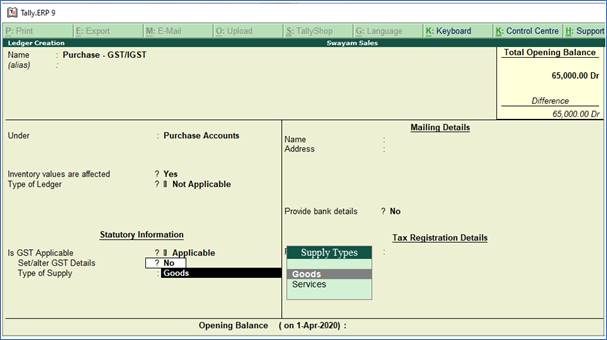

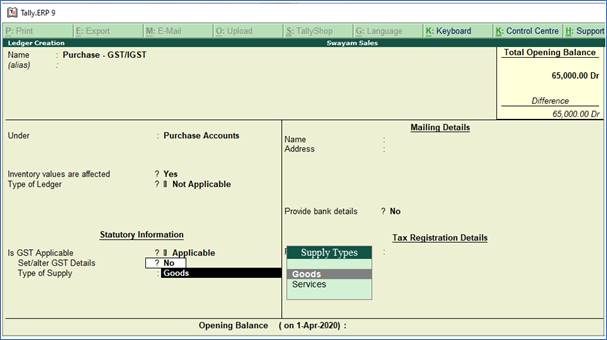

Creating a Purchase Ledger: Purchase-GST/IGST (both for Local & Outside State)

To Create a Purchase Ledger i.e. GST - Purchase (Local)

- Follow the steps used for Creating the Sales Ledger i.e. GST-Sales as above.

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name of the Sales ledger i.e. GST-Purchase (Local)

3. Select Purchase Account from the List of Groups in the Under field.

4. Set the option Inventory values are affected? to Yes ,.

5. Is GST Applicable - Applicable.

6. Set/alter GST Details - No,

Don’t specify the details in the GST Details because GST Rate specified in all Items will automatically Calculate the CGST and SGST as well as IGST.

7. Select the Type of supply. By default the type of supply is set to Goods.

8. Press Ctrl + A to save.

[ Note : Only one Ledger i.e. GST-Purchase (Local) will be created for all type of GST Purchase within State ] |