| |

FAQ on TDS (Tax Deducted at Source) in Tally.ERP9 |

FAQ-1 : How to Activate TDS in Tally.ERP 9 ? |

How to Enable TDS in Tally.ERP 9?

1. Ensure

while company creation State and PIN Code details are provided. If these information are not mentioned, alter the Company and select

State: Select the appropriate State from the list.

PIN Code: Enter the Postal Index Number, which is a numerical value of six digits

The State and Pin Code

fields are added to capture the state details.

2. In Tally.ERP 9,

activate TDS in F11: Features screen. The F11: Features button is available in almost all the screens of

Tally.ERP 9.

Gateway

of Tally > Click on the F11: Features button or press F11 Key

>Statutory and Taxation

a.

Set the option Enable

Tax Deducted at Source (TDS) to Yes

b.

Set the option Set/Alter

TDS Details? to Yes to view Company TDS Deductor Details screen

[13-1]

A brief description on

the fields that appear in the Company TDS Deductor Details screen

(i) Tax Assessment

Number: Enter the Tax Assessment

Number (TAN) in this field. The Tax Assessment Number (TAN) is a ten-digit

alphanumeric number, issued by the

Income Tax Department (ITD) to the deductors.

Only one TAN is required for different types of

deductions. TAN must be quoted properly on all Challans such as: Payment for TDS, Returns, All Certificates - Issue in Form

No.16/16A and correspondence with the Income-tax Department.

The format of TAN is something like

this: BLRA07884F

- BLR indicates the location code of the TAN allotment centre (eg: BLR for Bangalore)

- A indicates

the first alphabet of the deductor name

- 07884 is

the number within each location

- F is

the check digit for security and verification

(ii) Income Tax Circle/Ward (TDS): Enter the Income Tax Circle/Ward (TDS). The Income Tax Department issues Income

Tax Circle/Ward (TDS).

(iii) Deductor Type: Depending on your organisation,

you may select the Deductor Type (Government or

Others) from the list

(iv) Name of person responsible: Enter the name of the authorised person responsible for filing the TDS returns of your company.

Note: In

case Tally.ERP 9 is security feature enabled, this field will

be automatically filled with the user name.

(v) Designation: Enter the designation of the authorised person filing the TDS returns

|

|

FAQ-2 : How to create Expenses Ledger in Tally.ERP 9 ? |

Tally.ERP 9 gives the

flexibility to create

- Separate expense ledgers for each nature of payment

- A common expense ledger for all the nature of payments.

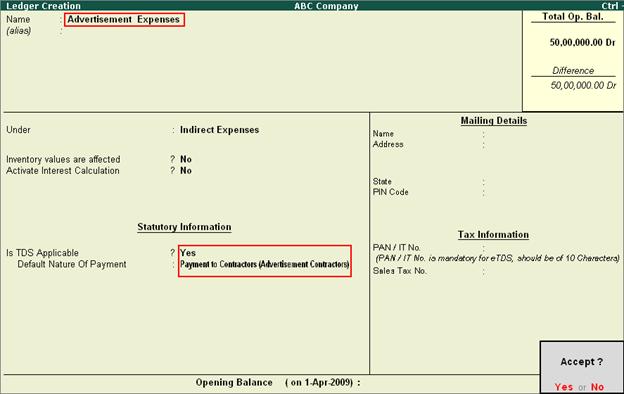

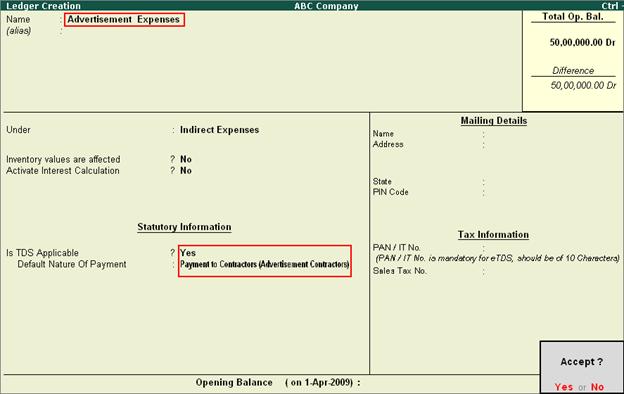

1. Create expense Ledger with defined Nature of Payment (separate expense ledgers for each nature of payment)

To Create the TDS Expense Ledger

Go to Gateway of

Tally > Accounts Info. > Ledgers > Create

- Enter the Name of

the expense ledger e.g. Advertisement

Expenses.

- In Under field select the group Indirect Expenses from the List of Groups.

- Set Inventory

values are affected to No.

- Set Is

TDS Applicable to Yes.

- In Default

Nature of Payment field

select Payment

to Contractors (Advertisement Contractors) from the List of TDS Nature of Pymt.

Note: All the Payments/Expenses subject to TDS have to be associated with relevant predefined TDS Nature of

Payments.

The completed expenses

ledger is displayed as shown

[13-2]

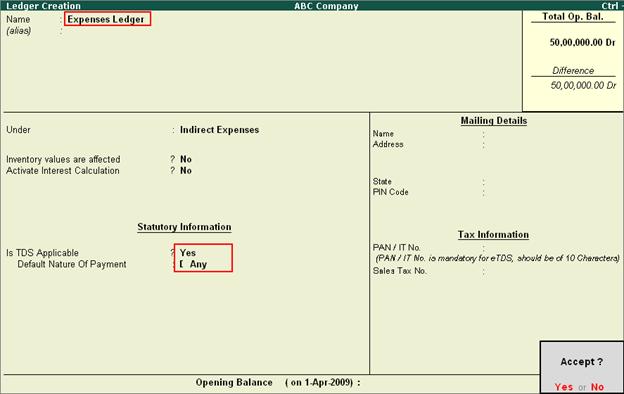

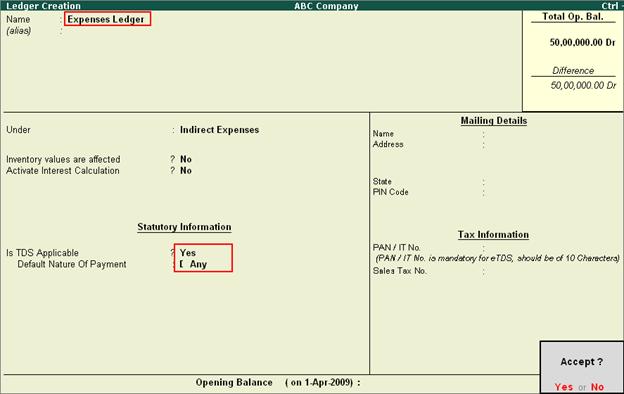

2. Create common expense Ledger

- Enter the Name of

the expense ledger e.g. Expenses

Ledger

- In Under field select the group Indirect Expenses from the List of Groups.

- Set Inventory

values are affected to No.

- Set Is

TDS Applicable to Yes.

- In Default

Nature of Payment field

select Any from the

List of TDS Nature of Pymt.

The completed expenses

ledger is displayed as shown

[13-3]

|

|

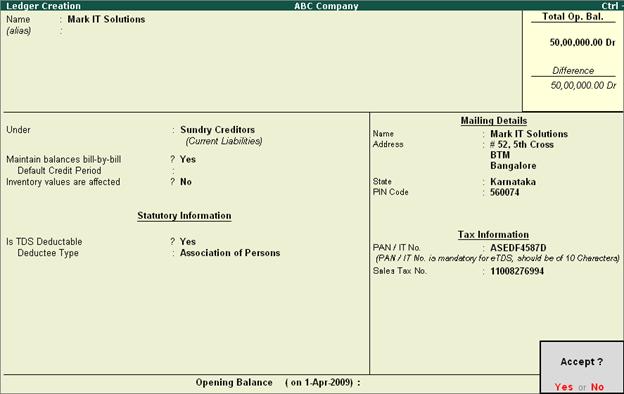

FAQ-3 : How to create TDS Party Ledger in Tally.ERP 9 ? |

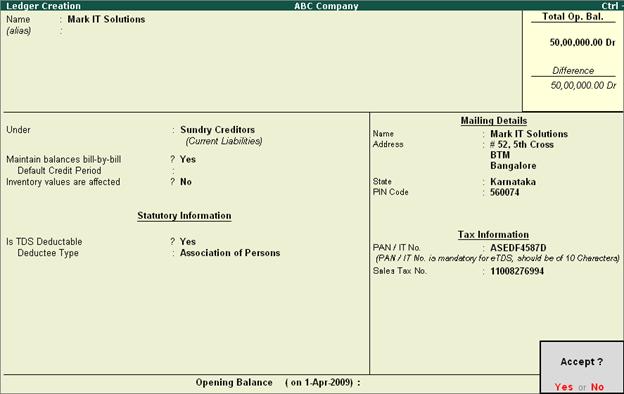

To create party ledger

in Tally.ERP 9

Setup:

- In F12:

Configuration (Ledger Configuration) set Allow Advanced entries

in Masters and Use Addresses for

Ledger Accounts to Yes

Go to Gateway of

Tally > Accounts Info. > Ledgers > Create

- Enter the Name of

the Party Ledger e.g. Mark

IT Solutions

- Select Sundry

Creditors from the List of Groups in the Under field.

- Set Maintain

balances bill-by-bill to Yes.

- Enter the Default Credit Period, if required.

- Set Is

TDS Deductable to Yes.

- In the Deductee Type field, select Association of Persons from the List of Deductee Type

- Enter Mailing and Tax

Information

[13-4]

|

|

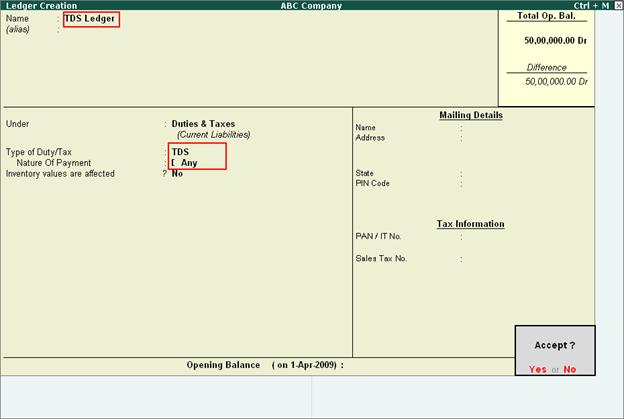

FAQ-4 : How to create TDS (Tax) Ledger in Tally.ERP 9 ? |

In Tally.ERP 9 you

can create

- Separate tax ledgers for each nature of payment

- A Common

tax Ledger for all the Nature of Payments

1. Create tax ledger with defined nature of payment

To create a Tax Ledger

Go to Gateway of

Tally> Accounts Info.> Ledgers> Create

- Enter the Name of

the Tax Ledger e.g. TDS

– Contractors

- Select Duties

& Taxes from the

List of Groups in the Under field.

- In Type

of Duty /Tax field

select TDS from the Types of Duty/Tax list

- In Nature

of Payment field, select Payment to Contractors

(Advertisement Contractors) from

the List

of TDS Nature of Payment.

- Set Inventory

values are affected to No

The completed tax ledger is displayed as shown

[13-5]

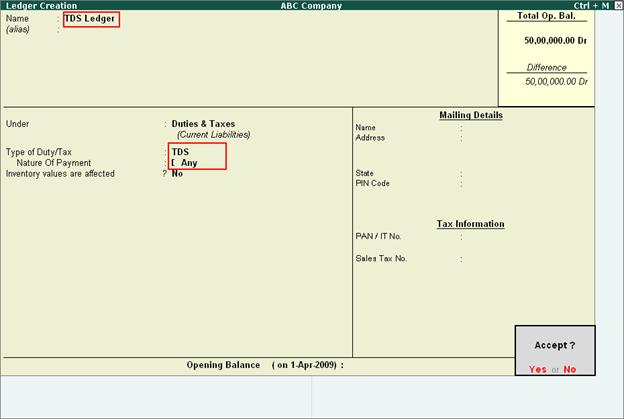

2. Create common tax ledger

- Enter the Name of

the Tax Ledger e.g. TDS Ledger

- Select Duties &

Taxes from the List of Groups in the Under field.

- In Type of Duty /Tax field

select TDS from the Types of Duty/Tax list

- In Nature of Payment field,

select Any from the List of

TDS Nature of Payment.

- Set Inventory values

are affected to No

The completed tax ledger is displayed as shown

[13-6]

|

|

FAQ-5 : How to Record Expenses and Deduct TDS in Tally.ERP 9 ? |

In

Tally.ERP 9 you can record TDS transactions through Journal Voucher or Purchase

Voucher (Account

/Item Invoice Mode)

Note: Recording TDS transactions

in Purchase Voucher in Voucher Mode is not supported.

Example: On 10-4-2009, ABC Company received bill

from Mark IT

solutions for Rs. 1,50,000 towards the Advertisement services provided.

Ensure

the required ledger masters are created before recording the transaction

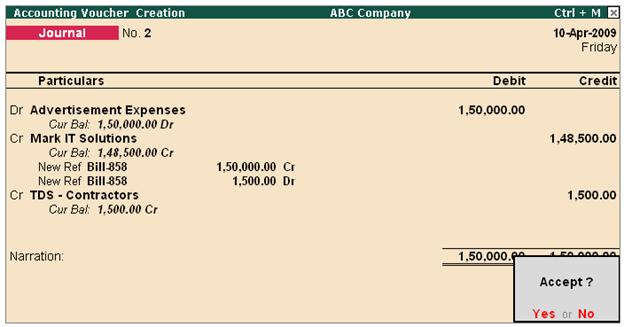

Case 1: Record the transaction in Journal Voucher

1.

In Debit field select the expense ledger - Advertisement Expenses and mention the transaction amount of Rs. 1,50,000 in Amount - field.

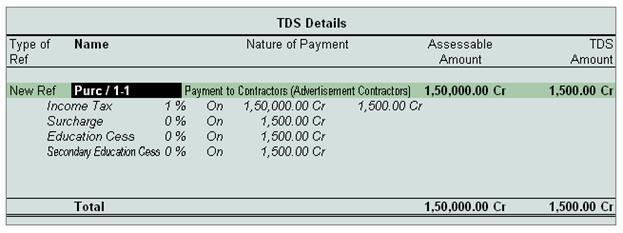

2.

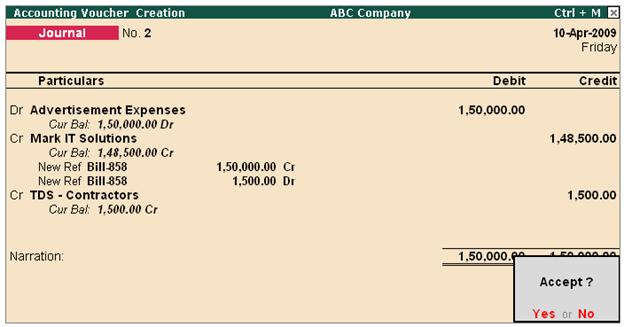

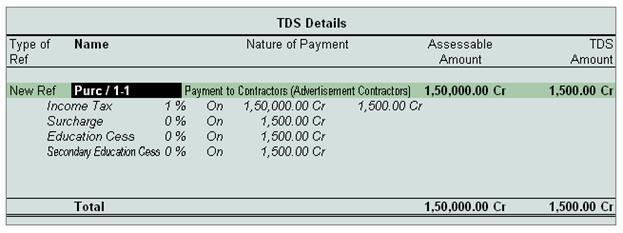

In Credit field select the party ledger - Mark IT Solutions and enter the TDS Details as shown

[13-7]

Note: In this transaction we are deducting TDS in the same voucher.

3. In the Bill-wise

Details screen provide the bill

details as shown

[13-8]

4. In Credit field select the TDS ledger - TDS Contractors to account the TDS deducted.

The completed Journal Voucher is displayed as shown

[13-9]

Case 2: Record the transaction in Purchase Voucher

1.

In Party A/c

Name field

select the party ledger - Mark It

Solutions

2.

Under Particulars select the expenses ledger - Advertisement Expenses and specify the expense amount - Rs. 1,50,000 in Amount filed

3.

Under Particulars select TDS ledger- TDS- Contractors and enter TDS Details as

shown

[13-10]

Note: TDS amount will be displayed

with negative sign

4.

In the Bill-wise

Details screen

enter the details as shown

[13-11]

The

completed Purchase Voucher is displayed as shown

[13-12]

|

|

FAQ-6 : How to Record TDS Payment Entry in Tally.ERP 9 |

All

the Tax deducted during a month is to be paid to the credit of Government on or

before 7th of the next month. In case 7th of the month happens to be a Sunday

or a bank holiday payment can be made on the next working day.

TDS

amount shall be paid to the government account through any designated branches

of the authorised banks, along with Income Tax Challan No.281.

In

Tally.ERP 9, from Release 2.0 all the Tax/Duty payments have to recorded using S: Stat Payment Button to auto compute

or manually enter the TDS amount to the government.

Procedure to record TDS payment entry

Go

to Gateway of Tally> Accounting Vouchers >

F5: Payment

·

In the Payment Voucher specify the payment date and click on S: Stat Payment (or press Alt+S)

[13-13]

·

In Statutory Payment screen

·

In Type of Duty/Tax field select the Duty/Tax Type for which the tax

payment to be made. select TDS from the list

[13-14]

Note: The Types

of Duty/Tax will

be displayed based on the statutory features enabled in F11: Features for the Company.

·

Auto

Fill Statutory Payment:

Set this option to YES to auto calculate and

fill the duty payable to the Government. Set this option to NO, if the user wants to manually select the duty ledger and duty

bills. ABC Company wants the tax details to be auto filled to the payment voucher, hence the option Auto Fill Statutory Payments is set to Yes.

·

On setting the option of Auto Fill Statutory Payment to Yes, based on the Type of Duty/Tax selected Tally.ERP 9 displays the appropriate

fields to fill the details.

·

In Section field select the section for which the payment is pending

[13-14A]

·

In Nature of Payment field select the nature of payment towards which

the payment to be made.

[13-15]

·

In Deductee Type select the applicable deductee type

·

In Cash/Bank field select the bank through which the payment is made

Completed Statutory Payment screen is displayed as shown

[13-16]

·

Press enter to accept.

The TDS amount payable will be auto calculated and displayed with the bill reference

[13-17]

·

Set the option Provide Details to Yes to enter the challan details

·

In Provide Details screen enter the payment details like, Period for which the payment is made, Cheque/DD number, Cheque/ DD Date, bank details,Challan Number and Date.

Completed Provide Details screen is displayed as shown

[13-18]

Completed

Payment Voucher is displayed as shown

[13-19]

|

|

FAQ-7 : How to record Works Contract Transactions in Tally.ERP 9 to Calculate TDS on the net amount of Purchase ? |

For Example:- ABC Company receives

bill form VRG Builders & Developers for works contract given.

Total

Value of the Bill received from VRG

Builders & Developers is Rs. 58925/-

Purchase

cost of Work contract

is Rs.54000/-

Vat @

5% is Rs. 2700/-

Service

Tax @ 4.12% is Rs.2225/-

TDS @ 1% to be Deducted on the above Bill

Steps to record the Works Contract transactions are:

Step 1: Create Ledger

Masters

Step 2:

Record Purchase Voucher (Account Invoice Mode)

Step 3: Record a Payment

Voucher (payment to party)

Step 4: Check TDS

Computation

Step 1: Create Ledger Masters

i. Party Ledger

(supplier): Create VRG Builders &

Developers ledger > under Sundry

Creditors > enable the option Is Service Tax

Applicable to Yes > enable the option Is TDS

Deductable to Yes > in Deductee Type field select Company -

Resident

ii. Purchase Ledger: Create Works Contract Purchases ledger > under Purchase Accounts

- Enable the option Is Service Tax Applicable to Yes > in Category

Name screen select Works Contract

Service

- Enable the option Used in VAT Returns to Yes > select VAT/Tax Class as Purchases

@ 5%

- Enable the option Is TDS Applicable to Yes > in Nature

of Payment field select Payment to

Sub-Contractors

iii. VAT Ledger: Create Vat @ 5% ledger > under Duties & Taxes > select VAT in Type of Duty/Tax field > VAT/Tax Class as Input VAT @ 5% > enable the option Is TDS

Applicable to Yes > select the Nature of

Payment as Payment to

Sub-Contractors

iv. Service Tax Ledger: Create Service Tax @ 4.12% ledger > under Duties & Taxes > select Service Tax in Type of Duty/Tax field > Category Name as Works Contract Service > enable the option Is TDS

Applicable to Yes > select the Nature of

Payment as Payment to

Sub-Contractors

v. TDS Ledger: Create TDS Ledger > under Duties &

Taxes > select TDS in Type of Duty/Tax field > Nature of Payment as Payment to Sub-Contractors

Step 2:

Record Purchase Voucher (Account Invoice Mode)

Go to Gateway of Tally > Accounting Vouchers > F9:

Purchase

Note: In F12: Configuration set the option Allow Alteration of TDS Nature of

Payment in Expenses to Yes

- In the Party A/c Name field select Party Ledger

- Under Particulars select the Purchase Ledger and specify the amount as 54,000 and press enter to view TDS Nature of Payment Details

screen.

- In TDS Nature of Payment

Details by default the Nature of Payment selected in the ledger will be displayed. In Assessable Value field accept the default amount of Rs.54,000

[13-20]

- Under Particulars select

the VAT ledger, VAT amount will

be calculated and displayed automatically. Press enter to

view TDS Nature of Payment Details screen, accept the

default details.

- Under Particulars select Service

Tax Ledger. In the Service Tax Computation screen

change the service tax percentage to 4% (as service Tax

charged on works contract is 4%). Service tax will be calculated

based on the Service Tax Rate defined.

In TDS Nature of Payment Details screen, accept the

default details.

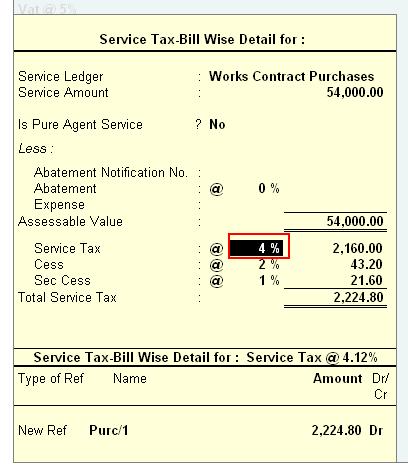

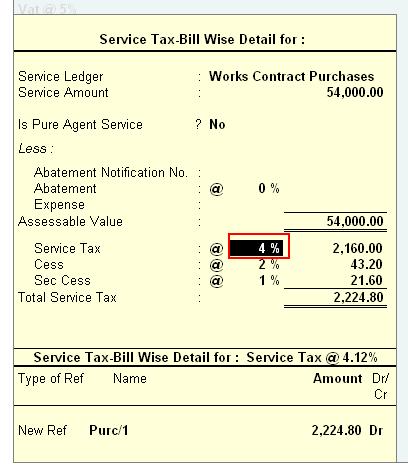

[13-21]

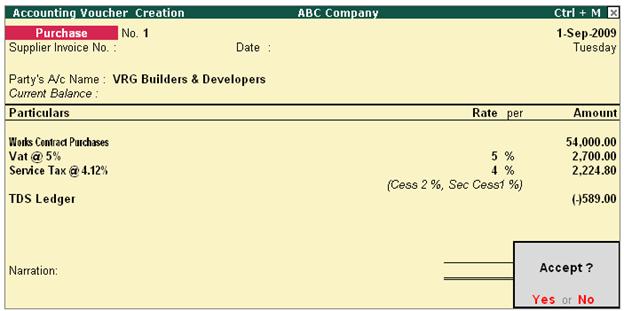

- Under Particulars select TDS

ledger and press enter to view the TDS Details screen. Observe

TDS is calculated on the Total Amount (Work

Contract Purchase Value + VAT + Service Tax = 58924.80).

Purchase Entry

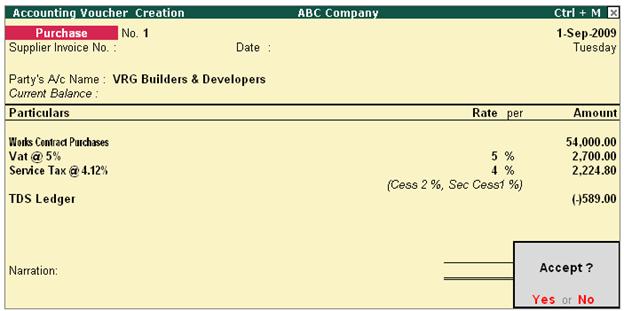

is displayed as shown

[13-22]

Note: TDS deducted is displayed with Negative Sign.

In Bill-wise Details screen select the reference details as shown

[13-23]

Completed Purchase Voucher is as shown below

[13-24]

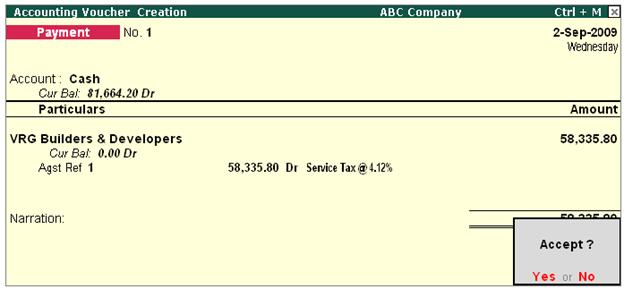

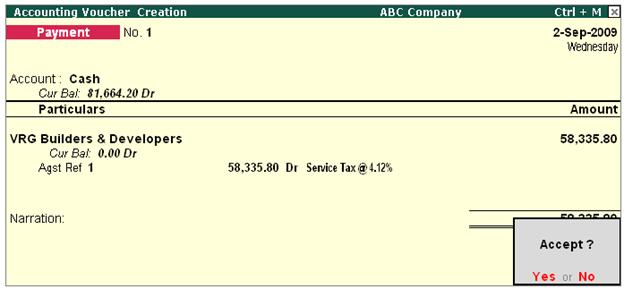

Step 3: Record a Payment Entry

Make the payment

to the party and the payment voucher will be dispalyed as shown

[13-25]

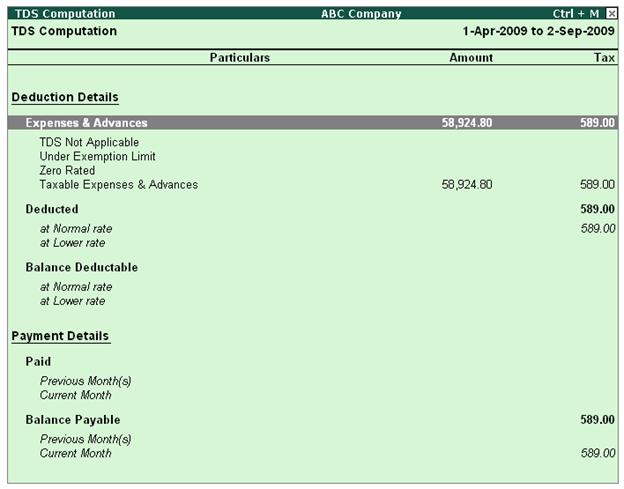

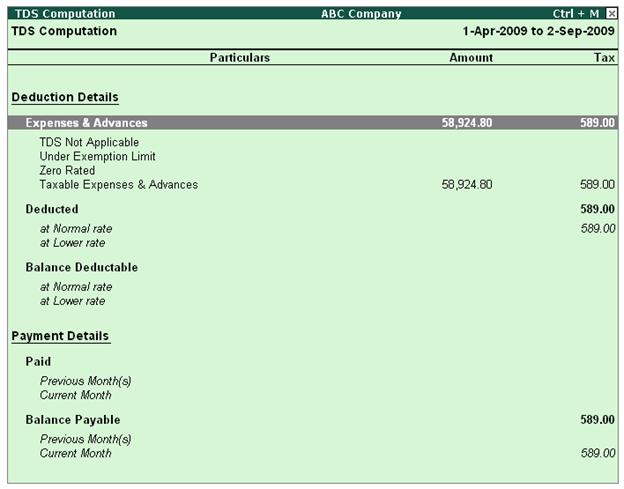

Step 4: Check TDS Computation

Go

to Gateway

of Tally > Display > Statutory Reports > TDS Reports > Computation

[13-26]

Similarly you can check Input Credit Form and VAT

Computation reports to view the details of Service Tax and VAT

|

|

FAQ-8 : How Calculateto Service Tax on total Transaction Amount including TDS in Tally.ERP 9 ? |

How to Calculate Service Tax on

total transaction amount including TDS ?

For

the accurate calculation of Service

Tax and TDS follow the given steps

1.

Book the Expenses

and Service Tax through Purchase Voucher as shown

2.

Deduct TDS in a separate Journal Voucher using of Alt + S: TDS Deduction

3. Make the Payment to party

4.

Check the Service-Tax Input

credit Form -report displays

the realised value & total credit as shown

below

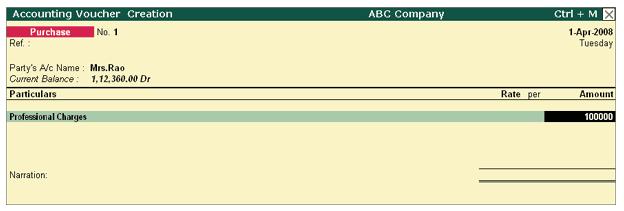

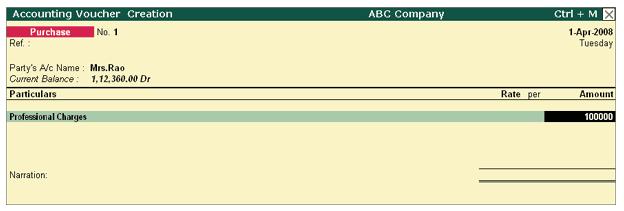

Step1. Book the Expenses

and Service Tax through Purchase

Voucher as shown

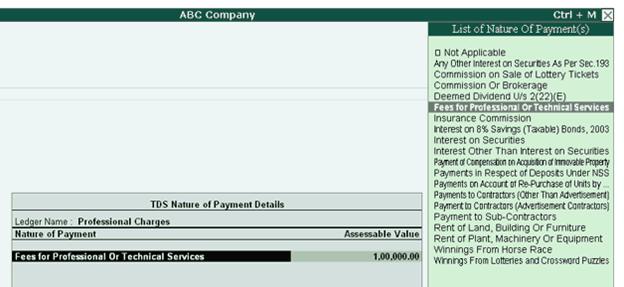

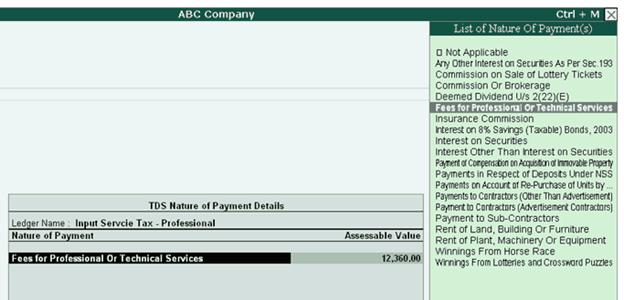

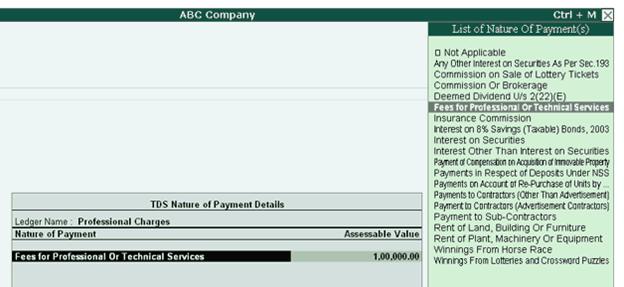

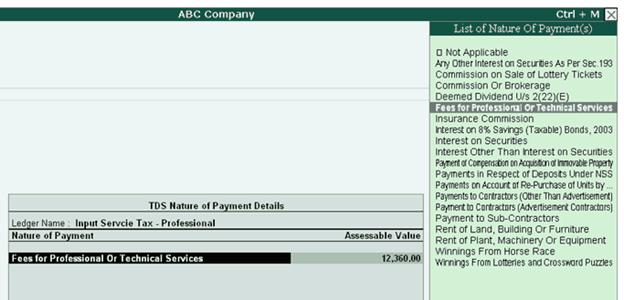

Select

the Expenses

ledger and

allocate the entire amount to the applicable TDS Nature of Payment

[13-27]

[13-28]

Select

the Input

Service Tax Ledger and in

the Service

Tax Bill-wise details screen select the default bill details

[13-29]

In

the Expense

Allocation screen

select the applicable TDS

Nature of Payment

Note: TDS Nature of Payment for the Input Service Tax Ledger as Even on the service Tax amount TDS needs to deducted.

[13-30]

In the TDS Details screen select the details as shown

[13-31]

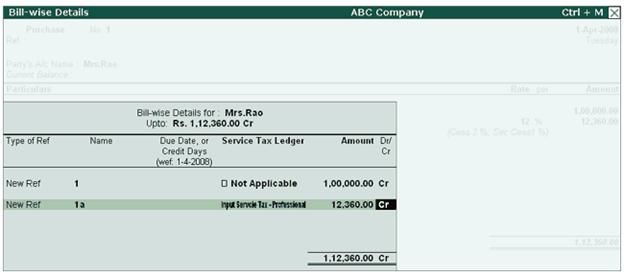

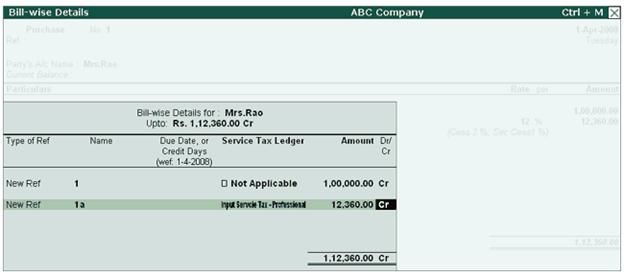

In

the Bill-wise

Details screen

enter the bill references as shown

[13-32]

Save

the purchase voucher

Adjust the Bill Number -

1 and save the voucher

[13-33]

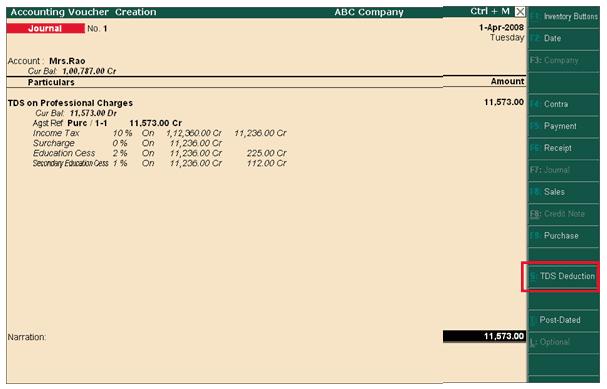

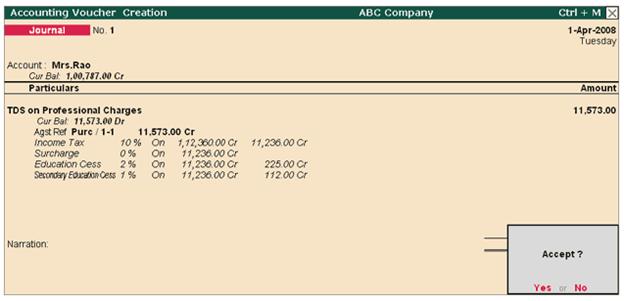

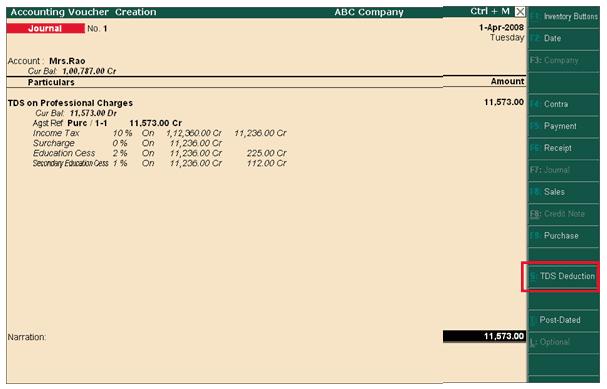

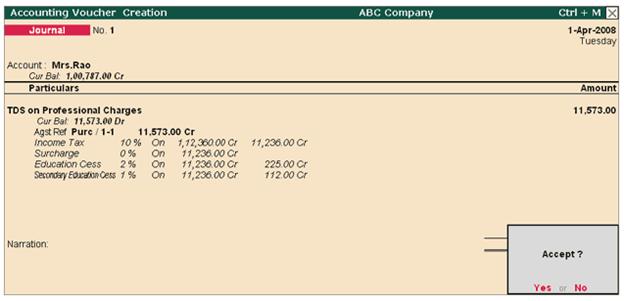

Step 2. Deduct TDS in a separate Journal Voucher using of Alt + S: TDS Deduction option as shown

[13-34]

[13-35]

[13-36]

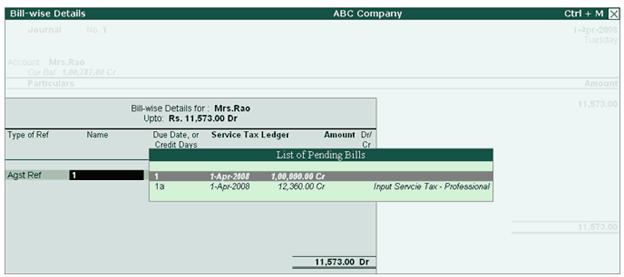

Step 3. Make the Payment to party

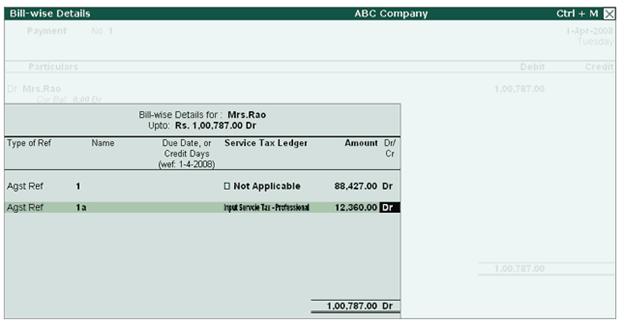

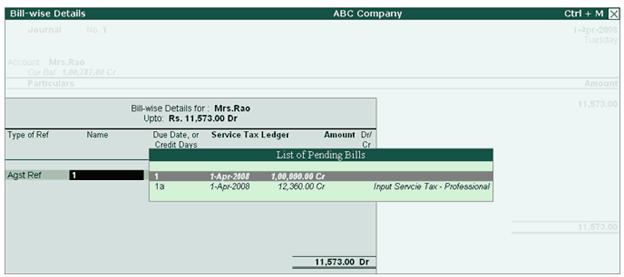

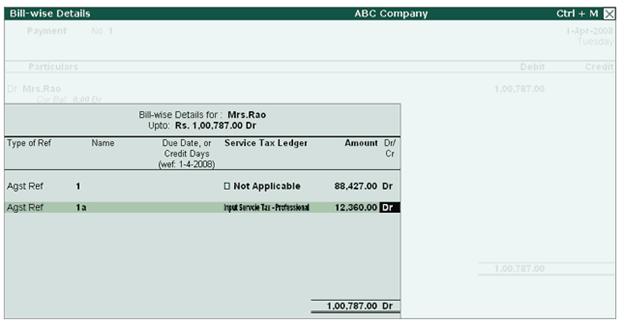

Select Mrs. Rao and in the Bill-wise Details screen select the bill reference as shown

[13-37]

Save the Payment Voucher

[13-38]

Step 4. Check the Service-Tax Input

credit Form -report displays the realised value & total credit as shown below

[13-39]

|

|

FAQ-9 : How to Account Sales Commission and Deduct TDS in the same voucher ? |

Solution

In Tally.ERP 9, from

release 1.8 you can record sales commission transactions in Credit Note and Deduct TDS on Commission

Example: ABC Company sells the goods to

partners on a condition that, on each sales Rs.100 will be paid as sales

commission. To account sales commission separate expense entry is not booked in

Journal but directly a credit note is raised in favour of the partner (to reduce party outstandings) and TDS

is deducted on commission. As on 15-10-2009 ABC Company has to pay Rs.

50,000 commission (sales) to partner Mark IT Solutions.

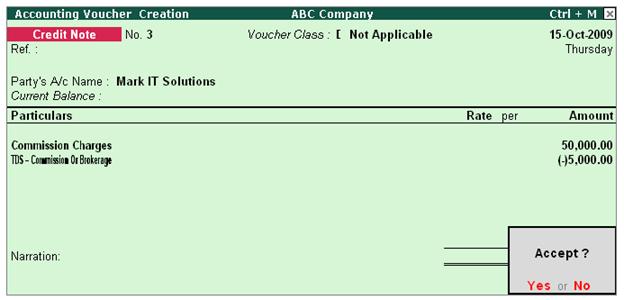

1. Record the transaction in Credit Note

Set up: Ensure in F11: Features

(F1: Accounting Features) following options are set to Yes

- Use Debit/Credit Notes

- Use Invoice mode for Credit

Notes

Go to Gateway of

Tally > Accounting Vouchers > Ctrl + F8: Credit Note (Account Invoice

Mode)

1.

In Party A/c Name field select Mark IT Solutions

2.

Under Particulars field select Commission Charges Ledger to account commission expenses

3.

In Amount field enter Rs.50,000 (total commission due for the party)

4.

Under Particulars select TDS - Commission Or Brokerage ledger to deduct TDS on

the payment of commission.

5.

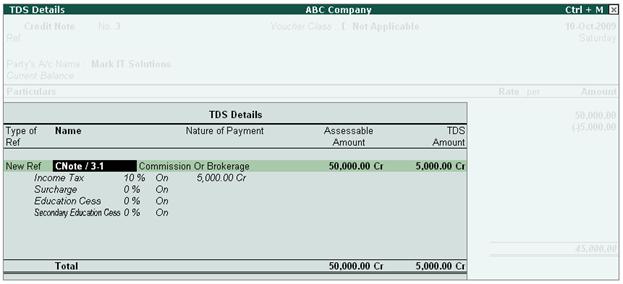

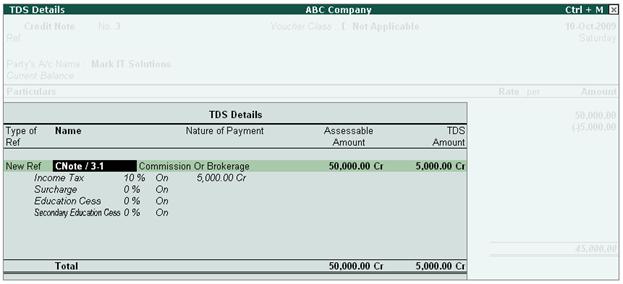

In TDS Details screen

o

In Type of Ref field select New Ref

o

In Name field accept the default Reference Number –CNote/ 3-1

o

In Nature of Payment field select Commission Or Brokerage will be defaulted automatically

o

Assessable Amount and TDS Amount field details are defaulted automatically, based

on the information provided in the voucher

[13-40]

TDS Deducted on

Commission Rs. 5000 will be displayed with Negative sign

6. In Bill-wise

Details screen

- In Type

of Ref field select New Ref (if Required you can select Agst Ref to adjust against the sales bill)

- In Name field enter the Bill Reference Number as CN/001

- Accept the default amount allocation and Dr/Cr. By default Tally.ERP 9 displays the Bill amount in the amount field as the credit balance.

- Press Enter, select New Ref as Type of Ref and enter Bill name as CN/001

- Skip the Due Date or Credit Days field and accept the default amount allocation and Dr/Cr. By default Tally.ERP 9 displays the Tax amount in the

amount field as the debit balance.

[13-41]

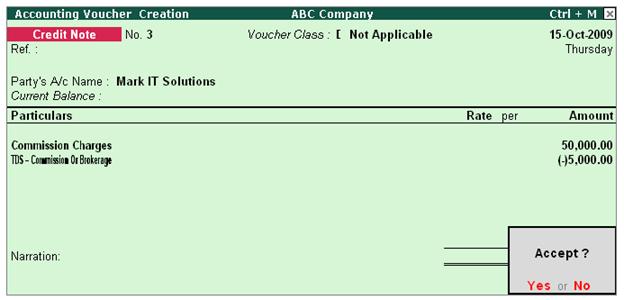

Completed

Credit Note voucher is displayed as shown

[13-42]

7. Press Enter to accept and save. |

|

FAQ-10 : How to Reverse Excess TDS Deducted in Tally.ERP 9 ? |

Solution

In case of partial cancellation of transaction (s), the expenses

and excess TDS deducted needs to be reversed. In Tally.ERP 9, such reversal of

expenses and TDS is possible only when the cancellation of transaction is made

before the payment of TDS to the Government.

In Tally.ERP 9, reversal of expenses can be accounted using Debit

Note and reversal of TDS deducted can be accounted using Credit Note.

Example: On 17-10-2009 ABC Company received bill from Pheonix Agencies for Rs. 75,000 towards Advertising

expenses. On 21-10-2009 ABC Company cancelled the advertisement services

to the extent of Rs.25,000 and Expenses and TDS

deducted are reversed.

To account these Transaction follow the given steps

1. Book the Expenses in

Journal Voucher

2. Reverse the Expenses

(Debit Note)

3. Reverse the

excess TDS Deducted (Credit Note)

Step 1: Book the Expenses in Journal Voucher

Before recording the

transaction ensure all the masters are created.

Go to Gateway of

Tally > Accounting Vouchers > F7: Journal

- In Debit field select Advertisement Expenses and enter 75,000 in

the Amount field.

- In Credit field select Phoenix Agencies and press enter to view TDS Details screen

- In TDS

Details screen,

- Select Type

of Ref as New Ref.

- In Name filed accept default reference number

- Select Payments to Contractors (advertisement Contractors) in Nature of payment field

- Select the TDS Ledger

- In Assessable

Amount field amount specified

against the expenses ledger will be displayed

- Set Yes in Deduct

now field

[13-43]

- Payable Amount as calculated in the TDS Details screen will be

defaulted in the Party’s Amount (Credit) field.

- In Bill-wise

Details screen

- Select New

Ref as the Type of Ref

- In the Name field enter the Bill name as Bill -0178

- Skip the Due Date or Credit Days field

- Accept the default amount allocation and Dr/Cr. By default Tally.ERP 9 displays the Bill amount in the amount field as the credit balance.

- Press Enter, select New Ref as Type

of Ref and Enter Bill name as Bill -0178

- Skip the Due Date or Credit Days field and accept the default amount allocation and Dr/Cr. By default Tally.ERP 9 displays the Tax amount in

the amount field as the debit balance.

- In the Credit field select TDS – Contractor from the List of Ledger Accounts.

- In the Amount field, Rs. 1500 [Bill amount (75,000) – Pending Amount

(73,500)] is displayed automatically.

[13-44]

- Press Enter to accept and save.

Step 2: Reverse the Expenses (Debit Note)

Go to Gateway of

Tally > Accounting Vouchers > Ctrl+F9: Debit Note

- Press Alt

+ I for Account Invoice mode.

- In Party’s

A/c Name field select Pheonix Agencies from the List of Ledger

Accounts.

- Under Particulars select Advertisement

Expenses and enter Rs. 25,000 in the Amount field.

- In TDS

Details screen

- In Type

of Ref select Agst Ref

- In Name field, select Jurl/16-1 to adjust the reversal of expenses and select Payments

to Contractors (advertisement Contractors) in Nature of Payment field

- Based on the Tax Reference Number selected, Tally.ERP 9 defaults TDS Duty Ledger. In Assessable

Value field Rs. 25000 will be

displayed indicating that Rs.25000 is reversed against the expenses

booked on 17-10-2009

[13-45]

Note: Observe TDS Amount is not displayed as we are

not reversing TDS in Debit Note

- In Bill–wise

Details screen, select Agst Ref as the Type of Ref. In the Name field select Bill-0178 dated 17-10-2009

from the Pending Bills to reverse the expenses.

[13-46]

[13-47]

- Press Enter to accept and save.

Step 3: Reverse the excess TDS Deducted (Credit Note)

Go to Gateway of

Tally > Accounting Vouchers > Ctrl+F8: Credit Note

- Press Alt

+ I for Account Invoice mode.

- In Party’s

A/c Name field select Pheonix Agencies

- Under Particulars select TDS

- Contractor and press

enter to view TDS Details screen

- In TDS

Details screen, select Agst Ref in Type of Ref, in Name field select Jurl/16-1

to adjust the reversal of TDS. Based on

the Tax

Reference Number selected,

Tally.ERP 9 defaults Nature

of Payment and TDS Amount

[13-48]

- In Bill–wise

Details screen, select Agst Ref as the Type of Ref. In the Name field

select Bill-0178 dated 17-10-2009 from the Pending Bills to reverse the

TDS.

[13-49]

[13-50]

- Press Enter to accept and save.

|

|

FAQ-11 : How to account the receipts towards the sale of services, where the service receiver has deducted TDS and made the balance payment to the Service provider and Tally.ERP displays complete service bill amount including TDS amount in Service Tax payable Report ? |

Solution

Step 1: Record Service Sales Invoice

[13-51]

Step 2: Record a receipt voucher to account the receipt towards

the services sold

Assume that service

receiver has made full payment towards the above sales after

deducting TDS on Professional Services.

In Credit field select the party ledger - Birla

Associates and press enter. Service

Tax Details screen appears. In Service Tax Details screen select End of List.

[13-52]

In Amount field

enter the actual amount received from the customer. ABC Company received Rs. 32,966 from the customer.

In Bill-wise Details screen select the appropriate bill towards which the payment

is received. In Amount field the actual amount received will be displayed.

[13-53]

In Debit field, select the Bank/Cash ledger depending on the nature of receipt. Here the

receipt is in the form of Cheque hence Bank

ledger is selected.

Completed receipt entry

appears as shown:

[13-54]

Save the Receipt

Voucher.

Step

3: Accounting the TDS Deducted to

wards the services provided

In Tally.ERP 9 Releases 1.8 onwards

provision has been made to account the TDS amount on the servcies provided and capture the details in appropriate reports. To

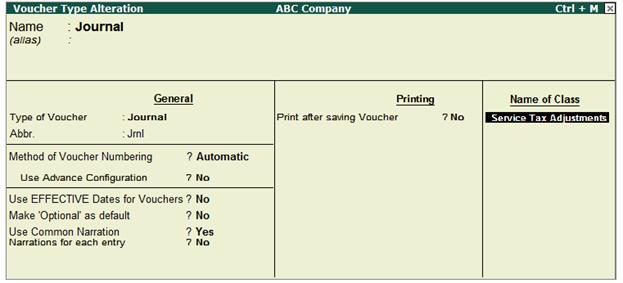

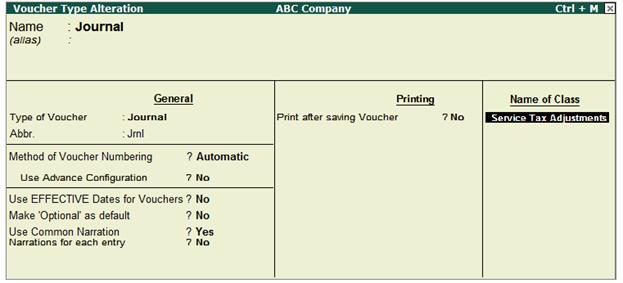

account these types of adjustments - Service Consideration Adjustments flag has been provided in Journal Voucher (This flag will be avaialbe only when the vocuher class is created for Journal Voucher)

1.

Create Service Tax Adjustment Class in Journal Voucher

Go to Gateway of Tally > Accounts Info. > Voucher

Types > Alter > select Journal

In Voucher Type Alteration screen

- Tab Down to Name of Class field and enter the class name as Service Tax

Adjustments

[13-55]

- In Voucher

Type of Class screen

- Enable the option Use Class for Service Tax Adjustments as “YES”

[13-56]

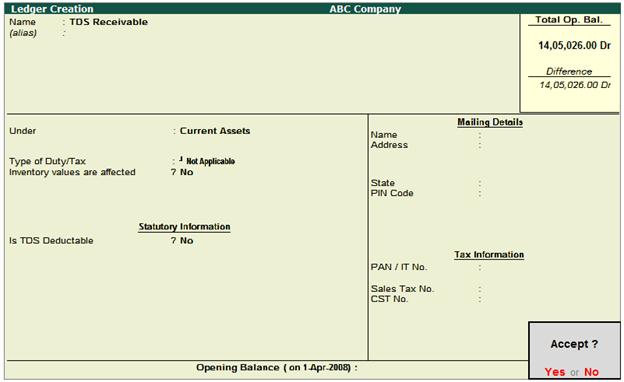

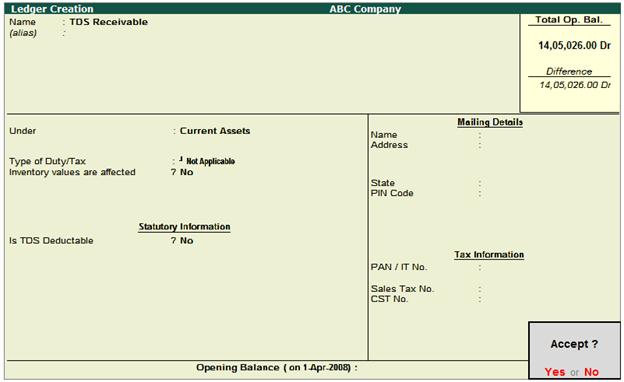

2.

Create ledger to account TDS Amount

Create the ledger under Crrent Asets as shown below

[13-57]

3.

Record the transaction in Journal Voucher

Go to Gateway of

Tally > Accounting Vocuhers > F7: Journal

Voucher

In Change Voucher Type

Class screen, select Service Tax Adjustments in Class field

[13-58]

In Used for field

select the flag “Service

Consideration Adjustments”

[13-59]

In Debit field select TDS Receivable ledger (grouped under current assets or any

group) and enter the amount which is deducted as TDS. In Debit (amount) field enter Rs. 3,663[Total Bill Amount (36,629) - Amount Received

(32,966)].

In Credit field select the Service Receiver - Birla Associates and press enter to view Service Tax Details

screen. In Service Tax

Details screen, select End of List.

[13-60]

In Bill-wise

Details screen select the

appropriate bill to adjust the amount deducted as TDS.

[13-61]

The completed Journal

Voucher appears as shown:

[13-62]

Save the Journal

Voucher.

Note: This adjustment entry can be

booked based on the TDS certificates received from service receiver

periodically or yearly depending upon users requirement.

|

|

FAQ-12 : TDS on Advance Payments to Party |

Query

Is it possible to

account Advance payments to party and deduct TDS on

such advances? How to adjust the advances paid to the party towards the

Bill?

Example: On 15-04-2010, ABC Company made an advance payment of Rs.50,000 to Pheonix Agencies towards

Advertisement Expenses. While making payment tax was deducted form the Source. Advances were adjusted towards

the bill of Rs.2,00,000 dated 26-04-2010.

Solution

Tally.ERP 9 allows accounting advance payments to party and deduct

TDS on the advances and later adjust the advance paid towards the Bill.

Follow the given procedure to account advances

and adjust the advances towards the Bill

Step 1: Record a Payment Voucher (to account advances)

To create a Payment Voucher

Go to Gateway of

Tally > Accounting Vouchers > F5: Payment.

Set up

In F12: configure

(Payment Configuration)

- Ensure Use

Single Entry mode for Pymt/Rcpt/Contra is set to Yes

1. In Account field select the Bank Ledger. E.g. Canara Bank

2. Under Particulars select the party ledger Pheonix Agencies. In Amount field enter the amount paid as advance and press

enter to view Bill-wise Details screen

3. In Bill-wise

Details screen

- In Type of Ref field select the reference as Advance

- In Name field enter the bill name as Adv-201

- Amount will be displayed automatically

[13-63]

4. Accept the Bill-wise

Details screen

5. Under Particulars select tax ledger, TDS - Contractor and press enter to view TDS Details screen

TDS Details screen appears as shown

[13-64]

6.

Press Enter to accept the TDS Details. Tax

deducted will be displayed with negative sign.

The

completed Payment Voucher is displayed as shown

[13-65]

7. Press Enter to save.

Step 2: Record a Journal Voucher (to account the bill &

adjust the advances)

To account the bill

received and adjustment of advances paid

Go to Gateway of

Tally > Accounting Vouchers > F7: Journal

1. In Debit field select the expenses ledger - Advertisement

Expenses. In Debit amount field enter the total bill amount of Rs. 2,00,000

2. In Credit field select the Party Ledger - Pheonix Agencies. Press Enter to view TDS Details screen

3. In TDS Details screen

- In Type

of Ref field select Agst Ref

- In Name field select Pymt/1-2 from the Pending Tax Bills. On selection of Tax bill

Nature of Payment, TDS Duty Ledger, Assessable Amount and Payable Amount will be defaulted

automatically and application will not allow altering the

details.

[13-66]

- In Type

of Ref field select New Ref.

- In Name field Tax Bill reference will be defaulted automatically

- In Nature of Payment select Payment

to Contractors (Advertisement Contractors)

- In TDS Duty Ledger field select TDS – Contractors and set Deduct Now to Yes.

The completed TDS

Details screen is displayed as shown

[13-67]

Observe, the advance of Rs. 50,000 is adjusted towards the bill and TDS is calculated only on the balance

amount of Rs. 1,50,000.

4. In Bill-wise

Details screen select the bill

reference as shown

- In Type

of Ref select Agst Ref, in Name field select the bill Adv-201 dated 15-4-2010 form the pending bills and in Amount field mention the amount adjusted as Rs. 50,000.

- In Type

of Ref select New Ref, in Name field enter the bill name as PA/152/10-11 and in amount filed mention the amount pending for payment

- In Type

of Ref select New Ref, in Name field enter the bill name as PA/152/10-11 and in amount filed tax deducted will be defaulted.

[13-68]

5. In Credit field select the TDS ledger TDS- Contractor. Tax deducted - Rs. 3,000 (on 1,50,000) will be

defaulted automatically.

The completed journal

voucher is displayed as shown

[13-69]

6.

Press Enter to save.

|

|

FAQ-13 : Is it possible to account Advance payments to party and deduct TDS on such advances? How to adjust the advances paid to the party towards the Bill ? |

Example: On 15-04-2010, ABC Company made an advance payment of Rs.50,000 to Pheonix Agencies towards Advertisement Expenses. While making payment tax was deducted form the Source. Advances were adjusted towards the bill of Rs.2,00,000 dated 26-04-2010. |

Solution

Tally.ERP 9 allows accounting advance payments to party and deduct TDS on the advances and later adjust the advance paid towards the Bill.

Follow the given procedure to account advances and adjust the advances towards the Bill

Step 1: Record a Payment Voucher (to account advances)

To create a Payment Voucher

Go to Gateway of Tally > Accounting Vouchers > F5: Payment.

Set up

In F12: configure (Payment Configuration)

- Ensure Use Single Entry mode for Pymt/Rcpt/Contra is set to Yes

1. In Account field select the Bank Ledger. E.g. Canara Bank

2. Under Particulars select the party ledger Pheonix Agencies. In Amount field enter the amount paid as advance and press enter to view Bill-wise Details screen

3. In Bill-wise Details screen

- In Type of Ref field select the reference as Advance

- In Name field enter the bill name as Adv-201

- Amount will be displayed automatically

[13-63]

4. Accept the Bill-wise Details screen

5. Under Particulars select tax ledger, TDS - Contractor and press enter to view TDS Details screen

TDS Details screen appears as shown

[13-64]

6. Press Enter to accept the TDS Details. Tax deducted will be displayed with negative sign.

The completed Payment Voucher is displayed as shown

[13-65]

7. Press Enter to save.

Step 2: Record a Journal Voucher (to account the bill & adjust the advances)

To account the bill received and adjustment of advances paid

Go to Gateway of Tally > Accounting Vouchers > F7: Journal

1. In Debit field select the expenses ledger - Advertisement Expenses. In Debit amount field enter the total bill amount of Rs. 2,00,000

2. In Credit field select the Party Ledger - Pheonix Agencies. Press Enter to view TDS Details screen

3. In TDS Details screen

- In Type of Ref field select Agst Ref

- In Name field select Pymt/1-2 from the Pending Tax Bills. On selection of Tax bill Nature of Payment, TDS Duty Ledger, Assessable Amount and Payable Amount will be defaulted automatically and application will not allow altering the details.

[13-66]

- In Type of Ref field select New Ref.

- In Name field Tax Bill reference will be defaulted automatically

- In Nature of Payment select Payment to Contractors (Advertisement Contractors)

- In TDS Duty Ledger field select TDS – Contractors and set Deduct Now to Yes.

The completed TDS Details screen is displayed as shown

[13-67]

Observe, the advance of Rs. 50,000 is adjusted towards the bill and TDS is calculated only on the balance amount of Rs. 1,50,000.

4. In Bill-wise Details screen select the bill reference as shown

- In Type of Ref select Agst Ref, in Name field select the bill Adv-201 dated 15-4-2010 form the pending bills and in Amount field mention the amount adjusted as Rs. 50,000.

- In Type of Ref select New Ref, in Name field enter the bill name as PA/152/10-11 and in amount filed mention the amount pending for payment

- In Type of Ref select New Ref, in Name field enter the bill name as PA/152/10-11 and in amount filed tax deducted will be defaulted.

[13-68]

5. In Credit field select the TDS ledger TDS- Contractor. Tax deducted - Rs. 3,000 (on 1,50,000) will be defaulted automatically.

The completed journal voucher is displayed as shown

[13-69]

6. Press Enter to save. |

|

| |

|

|

|

|