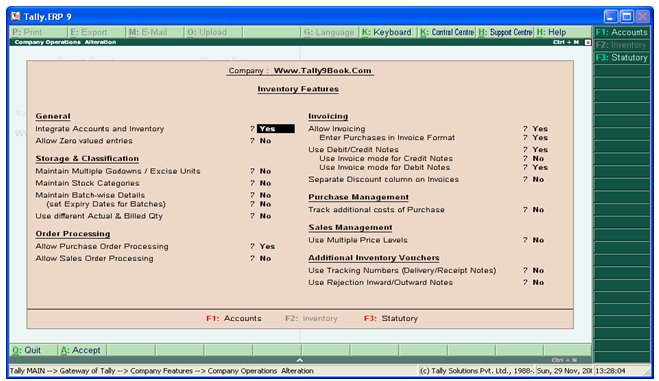

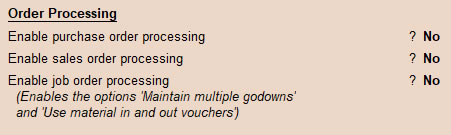

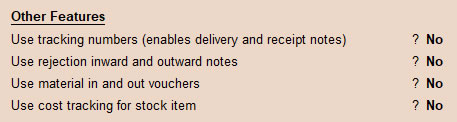

C- Order Processing

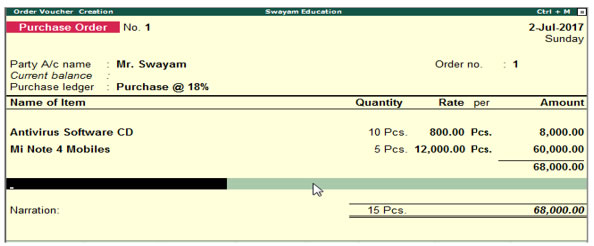

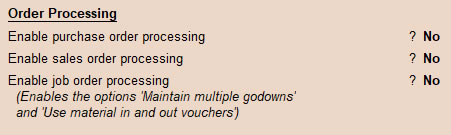

1. Processing the Purchase Order :

Set it as “Yes” if you want to maintain the Purchase Order this option would be available at “Inventory Voucher” otherwise set it as “No”.

Example : If you want to place an order for an item to your supplier Mr.Swayam with specification of your order number, name of the item and their acceptable price and record the transaction in Tally.ERP it will be appear as shown below :

Gateway of Tally.ERP9 > Inventory Voucher > Purchase Order (Alt + F4)

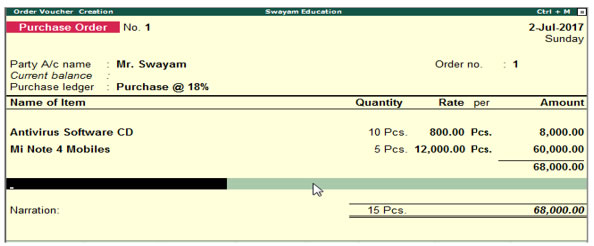

2. Allow Sales Order Processing :

Set it as “Yes” if you want to maintain the Sales Order, otherwise set it as “No”. This option is available at “Invoice Voucher”.

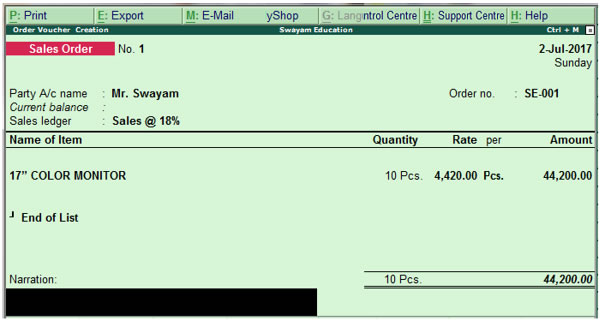

Example: If you want to record an order of 10 pcs of 17” COLOR MONITOR @ ₹. 4,420 from the customer Mr. Swayam, then the recorded transaction in Tally.ERP will appear as shown below :

Gateway of Tally.ERP9 > Inventory Voucher > Sales Order (Alt + F5)

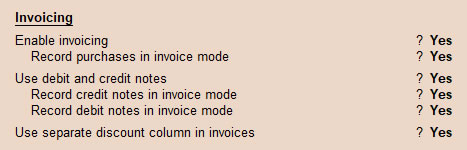

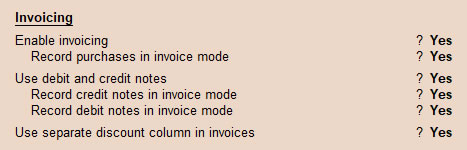

D- Invoicing

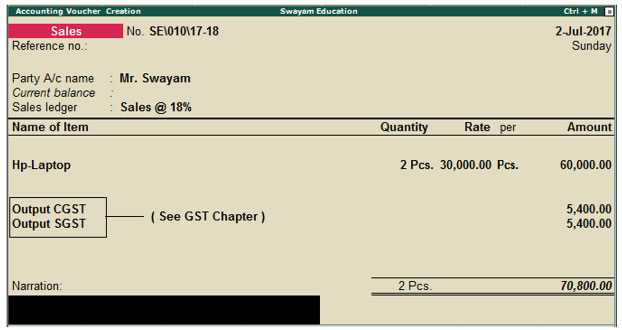

1. Sales Voucher in Invoice Format :

Setting the option as “Yes” will allow the Invoice Format for Sales Voucher and for Purchase, otherwise say “No”

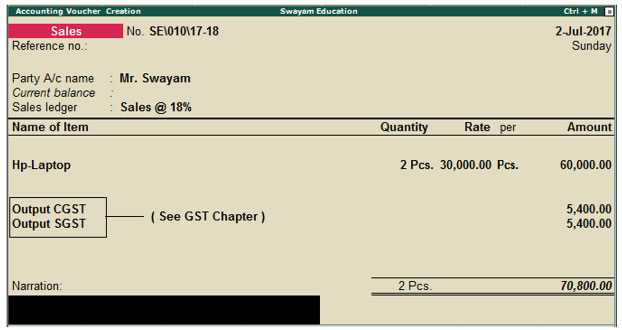

Example : If you want to issue an invoice to your customer Mr. Swayam for sale of Hp-Laptop Computer System, 2 nos @ ₹. 30,000 and record the transaction in Tally.ERP it will appear as shown below :

- Gateway of Tally.ERP g Accounting Voucher g Sale and Purchases in Invoice Format

This field performs the same function as explained in Accounting Features.

2. Use Debit/Credit Notes

This field performs the same function as explained in Accounting Features.

- Use Invoice Mode for Credit Notes

This field performs the same function as explained in Accounting Features.

- Use Invoice Mode for Debit Notes

This field performs the same function as explained in Accounting Features.

3. Separate Discount Column on Invoices

This option is active only if Allow invoicing is set to Yes. Set this option to Yes, if you want a separate column for discount in invoices.

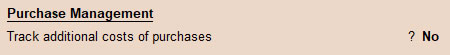

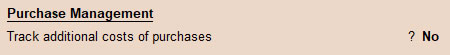

E- Purchase Management

1. Track Additional Costs of Purchase

In F11: Features (F2: Inventory Features) under Purchase Management, set Track additional costs of purchases to Yes.

Set this option to Yes, to obtain a break-up of purchase costs, without the need to separately debit ledger accounts for expenses. Typically, on purchases, one is interested in total costs and the breakup is of interest while doing analysis (except for expenses like GST which can be claimed). In such cases, passing of accounting entries for expenses will have no consequences other than lengthening your ledgers.

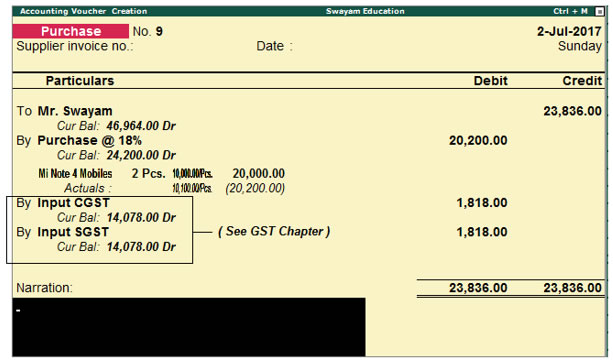

Example:

Purchases from Mr. Swayam: 2 Pcs of Mi Note-4 Mobile @ ₹. 10,000 = ₹..20,000. Expenses incurred =, Transportation Charges – ₹..200, GST @ 18% i.e. ₹..3636. Total purchase cost – ₹..20,200 + GST ₹..3636

If you activate Track additional costs, you can pass the entry in any of the following methods:

From an accounting perspective, both entries are identical. The ledger accounts Purchase Tax and Packing charges are not debited with the amounts. Hence these figures are reflected only as breakup or analysis figures of Purchases account. The Actuals figure reveals the total cost incurred on the Purchase and will also affect the stock value.

You may also allocate additional costs on Purchases through subsequent entries or vouchers.

The rules for including subsequent vouchers in purchase costs that Tally.ERP follows are:

Basic Cost + Additional costs allocated (if any) + All costs in subsequent vouchers that have zero quantity, up to the first voucher that has a non-zero quantity.

F- Sales Management

1. Use Multiple Price Levels

Set this option to Yes to create Multiple Price Levels. Refer Enable and Create Price Lists for more details.

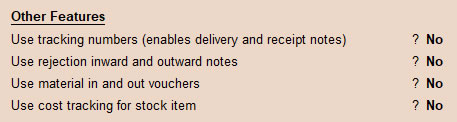

G- Other Inventory Features

1. Use Tracking Numbers (Delivery/Receipt Notes)

Use Tracking Number : You will use the Tracking Number to link this Receipt Note with the Supplier’s Invoice that will be received later. Tracking numbers link the different accounting and inventory vouchers as follows :

- Receipt Note/Goods in vouchers with Purchase Vouchers.

- Goods Out / Delivery Note with sales voucher / invoice.

- Rejection-in with Credit Note.

- Rejection-out with Debit Note

2. Use Rejection Inward/Outward Notes

Set this option to Yes, if you wish to record rejection of goods separately and not through a common Debit Note or Credit Note. |