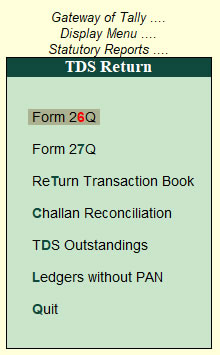

6. TDS Reports using Tally.ERP9

TDS Reports using Tally.ERP9 has been classified as…

A- Form 26Q (TDS)

Form 26Q is the Quarterly return of TDS in respect of all payments other than salaries. As per the Income Tax Act, 1961, every corporate and government entity responsible for deduction of tax at source should furnish TDS returns containing details of deductee(s) and challan details relating to deposit of tax with the Income Tax Department.

The Form 26Q report in Tally.ERP 9 assists you in generating accurate the returns to be filed.

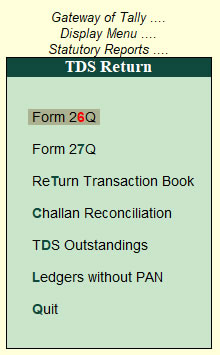

>> Go to Gateway of Tally > Display > Reports > Statutory Report > TDS Reports > Form 26Q

It has three main sections:

-

Statistics of Vouchers : The Statistics of Vouchers section of Form 26Q displays the total number of transactions pertaining to a period which are categorised as Included , Excluded and Uncertain Transactions .

-

Deduction Details : The Deduction Details section under the TDS Reports for Form 26Q or 27Q denotes the type of deduction under which each of the Included transaction is grouped

-

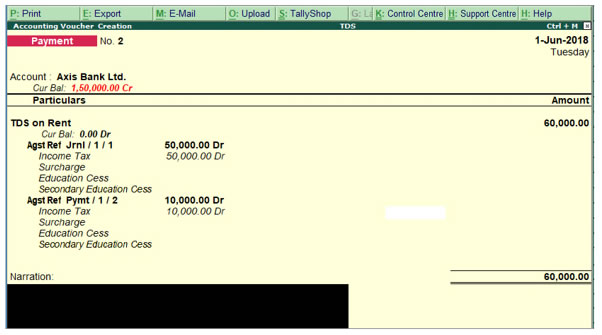

Payment Details : This section contains details of all TDS payment vouchers of the current period and displays all payment entries recorded for interest, penalty, late fee, and so on. These other payment entries for interest, penalty, and late fee, and so on will be displayed under Other Payments.

Payments made to party, petty expenses, or any statutory payments other than that of TDS are not displayed here.

B- Form 27Q (TDS)

Form 27Q is a Quarterly return for deduction of tax in respect of payments made to non-residents other than salary. The Form 27Q report in Tally.ERP 9 assists you in generating accurate returns to be filed.

The Form 27Q report has three sections:

1. Statistics of Voucher ,

2. Deduction Details , and

3. Payment Details

… like Form 26Q as above.

To generate Form 27Q : Go to Gateway of Tally > Display > Reports > Form 27Q

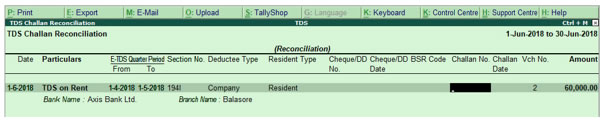

C- TDS Reconciliation Report

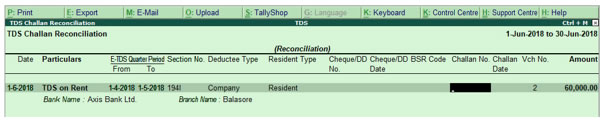

The TDS Reconciliation report displays the all the reconciled TDS payments where we can view the Challan Reconciliation Report and also we Reconcile TDS Payment Challans.

>> Go to Gateway of Tally > Display > Statutory Reports > TDS Reports > Challan Reconciliation.

>> Click F5: Reconcile Challan

>> Press Alt+S to set Challan Date

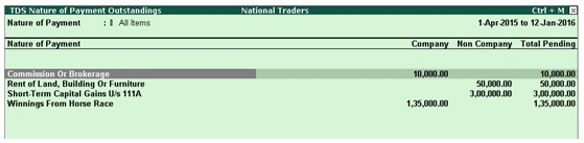

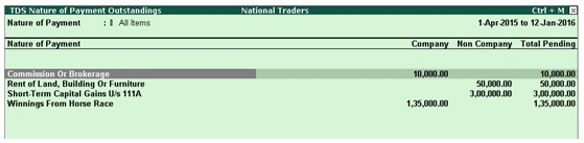

D- TDS Outstanding Report

The TDS Outstanding report displays all the pending TDS payments. You can view the pending details party-wise, or based on resident or non-resident status as shown below :

>> Go to Gateway of Tally > Display > Statutory Reports > TDS Reports > TDS Outstandings.

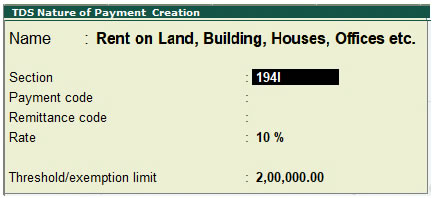

The TDS Nature of Payment Outstandings report appears as shown below:

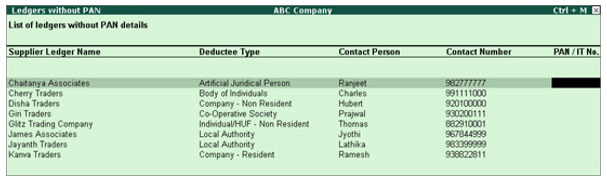

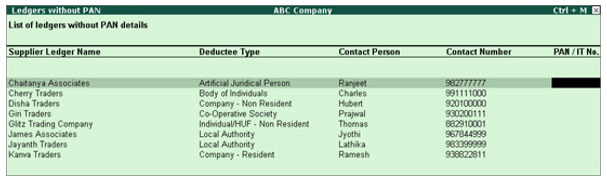

E- Ledgers without PAN (TDS)

While filing e-TDS returns, the correct PAN should be defined in the party ledgers configured for TDS deduction. The report Ledgers without PAN is introduced to display the list of all the party ledgers configured for TDS deduction for which PAN is not defined. This report can be configured to view the list of all ledgers for which PAN is defined, and the PAN can be corrected, if required. Additionally, this report provides information on the Deductee Type , Contact Person , and Contact Number defined for the party ledger .

>> Go to Gateway of Tally > Display > Statutory Reports > TDS Reports > Ledgers without PAN

|