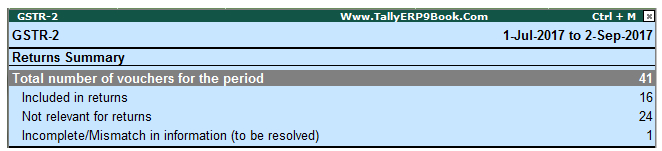

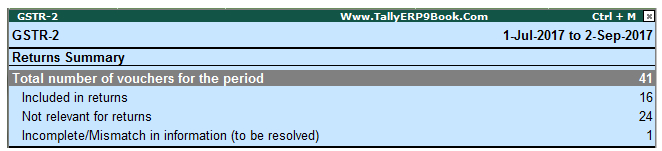

This section provides a summary of all transactions recorded in the reporting period. The transactions are further classified based on the presence of GST details in the vouchers and their effect on the returns.

Total Number Of Vouchers For The Period

Displays the total number of vouchers recorded in the reporting period.

Particulars (computation details):

This section displays the taxable value and tax amount from inward supplies considered in the returns.

Drill down from any part to display detailed information at the subsequent levels.

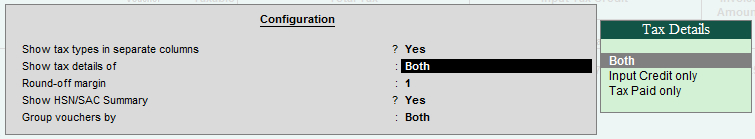

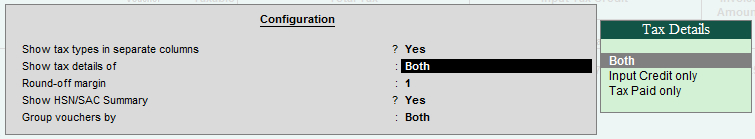

F12: Configure

Show tax types in separate columns? :

Enable this option to view all GST tax types in separate columns. This option is enabled by default. When this option is displayed, tax amount is displayed in a single column without the central tax, state tax and integrated tax break-up.

Show tax details of :

Select Input Credit Only to view only the tax amount that you can claim as credit. Select Tax Paid Only to view the tax amount that you have paid. Select Both to view the tax paid and the tax credit that can be claimed.

Round-off margin :

It is set to 1. You can change it as required to ensure the relevant transactions are included in the returns. |

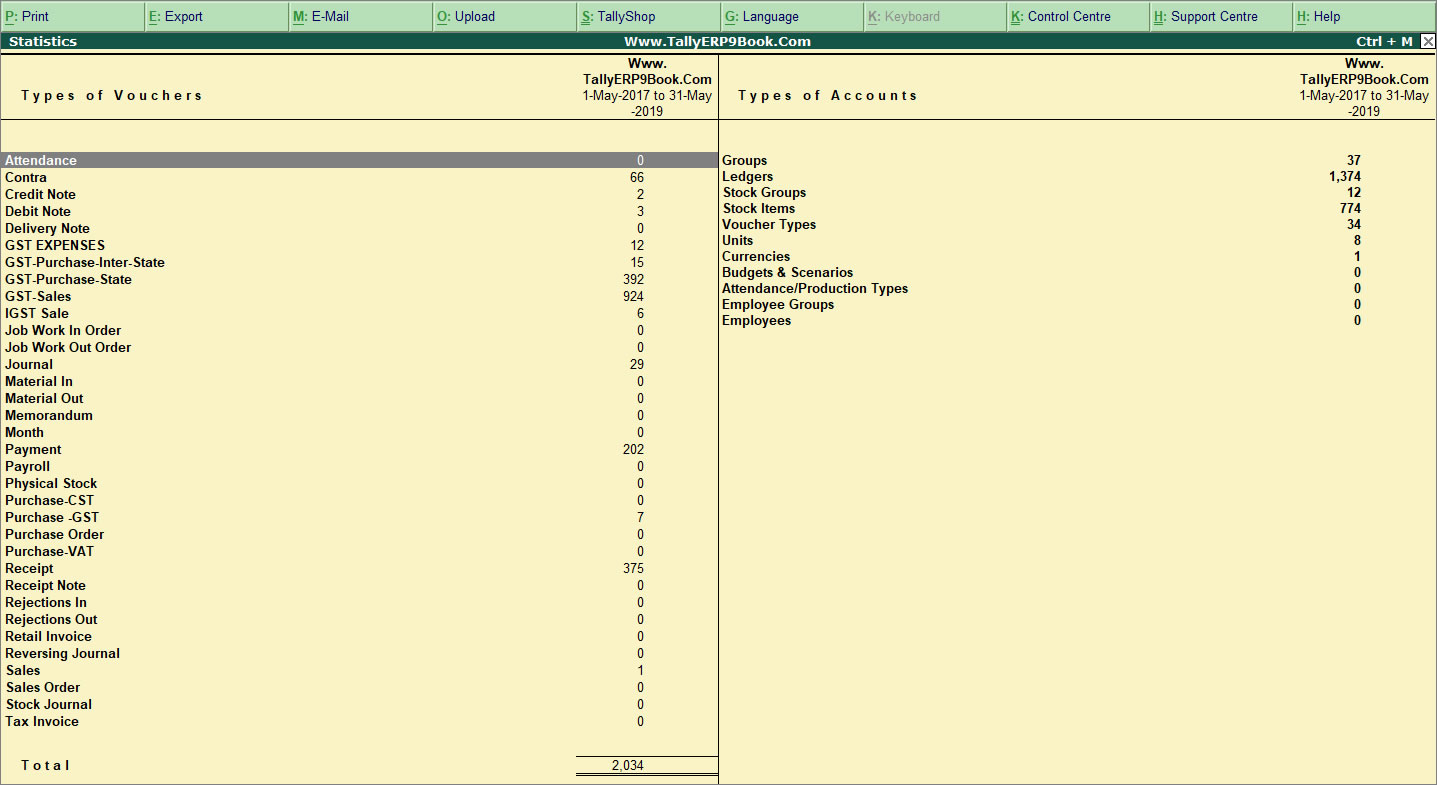

1. Total Number Of Vouchers For The Period

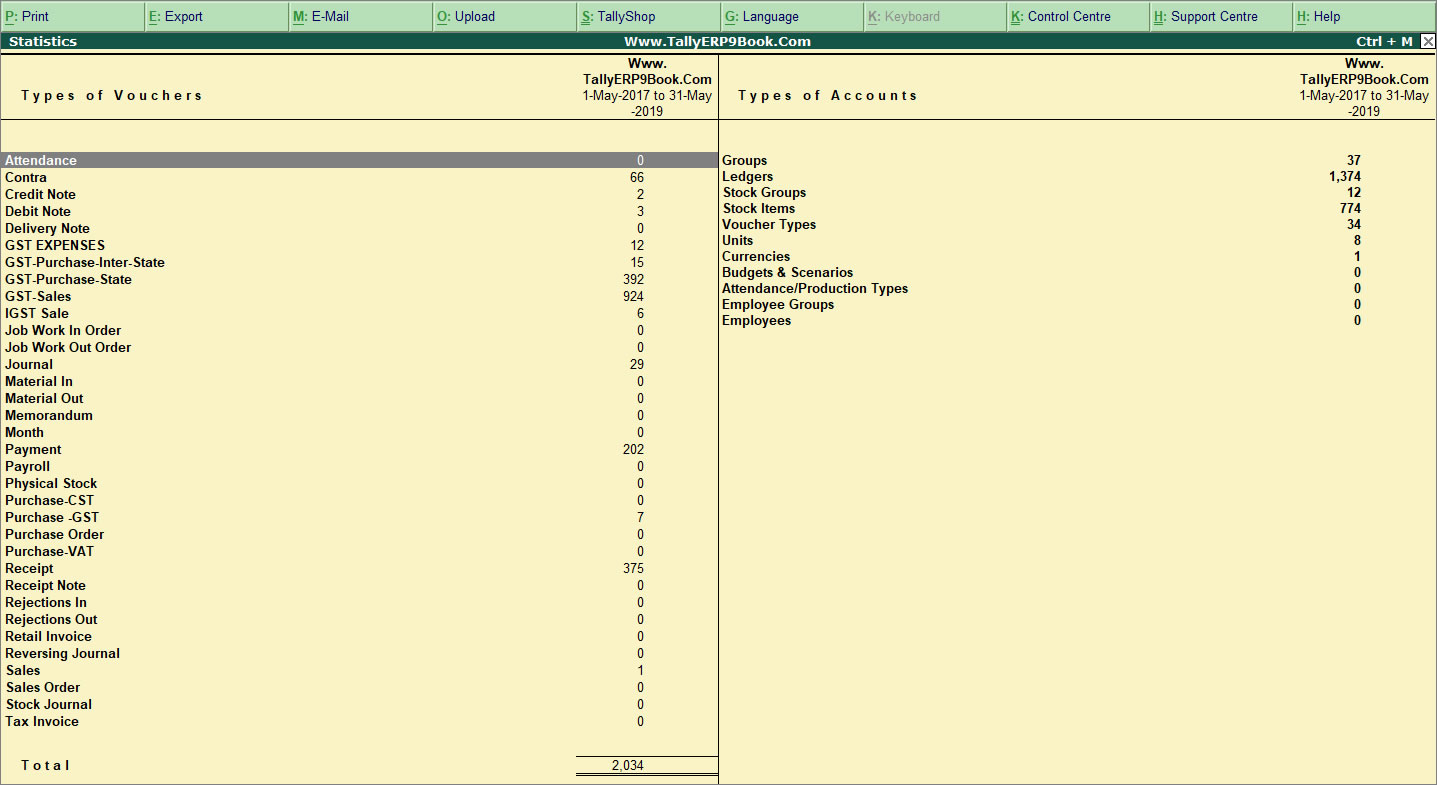

Displays the total number of vouchers recorded in the reporting period. Drill down will lead to the Statistics report, which displays the number of vouchers recorded against each voucher type, divided into included, excluded and uncertain based the vouchers participating in the GST returns.

The statistics report on drill down from Total number of vouchers for the period appears as shown below:

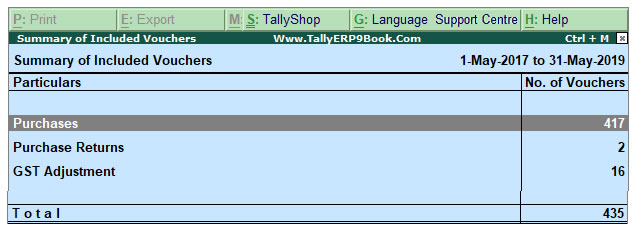

2. Included in the Returns

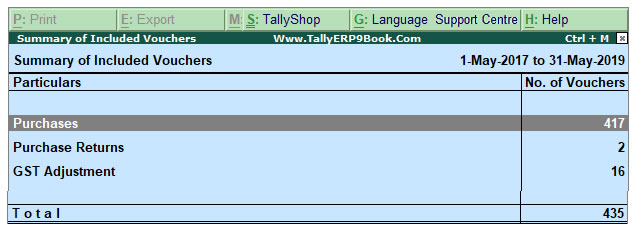

Displays count of all vouchers that have requisite information to comply with requirements of GST returns. Only these transactions will be exported as part of returns. Drill down from this row to view the Summary of Included Vouchers report, with the list of voucher-types with voucher count.

3. Not Relevant for Returns

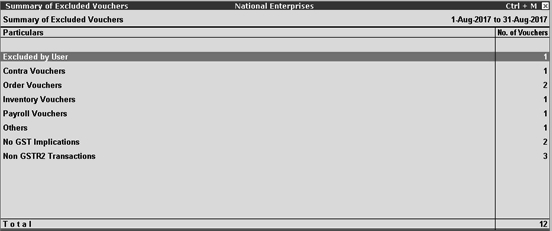

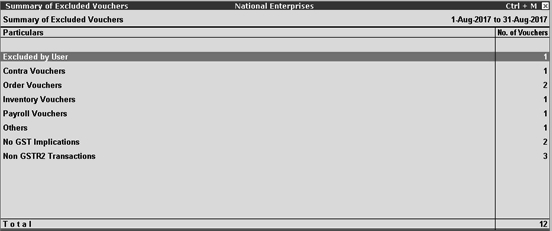

Displays the count of all vouchers which are not part of returns, as GST details are not provided in these vouchers. These vouchers will have no implication on returns. Drill down from this row to view Summary of Excluded Vouchers report, with transaction type-wise voucher count. The Summary of Excluded Vouchers report appears as shown:

Other transaction types that can appear under excluded vouchers:

-

Excluded by User: Manually excluded by you from the list of included or uncertain transactions. Drill down and use I: Include Vouchers, if required. Based on the information in the voucher it will move to either included or uncertain.

-

Contra Vouchers: The count of contra entries which involve only bank and cash ledgers.

-

Order Vouchers: The count of sales order, purchase order, job work in order, and job work out order vouchers.

-

Inventory Vouchers: The count of receipt note, stock journal, delivery note, material in, material out, rejections in, rejections out, and physical stock vouchers as they are purely inventory in nature and do not attract GST.

-

Payroll Vouchers: The count of transactions recorded using payroll and attendance vouchers. GST does not apply to these transactions.

-

Other voucher: The count of memorandum and reversing journal vouchers.

-

No GST Implications: The count of receipts, payments, and journal vouchers that do not have any GST implication.

-

Non GSTR-2 Transactions: The transactions which are part of other returns, for example: GSTR – 1, and hence will not have any implication on GSTR–2.

All the transaction types are not displayed by default. Based on the voucher type used and the exclusions done by you, the relevant categories appear with the voucher count. |