As per accounting rules, the final results of a company's working depend on the valuation of inventory (stocks). As per norms, there are many concepts of evaluating the company's stock. Tally.ERP 9 goes one step ahead, by providing all the required stock valuation methods for you to choose from. In addition, Tally.ERP 9 allows you to choose different valuation methods for different items.

1. Stock Valuation Method in Tally.ERP9

The Stock Valuation / Costing Methods provided in Tally.ERP 9 are:

- First In First Out (FIFO)

- LIFO Annual (Last In First Out Annual)

- LIFO Perpetual (Last In First Out Perpetual)

- In addition, Tally.ERP 9 provides the following Market Valuation Methods:

Depending on the Market Valuation Method defined in the stock item master, Tally.ERP 9 displays the rate/ price automatically at the time of Invoice entry. The Market Valuation Method is set as Average Price by default. The Average Price displays the average of all the sales prices given in the previous sales entries, as the selling rate/ price while the current sales entry is being made.

Let us now examine the result of the different stock valuation methods

2. Display Stock Summery in Tally.ERP9

Setup :

-

Go to Gateway of Tally > F12: Configure > Accts / Inventory Info.

-

Go to Gateway of Tally > Inventory Info. > Stock Item > Alter,

-

Select HP - 27 Printer Cartridges, you will find that the details of Costing Method and Market Valuation Method under Behaviour

-

Select Average Cost and Average price respectively

-

Accept the master information.

Go to Gateway of Tally > Stock Summary,

-

Select Printers Stock Group

-

Press F2: Period and change the period from 1-07-2009 to 31-07-2009.

-

Click Auto Column (Alt + N) button and select Stock Valuation Methods.

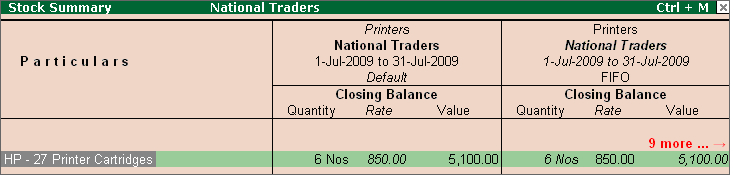

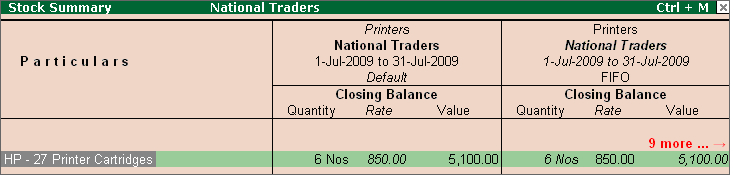

The closing balance of stock as per Default and FIFO stock valuation methods are shown below :

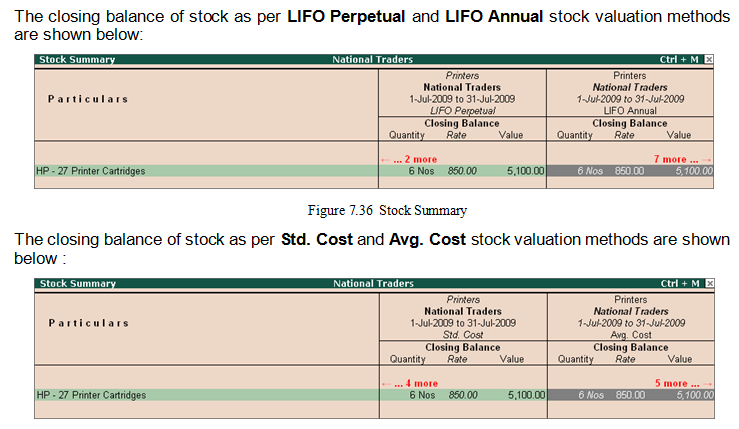

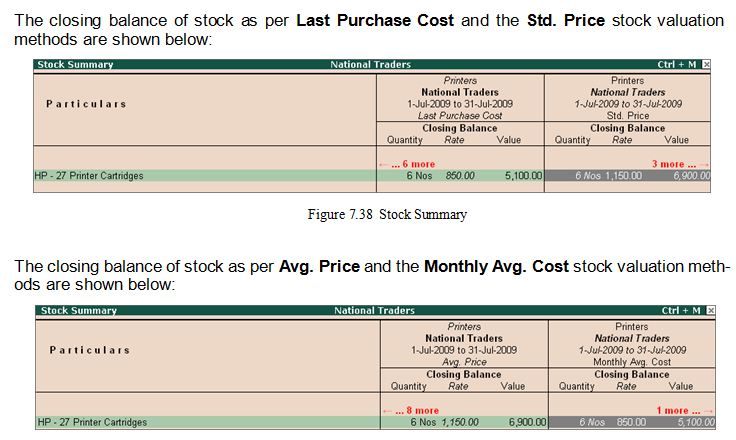

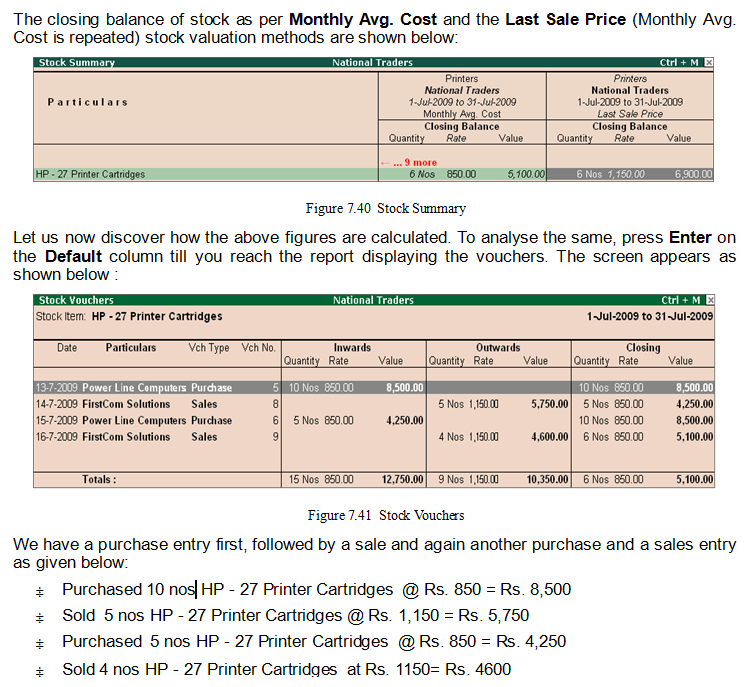

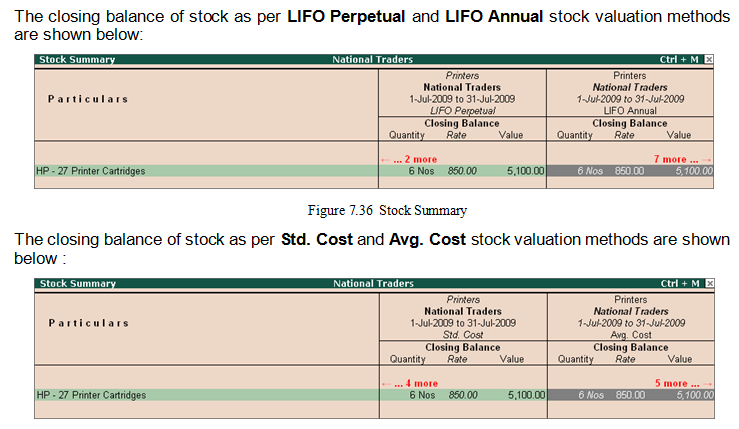

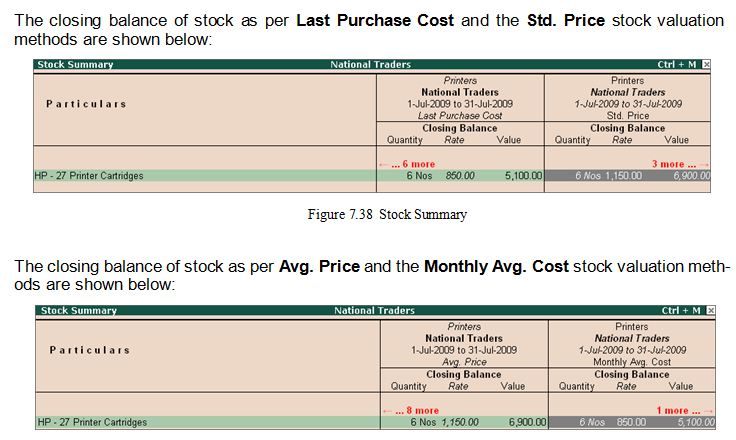

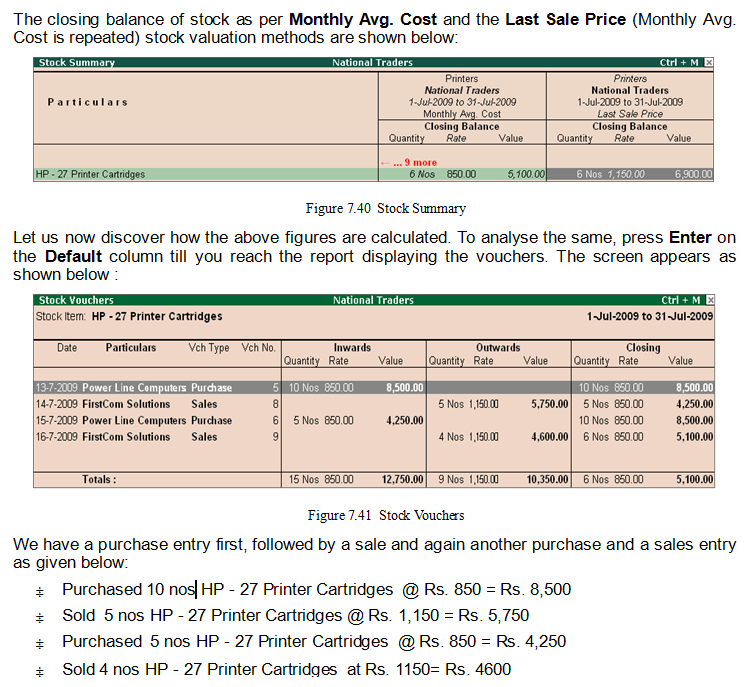

Tally.ERP 9 displays the closing stock of 6 nos of HP - 27 Printer Cartridges as per different stock valuation methods. Since there are 11 columns in the report the same is displayed in six screens as shown below:

We have purchased a total of 15 nos for Rs. 12750. The average now is Rs. 12,750 / 15 = Rs. 850 with a closing balance of 6 nos x 850 = Rs. 5,100 (Average cost method of valuation)

You can decide which method of stock valuation is most appropriate for your business and accordingly define that in the item master. FIFO (First In First Out) and Average Cost are the most popular stock valuation methods used in today’s business. |