Do it ... Yourself !

Record the following Journal Voucher with date wise…

JOURNAL VOUCHER TRANSACTION [F7]

Sl. No. Date Transactions

1. 30/4/2020 Interest on Loan is due on Loan from Axis Bank Ltd. of Rs.7,500 (F7: Journal)

2. 30/4/2020 Salary for the Month of April is due on Salary Payable of Rs.22,000 (F7:Journal)

3. 30/4/2020 Salary of Rs.2,500 is adjusted against Advance of Staff. (F7: Journal)

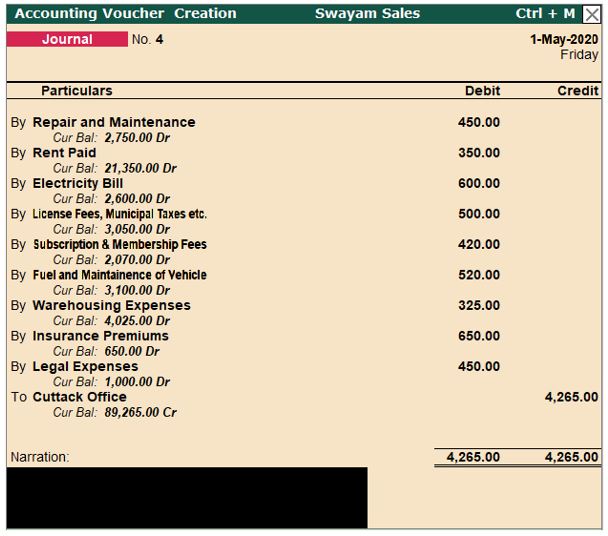

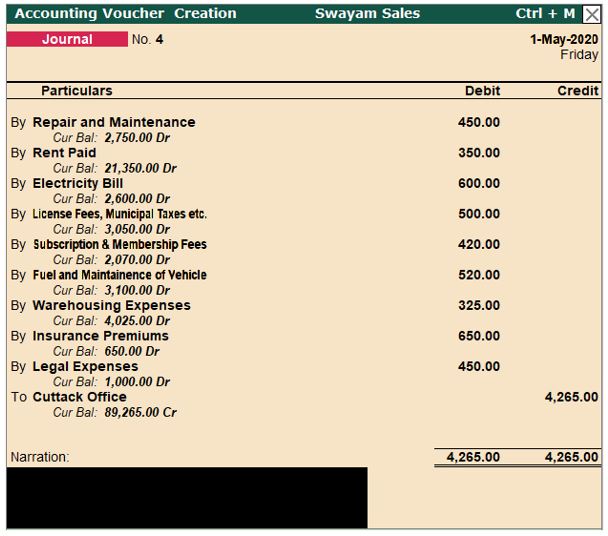

4. 25/5/2020 Following Expenses are paid by Cuttack Office (F7:Journal)

Repair and Maintenance 450

Rent Paid 350

Electricity Bills 600

License Fees, Municipal Taxes etc. 500

Subscription & Membership Fees 420

Fuel and Maintenance of Vehicle 520

Warehousing Expenses 325

Insurance Premiums 650

Legal Expenses 450

5. 29/5/2020 Interest Charged by the Supplier Sony India Ltd. of Rs.3,000 (F7:Journal)

6. 30/5/2020 Interest on Loan is due in Case of following (F7:Journal)

Loan from Mr. You 2000

Loan from Mr. Me 3000

7. 8/6/2020 Following Expenses are paid by BBSR Office. (F7:Journal)

Repair and Maintenance 550

Rent Paid 400

Electricity Bills 350

License Fees, Municipal Taxes etc. 250

Subscription & Membership Fees 200 |