How do I pass interest Entries? @ Tally.ERP9 |

Query

How do I enter the Interest Receivable / Payable amounts into books?

Or

The interest report shows only the interest implications, since the interest amount receivable/payable are not being entered into the books. How can this be accounted for in Tally.ERP 9?

Answer

The interest amounts calculated in different ways are shown in the Interest Calculation Report. However, these have not been brought into books and they simply give you the interest implications. You must book them if you want them to be entered into the books.

Entering Calculated interest amount

The calculated interest amounts are entered using the Debit and Credit Notes with Voucher Classes.

The Debit notes are used for the Interest receivable while the Credit Notes are used for the Interest payable.

Interest is calculated on a Simple or Compound basis and separate voucher classes should be used for them.

Set-up Debit/Credit Note Classes for Interest entries

We will now discuss the set up of Debit Notes, since the Credit Notes behave in the same way (in the case of Interest payable).

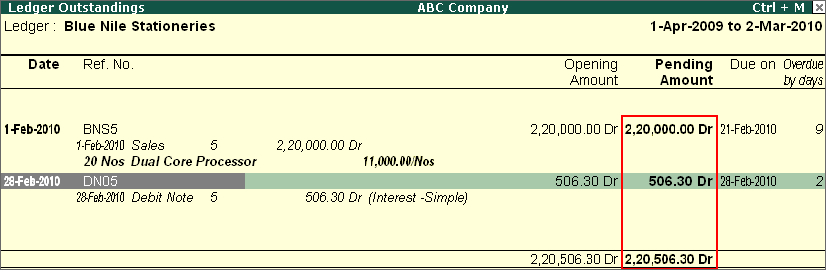

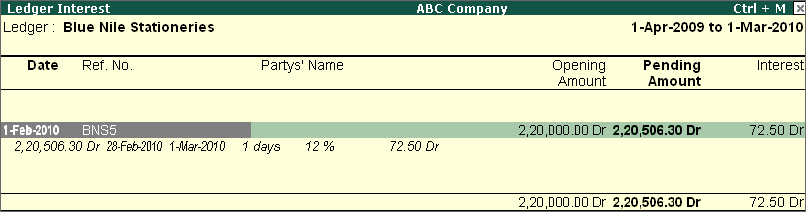

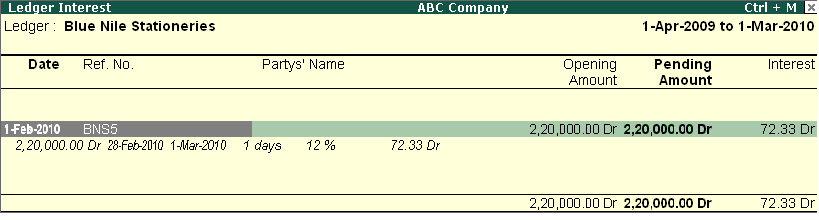

- Assume you have raised an invoice to your debtor ‘M/s Blue Nile Stationeries for Rs.44,200 on 1st Feb 2009 and have given a Credit Days of 20, so the invoice would fall due on 21st Feb 2009. The Interest rate is set to 12% per 365-Day Year and is calculated Transaction-by-Transaction, as shown below:

|

|

Let us see the accounting of interest amount for the above, if the same is treated as:

(a) Simple Interest

(b) Compound Interest

In case the interest amount is treated as Simple Interest

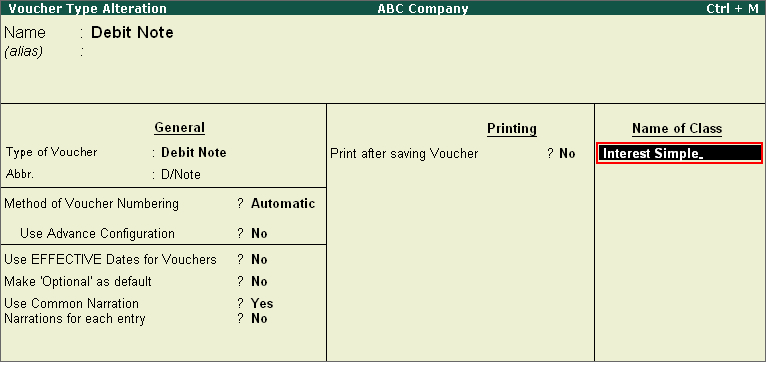

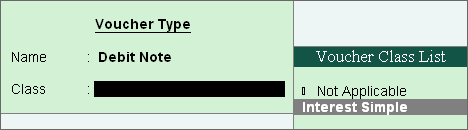

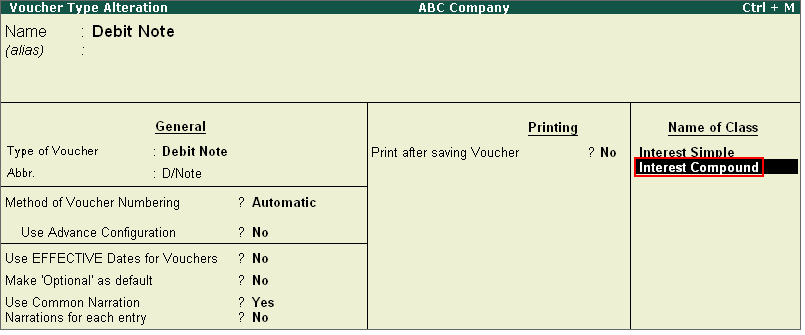

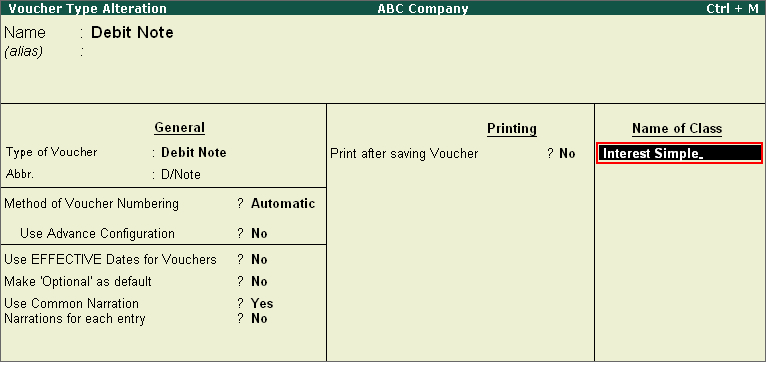

a) Alter the Voucher Type Debit Note. Tab down to the field Class and type a class name, for example Interest-Simple |

|

| b) Set Yes to Use Class for Interest Accounting? and save the voucher type |

|

c) Create a ledger Interest Received under the group Indirect Incomes

d) Debit Note Entry

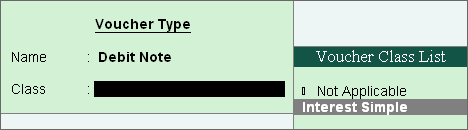

Go to Accounting Voucher > Debit Note (Ctrl+F9) > Select the Class Interest-Simple |

|

| e) Say for instance, we are passing the entry on 28th April 2009, so enter the same. Debit Blue Nile Stationeries > it will automatically display the List of Interest Bills under the Interest Details pop up screen, the interest amount due as on the debit note entry date > Select the particular interest reference > Credit Interest Received and save the voucher. |

|

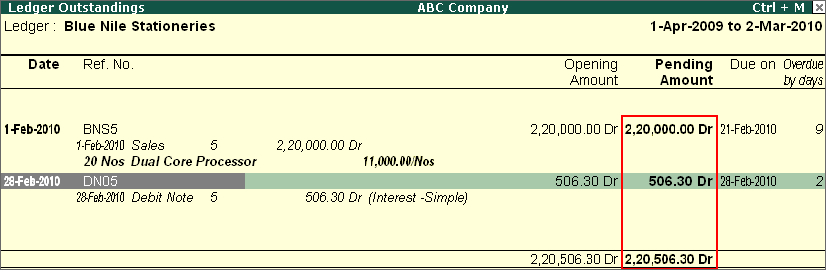

f) Outstanding Statement

Go to the Outstanding Statement ie, Display > Statement of Accounts > Oustandings > Ledger > Blue Nile Stationeries >

You will see interest amount also added in the outstanding statement in a separate line showing the date and reference no. of the Debit Note entry passed, which gives you the total outstanding amounting to Rs.2,20,506.30 (2,20,000 + 506.30) as on 28th Feb 2009. |

|

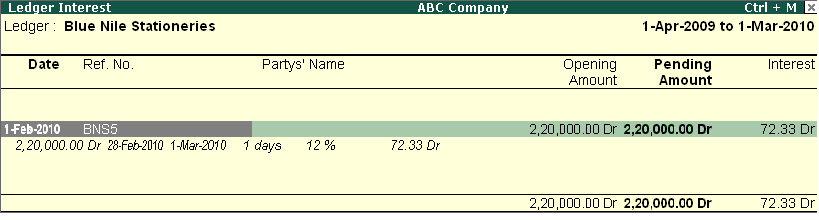

g) Interest Report

View the Interest calculation report as on 1st March 2009, ie, Go to Display > Statement of Accounts > Interest Calculations > Ledger > Blue Nile Stationeries > F2: Period = 1-4-2009 to 1-3-2010. Since the interest amount was charged to the party on 28th Feb 2009, interest is calculated for 1 Day and will show Rs. 72.33 as interest receivable (ie, 220,000 * 12/100/365*1 = Rs. 72.33) |

|

h) Pass the receipt entry normally as usual ie, Cr. Dynamic Computers > select the relevant pending references/bills, Credit Cash/Bank Account.

In case of interest amount treated as Compound Interest:

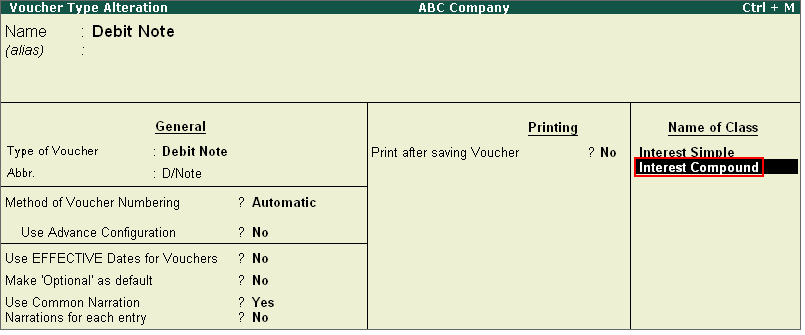

a) Alter the Voucher Type Debit Note. Tab down to the field Class, and type a class name, for example Interest-Compound |

|

| b) Set the option Use Class for Interest Accounting? and Amounts to be treated as Compound Interest? to 'Yes' and save the voucher type. |

|

c) Create a ledger Interest Received under the group Indirect Incomes

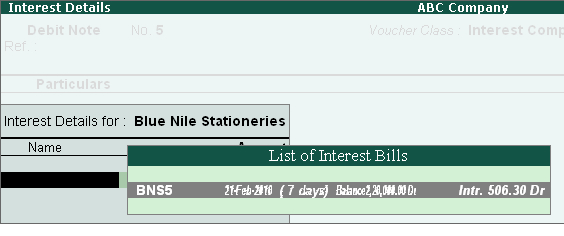

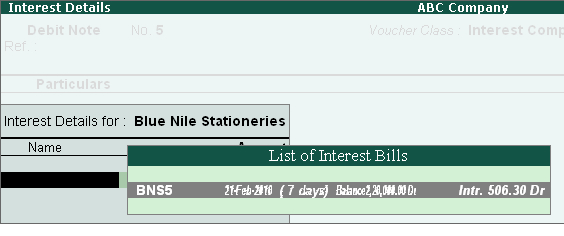

d) Debit Note Entry

Go to Accounting Voucher > Debit Note (Ctrl+F9) > Select the Class Interest - Compound |

|

| e) Say for instance, we are passing the entry on 28th April 2009, so enter the same. Debit Blue Nile Stationeries > it will automatically display List of Interest Bills under Interest Details pop up screen, the interest amount due as on the debit note entry date > Select the particular interest reference > Credit Interest Received and save the voucher. |

|

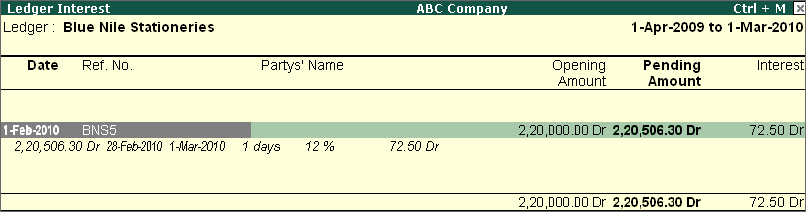

f) Outstanding Statement

Go to the Outstanding Statement ie, Display > Statement of Accounts > Oustandings > Ledger > Blue Nile Stationeries > You will see the interest amount also added to the principal amount of the bill in the outstanding statement. The Opening Amount of the bill is Rs.220000 and the Pending Amount as on 28th Feb 2009 is Rs.220506.30 (220000 + 506.30). |

|

g) Interest Report

View the Interest calculation report as on 1st March 2009, ie, Go to Display > Statement of Accounts > Interest Calculations > Ledger > Blue Nile Stationeries > F2: Period = 1-4-2009 to 1-3-2010. Since the interest amount was charged to the party on 28th Feb 2009, interest is calculated for 1 Day. It will calculate the interest on the compound value ie, on Rs.220000 + 506.30 = 220506.30 and will show Rs.72.50 as the interest receivable (ie, 220506.30 * 12/100/365*1 = Rs.72.50) |

|

| h) Pass the receipt entry normally as usual ie, Cr. Blue Nile Stationeries > select the relevant pending references/bills, Credit Cash/Bank Account. |

| |

|