How to Calculate Interest for Ledger with default Credit Period? @ Tally.ERP9 |

Query

How to calculate Interest for Ledger with default Credit Period?

Or

How to calculate Interest without effecting the outstanding of a Bill?

Answer

To calculate interest for Ledger with default Credit Period/without effecting the outstanding of a bill follow the steps:

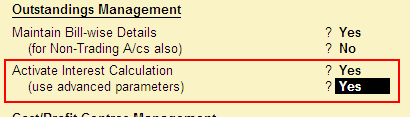

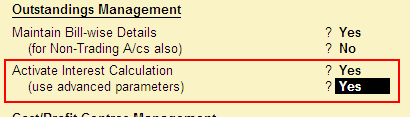

Step 1: Enable Interest Calculation Feature

From Gateway of Tally > F11: Features > Accounting Features (F1)

|

|

Step 2: Create the Customer Ledger by enabling Interest Calculation option

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

Create the Customer ledger under the primary group sundry debtor; activate the option Maintain balances bill-by-bill. Enable the option Activate Interest Calculation to Yes |

|

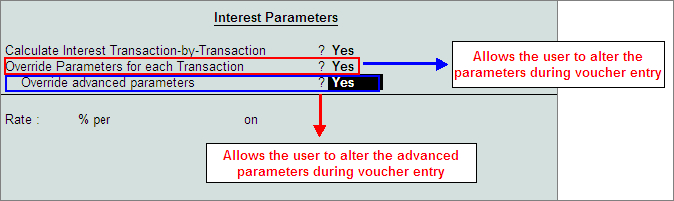

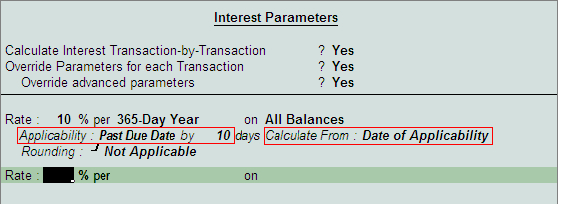

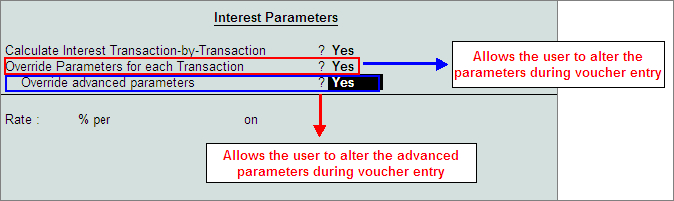

In Interest Parameter screen

|

|

Note: Tally.ERP 9 provides the flexibility to the user to override the parameters specified in the masters.

|

|

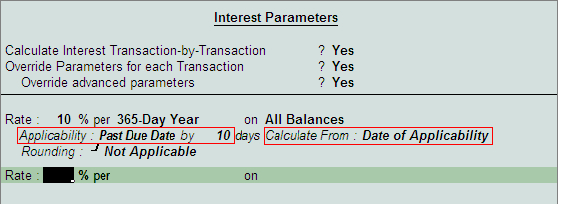

Here, in our example we are calculating interest @ 10% per annum on the bills from Mega Traders which exceeds due date by 10 days. This due date can be defined during voucher entry and also in the customer ledger master.

Step 3: Record the Sales Transaction

In the Sales Voucher,

|

|

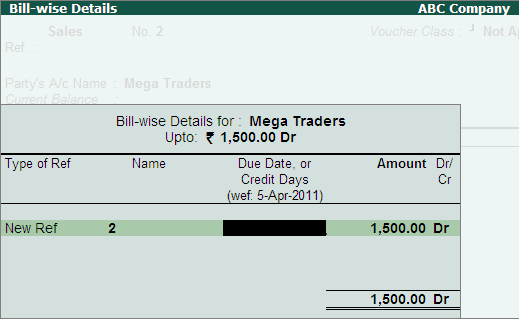

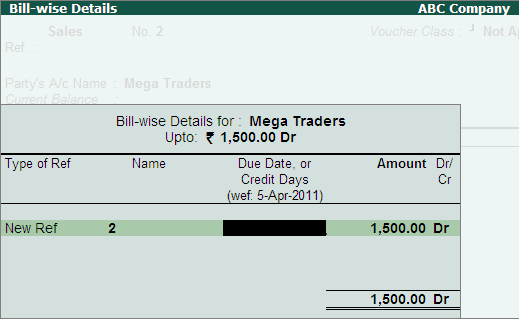

Now observe the Bill-wise details screen, you will see that under the heading Due Date, or Credit Days the number of credit period allowed is blank. The customer may fill any value or date to specify the due date.

Note: The interest calculation will start after 10 days from the due date specified here as we have specified the applicability as “Past due date by 10 days” in the customer ledger master |

|

In our example we will leave the field Due Date, or Credit Days blank so the interest calculation should from the 10th day after the voucher has been passed i.e. from 15th April 2011

Step 4: Check Interest Calculation Report

To see how Interest is getting calculated, navigate to Interest Calculation Report

From Gateway of Tally > Display > Statements of Accounts > Interest Calculations > Interest Receivable.

|

|

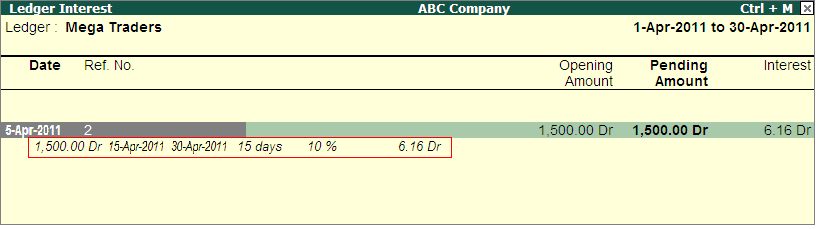

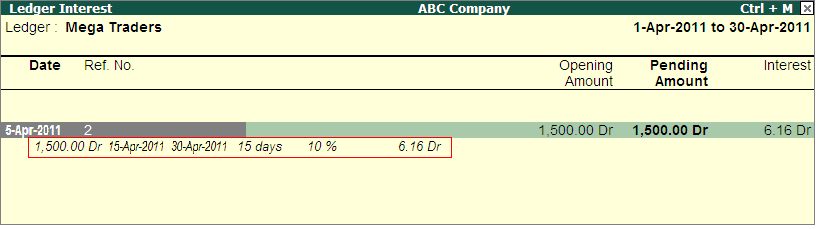

| The report can be further drill-down to Ledger Interest report to see the period for which Tally has calculated interest. Click on F1: Detailed button, from this screen we understand that the interest has been calculated for a period of 15 days (15-4-2011 to 30-4-2011) @ 10% p.a. If we calculate the amount of interest = 1500 x (15/365) x 10% = Rs. 6.1644 or Rs. 6.16 (rounded off to two decimal places) |

|

| |

|