Creating Master Ledger with TDS Transaction i.e. Expenses, Party Ledger, TDS Ledger

You can create or alter an Ledger for your business expenses, along with the applicable TDS.

Example :

On 1.4.2020, Swayam Sales paid to N. Jatania & Co Rs.5,00,000 as Rent

Step-1: Alter Expenses Ledger i.e. Rent Paid

Enable the option Is TDS Applicable ? and also Select the Nature of Payment from the List of Nature of Payments

The Ledger Alternation screen appears as shown below:

Step-2: Alter Party Ledger i.e. N. Jatania & Co ( Under Sundry Creditor) as below :

>> Enable the option Is TDS Deductible ? and Select a Deductee Type from the List and also Enable Deduct TDS in Same Voucher , if required

Note: TDS Rate will be 10% due to PAN is available and mention here, otherwise 20% will be calculated.

Step-3 : Create TDS Ledger i.e. TDS on Rent

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create.

2. Enter the Name and Select Duties and Taxes as the group name in the Under field, then Select TDS as the Type of Duty/Tax.

3. Select a Nature of Payment from the List of Nature of Payments.

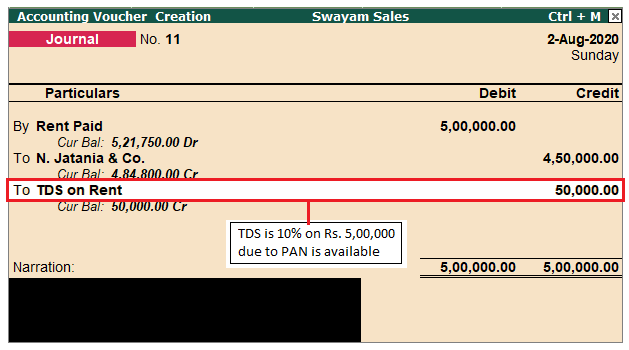

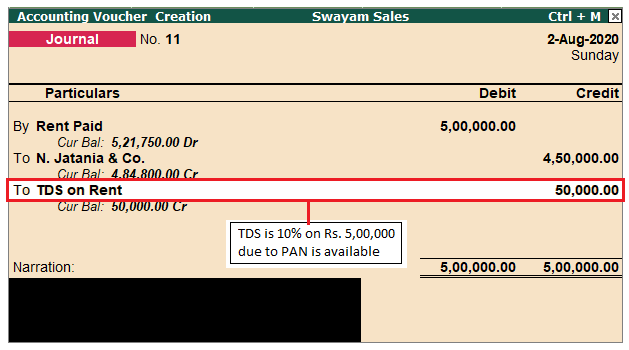

Step-4: TDS Transaction (Accounting for TDS on Expenses)

Go to Gateway of Tally > Accounting Voucher > F7: Journal and pass the Journal Entry as below :

Note : Out of Rs.5,00,000 towards Rent Paid to N. Jatania & Co, only Rs.4,50,000 is credited to party account and Rs. 50,000 ( i.e. 10% TDS) is transferred to TDS on Rent automatically and which is payable under Duties & Taxes.

4. TDS on Advance Payment against Expenses

You can create an accounting voucher for advance payments made directly or by a third-party, along with the applicable TDS.

Example :

On 01-08-2020, Swayam Sales paid an Advance of Rs. 1,00,000 on Rent to N. Jatania & Co. by cheque of Axis Bank Ltd.

Go to Gateway of Tally > Accounting Voucher > F5: Payment

Payment Voucher appears as shown below :

Note : When selecting TDS tax ledger, the TDS amount will automatically filled in the Amount field with Minus symbol (-) to deduct from the Advance amount i.e. 10% on Amount paid.

5. Recording Payment Transaction (TDS)

You can record a payment transaction with inclusion of the necessary TDS to be paid to the government.

Example :

On 1-9-2020, Swayam Sales paid TDS deducted in the month of August 2020 of Rs.60,000 to the Government directly by cheque of Axis Bank Ltd.

1. Go to Gateway of Tally > Accounting Vouchers > F5: Payment .

2. Click S : Stat Payment .

3. Select TDS as the Tax Type .

4. Enter the Period From and To dates.

5. Enter the Deducted Till Date .

6. Select the Section from the List of Section .

7. Select the required Nature of Payment .

8. Select the Deductee Status .

9. Select the Residential Status .

10. Select either bank or cash ledger in the Cash/Bank field. The payment voucher will be automatically filled with the relevant values. The Statutory Payment Details screen appears as shown below:

The Payment invoice appears as shown below automatically:

14. Press Enter or Press Ctrl+A to save the invoice.

|