| |

Fringe Benefit Tax (FBT)

|

The Finance Act, 2005 introduced a new tax structure under the title, Fringe Benefit Tax (FBT) , by including a New Chapter XII-H in the Income Tax Act 1961, containing Sec-115W to 115WL, which provides for the levy of additional Income Tax on Fringe Benefits offered by employers to their employees . FBT is payable in the year in which the expenditure is incurred , irrespective of whether the expenditure is capitalized or Not. However, the same expenditure will not be liable to FBT again in the year in which it is amortized and charged to Profit. |

| Valuation of Fringe Benefits |

Group |

Value |

Any free or concession ticket provided by the

employer for private journey of the employees or their family members. |

100% |

Any contribution by the employer to an approved

superannuation fund for employees |

100% |

|

Valuation of Deemed Fringe Benefits

Group |

Value |

Entertainment |

20% |

Hospitality |

20% |

Conference |

20% |

Sales Promotions |

20% |

Employee’s Welfare |

20% |

Conveyance, Tours and Travels |

20% |

Hotel, Boarding and Lodging |

20% |

Repair, running and maintenance of cars |

20% |

Repair, running and maintenance of Aircrafts |

20% |

Telephones |

20% |

Guest House |

20% |

Festival Celebrations |

50% |

Health Club |

50% |

Any other Club |

50% |

Gift |

50% |

Scholarship |

50% |

Thus, as per provisions of Sec-115W, employer has to pay Fringe Benefit Tax @ 30% on the assessable value of the Fringe Benefit.

Due Dates for Payment of FBT

Quarter |

Due date for paying Advance Tax |

April – June |

15 th. July |

July- September |

15th. October |

October – December |

15th. January |

January- March |

15th. March ( on an estimated basis.) |

Step-1 : ( Enabling FBT in Tally.ERP 9 )

Go to Gateway of Tally.ERP à F11: Features à F3 : Statutory & Taxation

Under Statutory & Taxation

- Set YES to Enable Fringe Benefit Tax (FBT)

- Set YES to Set / Alter FBT Details.

- Enter the Details in FBT Assessable Details Screen :

|

|

Note : When Association of Person (AOP) / Body of Individuals (BOI) Assesses Type is selected, the additional option Is Surcharges Applicable ? displays. Surcharges is, by default , applicable for other Assessee Types. For AOP / BOI , specify whether Surcharges is applicable.

- Press Enter to accept the Statutory & Taxation Features screen.

Note : In Tally.ERP, you can account for expenses implying FBT with the help of a Payment Voucher, Journal Voucher or Purchase Voucher.

The Complete Company Features screen displays as shown : |

|

Example :

Swayam Computer Education Pvt. Ltd. Reimbursed Rs.10,000 to Sanjay Satpathy (Senior Manager) towards conveyance Expenses by Cash.

Solutions :

Step 1 :

- Create the following :

- Ledger : Conveyance Expenses ( under Indirect Expenses)

- Set Is FBT Applicable to YES.

Note : The Option is FBT Applicable is available to enter FBT details for those grouped under Direct Expenses , Indirect Expenses, Fixed Assets, Misc. Expenses ( Assets) and Sub Groups.

Select ‘Conveyance’ from FBT Category. |

|

Note : The FBT category defaults automatically based on the definitions in the ledger masters. If FBT category is not specified during ledger creation, the same can also be defined during Voucher Entry.

Step 2 :

Make an Entry of the Transaction in the Payment Voucher (F5).

Step 3 : Payment of FBT

Example :

Swayam Computer Education Pvt. Ltd. Paid Rs. 680 towards FBT for the quarter ended June 30, 2011 by Cheque ( No-987654).

Solutions :

- Create Ledger – FBT ( under Duties & Taxes)

- Make en Entry of the Transaction in a Payment Voucher

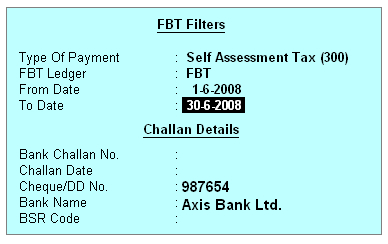

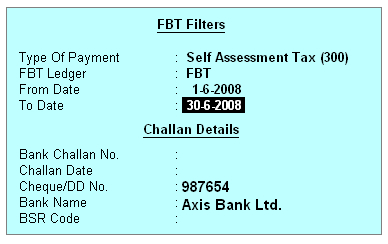

- Press ALT + F or click on FBT Helper available in the Toggle Buttons Bar to view the FBT Filters Screen.

- Ensure that the FBT Filters screen displays as shown below :

|

|

| 3. Tally.ERP will automatically update the FBT Benefit ( Tax ) Ledger with Amount, select AXIS Bank as Account.

4. To Print the FBT Challan, Press ALT + P to view the Print Configuration screen, activate Printing With Preview and Press Y or Enter to accept the screen. The FBT Challan will be Displays and Prints.

Step 4 : FBT Computation Report

The FBT Computation Report displays the particular of FBT categories of the transacted Expenses Ledger, Total Expenditures amount of Fringe Benefits, amount recovered ( if any ) and the net amount of Fringe Benefits. It also comments on the eligible percentage and the value of Fringe Benefits subject to FBT.

The FBT is computed at the prescribed Rates for the given quarter or the required period after deducting advance tax paid, if any. Surcharges, and Education cess are automatically calculated and included in then net Tax payable amount.

Go the Gateway of Tally.ERP à Display à Statutory Report à FBT Reports à FBT Computation.

To view any Advance payments made with respect to Fringe Benefit in the given period , press F12 : Configure in the report and set Show FBT payment details to YES. If required , you cal also view the relevant section codes to the FBT Categories as per statutes by setting Show Section Code to YES.

|

|

| |

|

|

| |

|