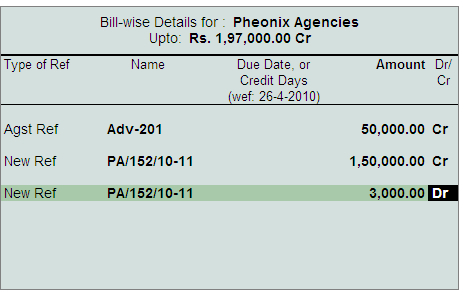

3. In Bill-wise Details screen

- In Type of Ref field select the reference as Advance

- In Name field enter the bill name as Adv-201

- Amount will be displayed automatically

|