For Example:- ABC Company receives

bill form VRG Builders & Developers for works contract given.

Total

Value of the Bill received from VRG

Builders & Developers is Rs. 58925/-

Purchase

cost of Work contract

is Rs.54000/-

Vat @

5% is Rs. 2700/-

Service

Tax @ 4.12% is Rs.2225/-

TDS @ 1% to be Deducted on the above Bill

Steps to record the Works Contract transactions are:

Step 1: Create Ledger

Masters

Step 2:

Record Purchase Voucher (Account Invoice Mode)

Step 3: Record a Payment

Voucher (payment to party)

Step 4: Check TDS

Computation

Step 1: Create Ledger Masters

i. Party Ledger

(supplier): Create VRG Builders &

Developers ledger > under Sundry

Creditors > enable the option Is Service Tax

Applicable to Yes > enable the option Is TDS

Deductable to Yes > in Deductee Type field select Company -

Resident

ii. Purchase Ledger: Create Works Contract Purchases ledger > under Purchase Accounts

- Enable the option Is Service Tax Applicable to Yes > in Category

Name screen select Works Contract

Service

- Enable the option Used in VAT Returns to Yes > select VAT/Tax Class as Purchases

@ 5%

- Enable the option Is TDS Applicable to Yes > in Nature

of Payment field select Payment to

Sub-Contractors

iii. VAT Ledger: Create Vat @ 5% ledger > under Duties & Taxes > select VAT in Type of Duty/Tax field > VAT/Tax Class as Input VAT @ 5% > enable the option Is TDS

Applicable to Yes > select the Nature of

Payment as Payment to

Sub-Contractors

iv. Service Tax Ledger: Create Service Tax @ 4.12% ledger > under Duties & Taxes > select Service Tax in Type of Duty/Tax field > Category Name as Works Contract Service > enable the option Is TDS

Applicable to Yes > select the Nature of

Payment as Payment to

Sub-Contractors

v. TDS Ledger: Create TDS Ledger > under Duties &

Taxes > select TDS in Type of Duty/Tax field > Nature of Payment as Payment to Sub-Contractors

Step 2:

Record Purchase Voucher (Account Invoice Mode)

Go to Gateway of Tally > Accounting Vouchers > F9:

Purchase

Note: In F12: Configuration set the option Allow Alteration of TDS Nature of

Payment in Expenses to Yes

- In the Party A/c Name field select Party Ledger

- Under Particulars select the Purchase Ledger and specify the amount as 54,000 and press enter to view TDS Nature of Payment Details

screen.

- In TDS Nature of Payment

Details by default the Nature of Payment selected in the ledger will be displayed. In Assessable Value field accept the default amount of Rs.54,000

[13-20]

- Under Particulars select

the VAT ledger, VAT amount will

be calculated and displayed automatically. Press enter to

view TDS Nature of Payment Details screen, accept the

default details.

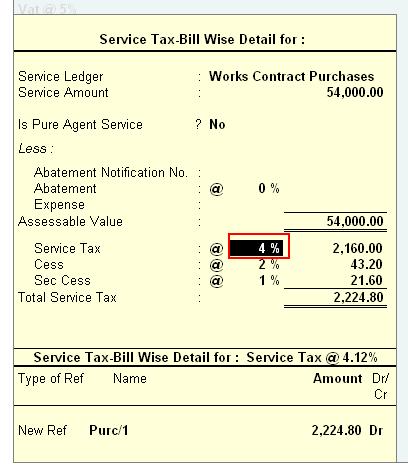

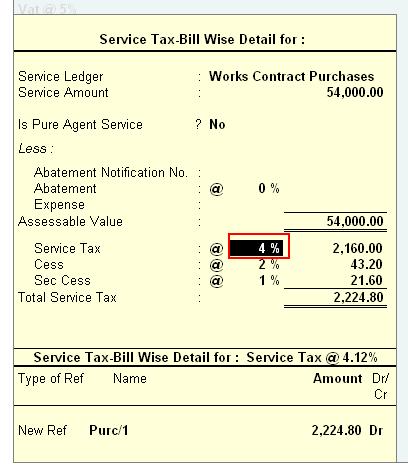

- Under Particulars select Service

Tax Ledger. In the Service Tax Computation screen

change the service tax percentage to 4% (as service Tax

charged on works contract is 4%). Service tax will be calculated

based on the Service Tax Rate defined.

In TDS Nature of Payment Details screen, accept the

default details.

[13-21]

- Under Particulars select TDS

ledger and press enter to view the TDS Details screen. Observe

TDS is calculated on the Total Amount (Work

Contract Purchase Value + VAT + Service Tax = 58924.80).

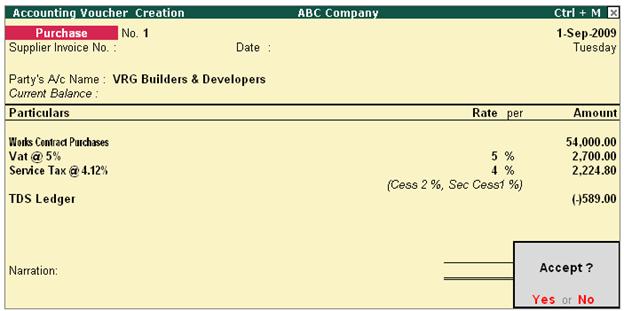

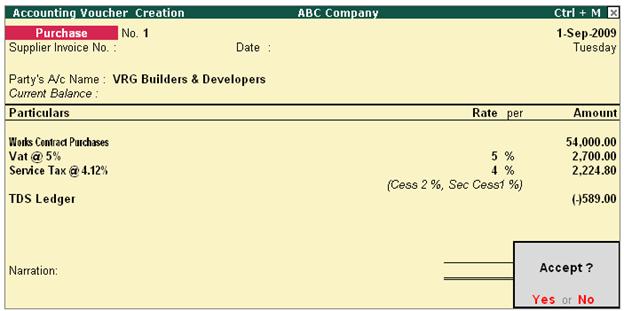

Purchase Entry

is displayed as shown

[13-22]

Note: TDS deducted is displayed with Negative Sign.

In Bill-wise Details screen select the reference details as shown

[13-23]

Completed Purchase Voucher is as shown below

[13-24]

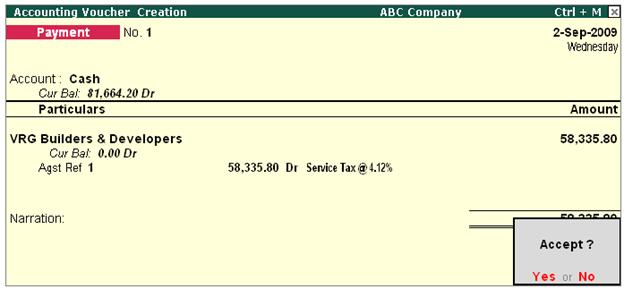

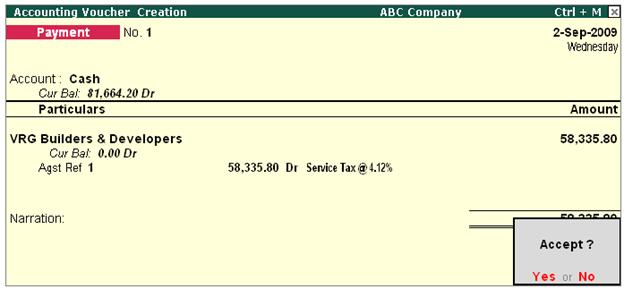

Step 3: Record a Payment Entry

Make the payment

to the party and the payment voucher will be dispalyed as shown

[13-25]

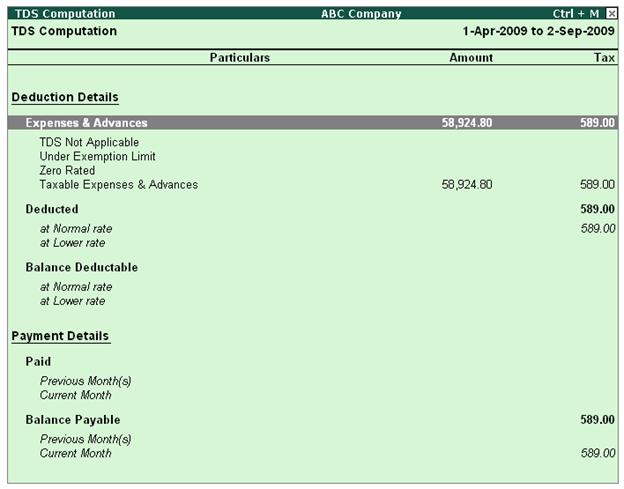

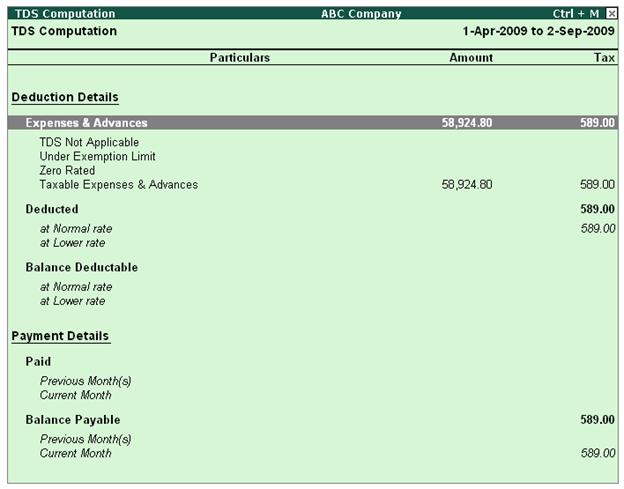

Step 4: Check TDS Computation

Go

to Gateway

of Tally > Display > Statutory Reports > TDS Reports > Computation

[13-26]

Similarly you can check Input Credit Form and VAT

Computation reports to view the details of Service Tax and VAT

|