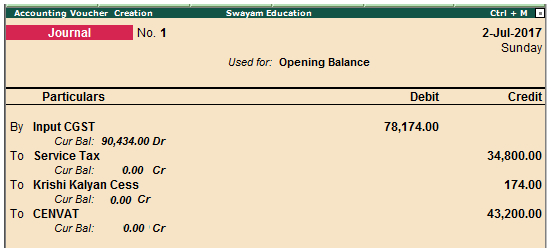

You can record a journal voucher to transfer the closing balance of tax credits of VAT, additional tax, cess, surcharge, CENVAT, service tax, krishi kalyan cess, and special excise duty/additional excise duty as opening balance under GST.

As GST is a new tax structure, the tax credits of previous tax regime will not be automatically carried forward to the GST account. Based on the date from which you want to maintain the books of accounts under GST, you need to carry forward the tax credit to state/central tax by recording a journal voucher.

Recording a journal voucher

The tax credits of service tax, krishi kalyan cess and CENVAT has to be transferred to the central tax ledger. The tax credit of VAT, additional tax, surcharge and cess has to be transferred to the state tax ledger. Hence, two separate journal vouchers have to be recorded to account for the opening balance of central and state taxes.

To record a journal voucher

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal.

Note: You can also create a journal voucher from Gateway of Tally > Display > Statutory Reports > GST > GSTR-1or GSTR-2.

2. Click J: Stat Adjustment.

3. In the Stat Adjustment Details screen, select the options as shown below: |