By using this voucher you can generate the purchase order register and keep track of records for orders placed to different parties.

Gateway of Tally.ERP > Voucher Entry > Alt+F4 : Purchase Order

To enable Sales Order and Purchase Order Processing in Tally.ERP 9, activate the following in F11: Features (F2: Inventory Features)

Set Allow Purchase Order Processing and Allow Sales Order Processing to Yes in the Order Processing section.

Purchase Order Processing

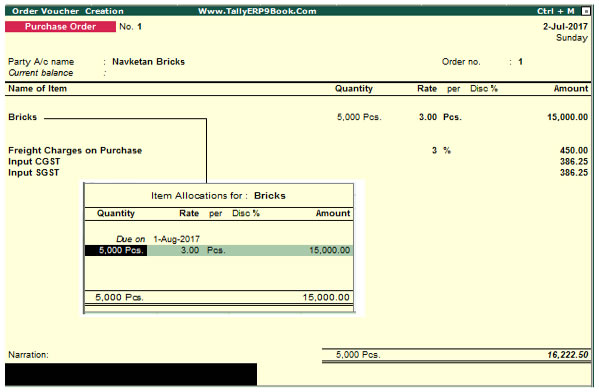

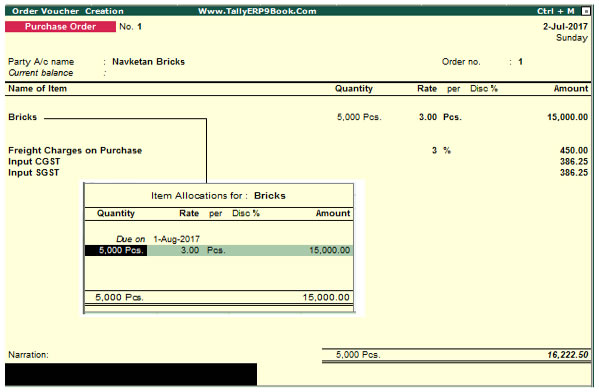

Raise a Purchase Order on 2-7-2017 on Navketan Bricks (vide Order No. 1) for 5,000 pcs of Bricks @ ₹. 3 /brick with GST @5%. The due date is 1-8-2017 and additional Freight charges @ 3% is applicable..

Setup:

-

Create a Supplier - Navketan Bricks Under Sundry Creditors with Maintain Balances bill-by-bill set to Yes.

-

Create a Stock Item - Bricks under Building Materials Stock Group, and select Not Applicable for the Stock category and specify the unit of measure as Pcs (If not listed create using Alt+C).

-

Press F12: Purchase Order Configuration and ensure that:

-

Accept Supplementary Details is set to Yes.

-

Complete Accounting Allocations in Order/Delivery Note is set to Yes.

-

Use Common Ledger for Item allocation is set to No.

Step 1: Create Purchase Order

Go to Gateway of Tally > Inventory Vouchers > F4: Purchase Order.

1. Date: 2-7-2017.

2. Party's A/c Name: Navketan Bricks

3. Order No: 1 This particular Order No. field is an additional field to record the order number if different from the voucher number.

4. Name of the item: Bricks. Press Enter and the Item allocation sub-screen appears.

Due on: 1-8-2017 (It is the due date for the delivery of the item. This will enable the monitoring of outstanding deliveries. The order can be split for delivery on different dates).

- Quantity, Rate and Amount - 5,000 Pcs @ 3 per Pcs (The amount is calculated automatically but is modifiable to enable rounding off)

5. Select Freight Charges on Purchase at 3% on the item value.

6. Select Input CGST & Input SGST (Create it under Duties & taxes with 0% of Calculation i.e. Don’t assign any GST % ).

7. Narration: Optional.

|