- Go to Gateway of Tally > Display > Statutory Reports > GST > e-Way Bill > Export for e-Way Bill .

The report appears for one day. You can change the date or period, if required.

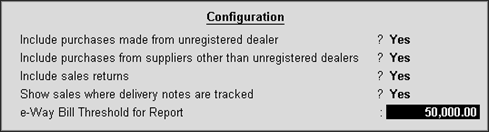

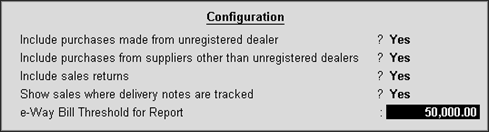

- Click F12: Configure , and enable the options to view purchases made from unregistered and other dealers, sales returns, and delivery notes tracked with e-Way Bill details. You can also change the threshold limit of the transaction to view the vouchers in the report.

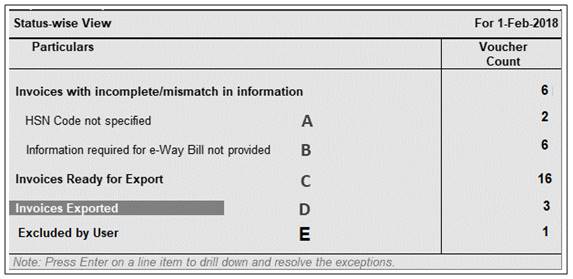

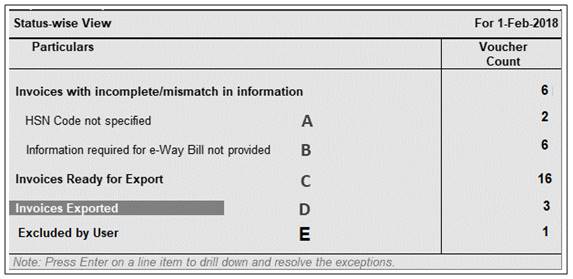

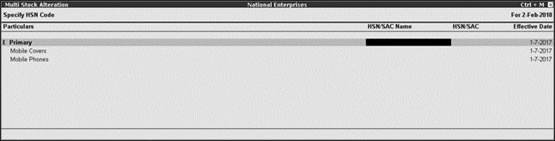

A- Exception : HSN Code not specified

Displays the count of transactions for which HSN code is not defined.

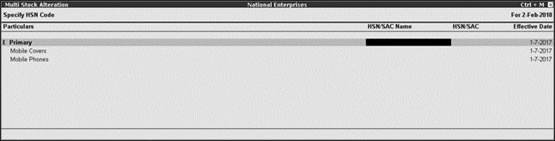

1. Select the exception HSN Code not specified , and p ress Enter

2. Select the required stock item.

3. Enter the HSN/SAC Name and HSN/SAC .

4. Press Ctrl+A to accept.

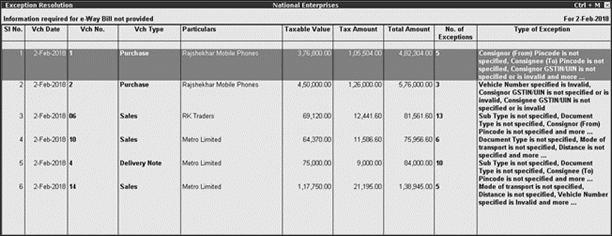

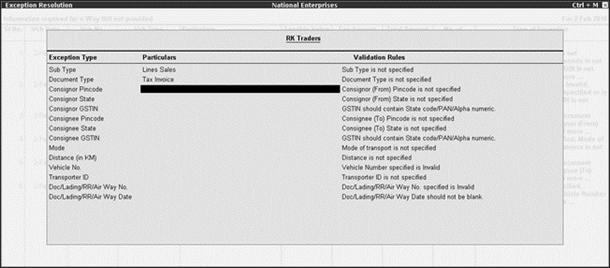

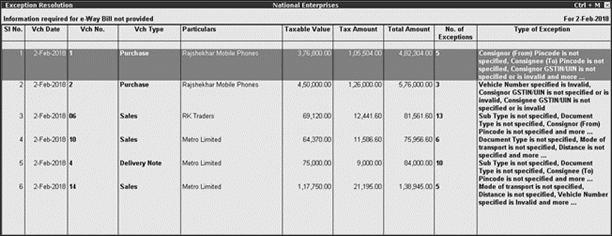

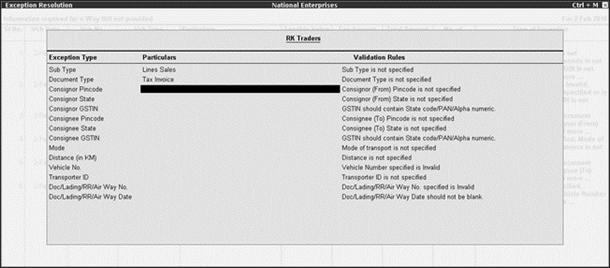

B- Exception: Information required for e-Way Bill not provided

Displays the count of transactions for which mandatory details required for generating e-Way Bill are not provided.

1. Select the exception Information required for e-Way Bill not provided , and press Enter

2. Select the required voucher, and press Enter

3. Enter the missing details.

4. Press Ctrl+A to accept.

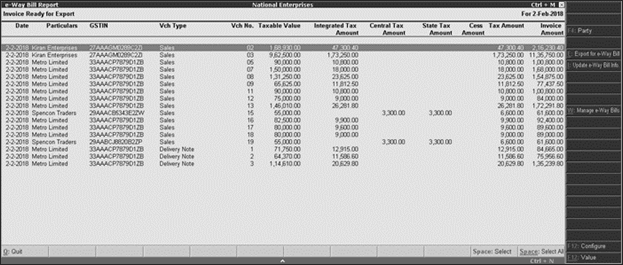

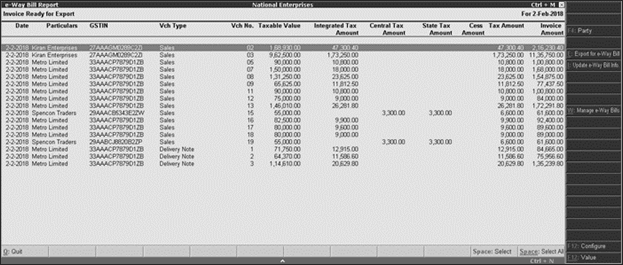

C- Invoices Ready for Export

Displays the count of transactions which have all the mandatory details required for generating e-Way Bill, and are ready for export.

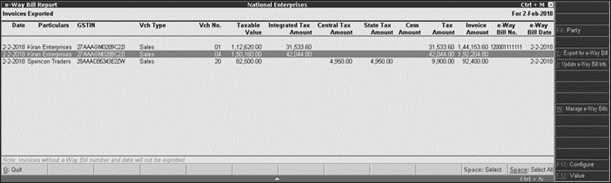

1. Select Invoices Ready for Export and press Enter .

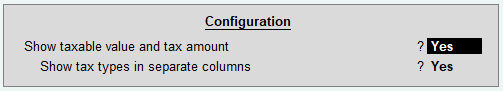

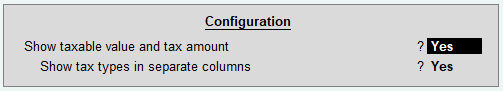

2. Click F12: Configure and enable the options to view the taxable value and tax amount in separate columns.

Click F4: Party to select a particular party ledger, and display the relevant transactions.

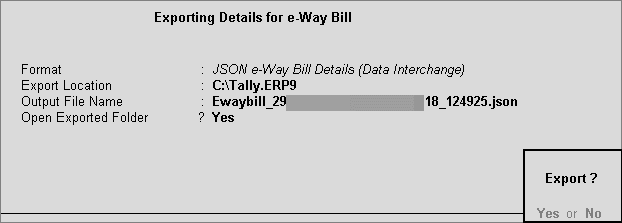

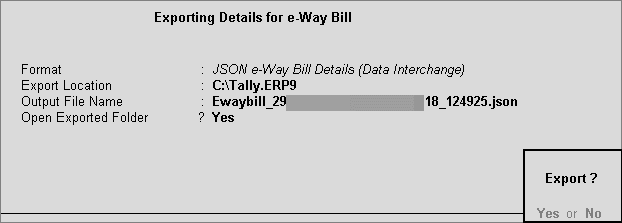

3. Select the required transaction (press Spacebar to select more than one transaction), and press Ctrl+E ( E : Export for e-Way Bill) to export

4. Press Enter to create the JSON file.

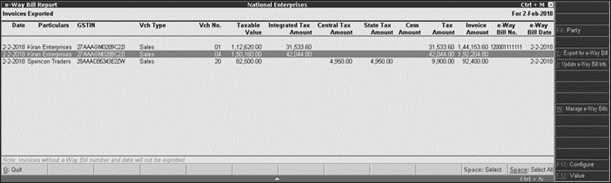

D- Invoices Exported

Displays the count of transactions which are exported in MS Excel or JSON format.

1. Select Invoices Ready for Export and press Enter .

Note : Click F12: Configure and enable the options to view the taxable value and tax amount in separate columns.

- Click F4: party and select the required party ledger.

- Press Ctrl+E for to export the transactions to MS Excel or JSON format. This button is highlighted only on selecting transactions that do not have e-Way Bill number and date.

- Press Ctrl+I to enter the e-Way Bill number and date in the Update e-Way Bill Information report.

- Press Ctrl+W to enter the e-Way Bill details for the invoice in Manage e-Way Bill screen (same as Statutory Details screen of the invoice).

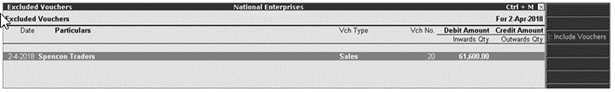

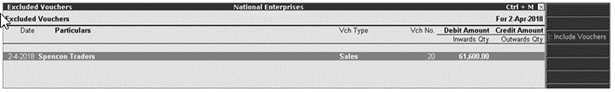

E- Excluded by User

Displays the count of transactions which excluded from the e-Way Bill report.

- Select Excluded by User and press Enter

Click I : Include Vouchers to include the transaction in the report. |