GSTR-2 is the monthly GST return to be filed by taxable person registered under GST.

GSTR-2 will include the details of all inward supplies (Purchase) made in the given period.

All transactions, whether recorded correctly, incorrectly or inadequately, are captured and categorised in this report. Further, to help you verify the tax details before exporting the returns, the GSTR-2 report in Tally.ERP 9 provides you with options to resolve exceptions in transactions that are not forming part of the returns due to incomplete information or mismatch.

The report also enables you to update the status of each transaction in the return based on the acceptance and reconciliation status of the transaction on GSTN portal using the Status Reconciliation option.

To view the report

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR–2.

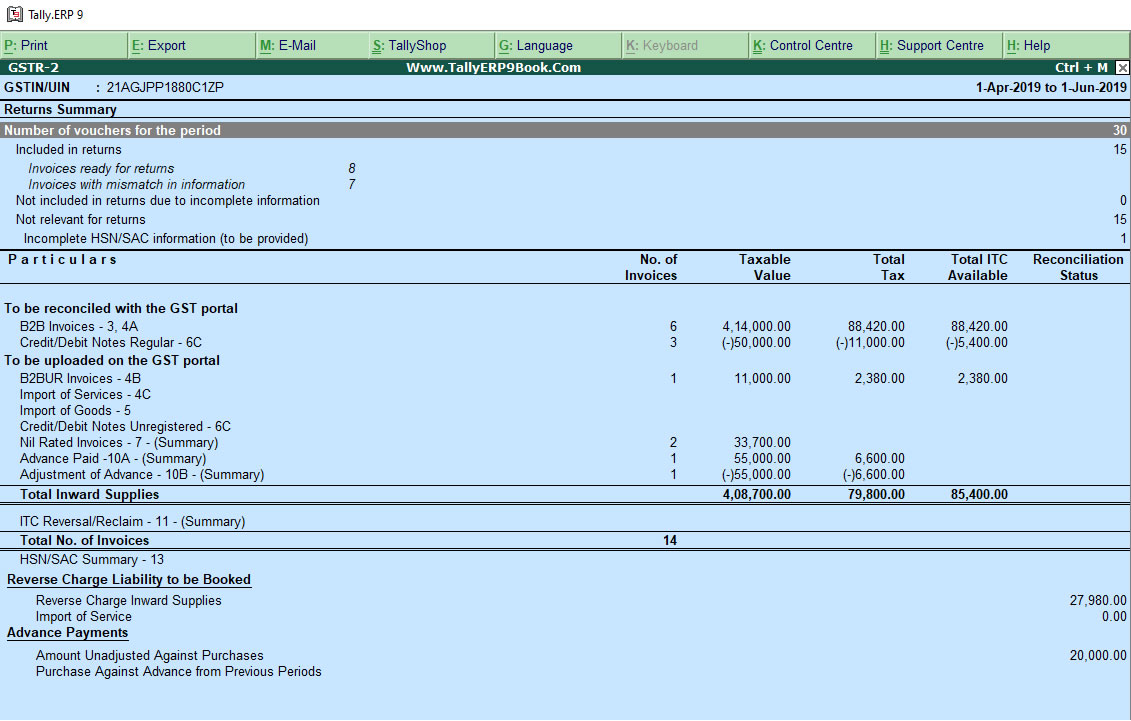

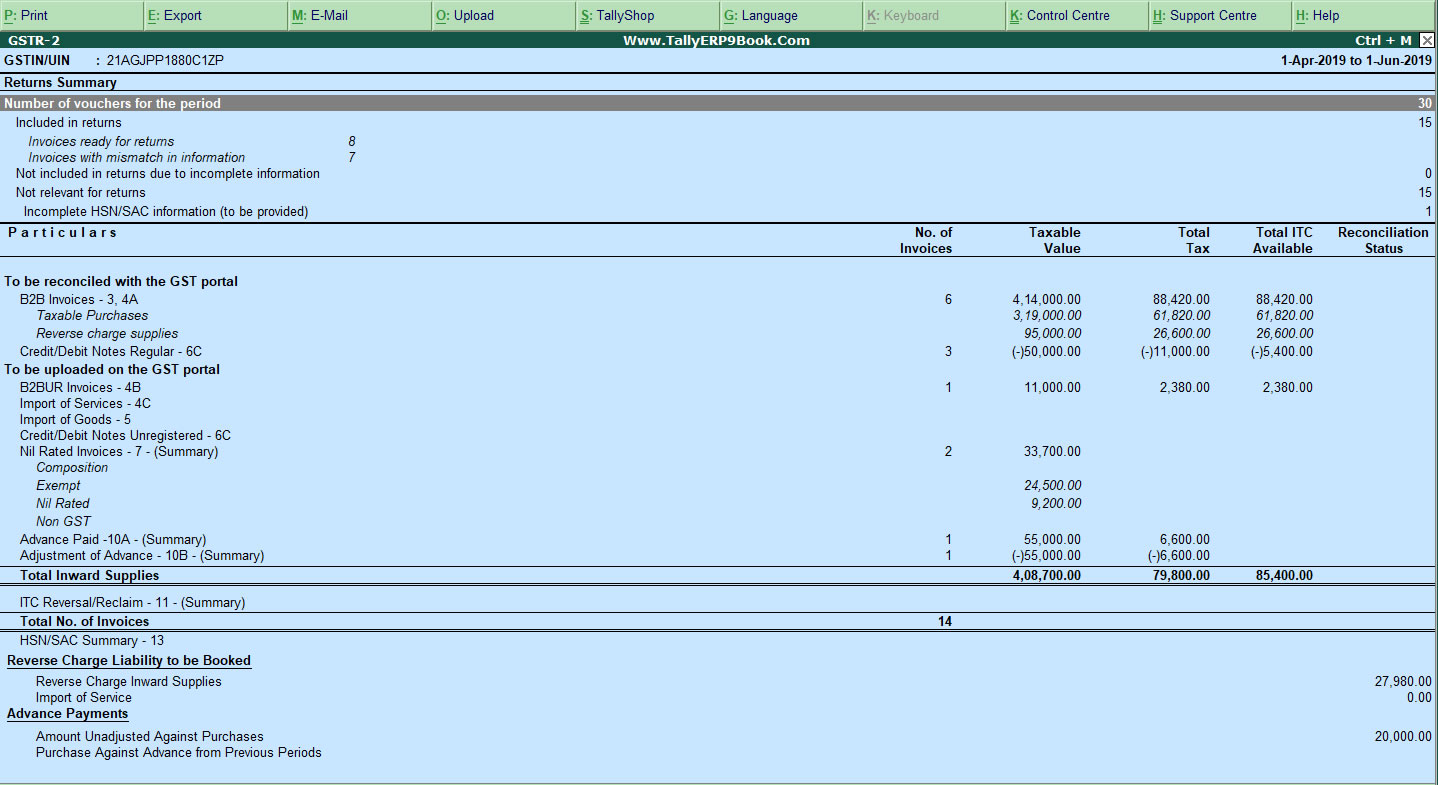

The GSTR-2 report appears as shown :

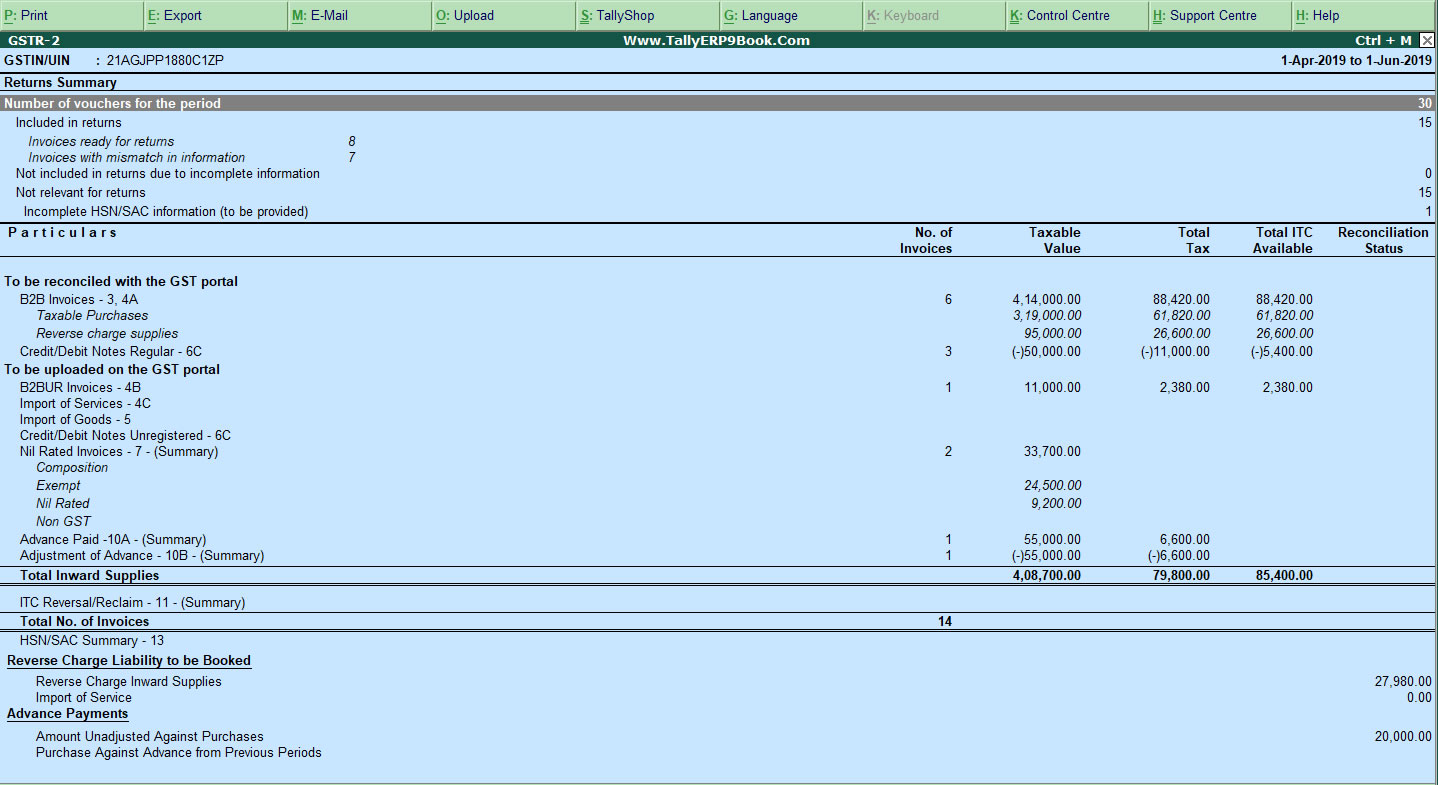

Click F1: Detailed to view the breakup of taxable purchases and purchases under reverse charge for B2B invoices.

- Specify the required reporting period by pressing F2.

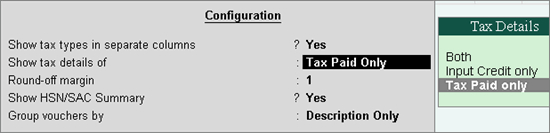

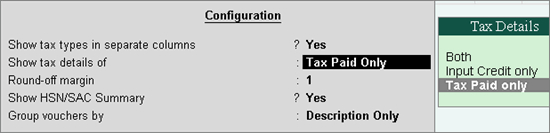

To view the tax types and tax amount for each table of the report, use F12: Configure.

-

You can generate the report with the line HSN Summary of inward supplies by enabling the option Show HSN/SAC Summary?.

-

You can generate the HSN/SAC Summary report with only the description or HSN or both, based on the grouping set in the option Group vouchers by.

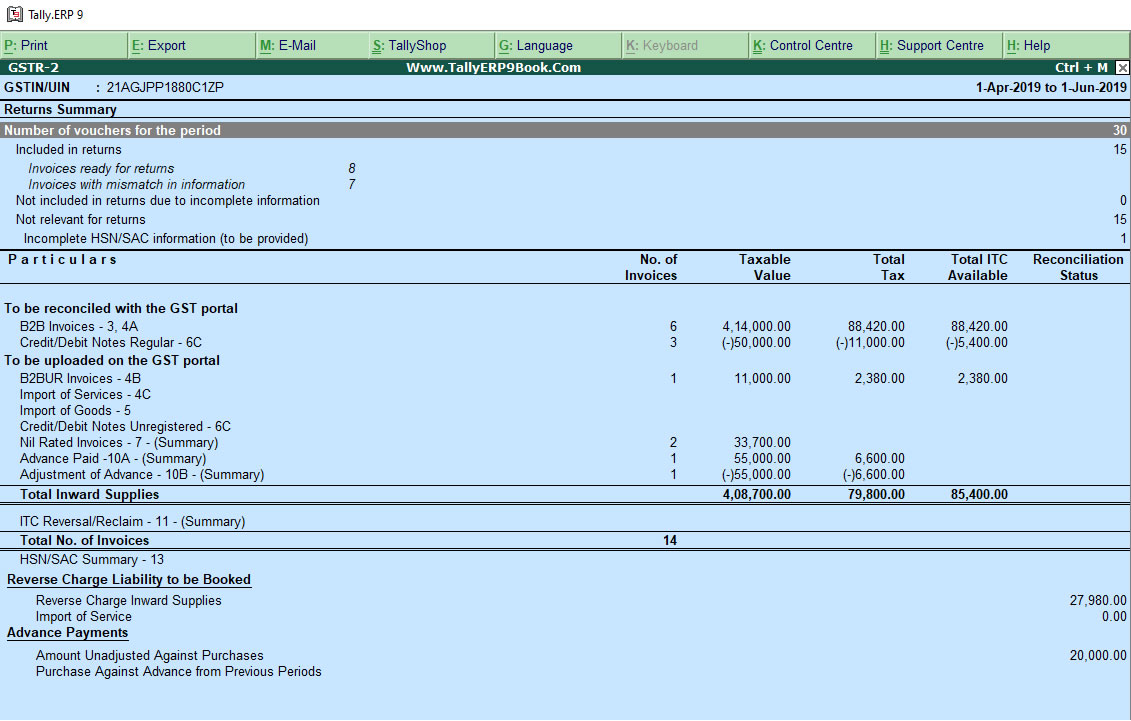

As per the GST return format view, there are two sections in this report:

|