How to Calculate Service Tax on

total transaction amount including TDS ?

For

the accurate calculation of Service

Tax and TDS follow the given steps

1.

Book the Expenses

and Service Tax through Purchase Voucher as shown

2.

Deduct TDS in a separate Journal Voucher using of Alt + S: TDS Deduction

3. Make the Payment to party

4.

Check the Service-Tax Input

credit Form -report displays

the realised value & total credit as shown

below

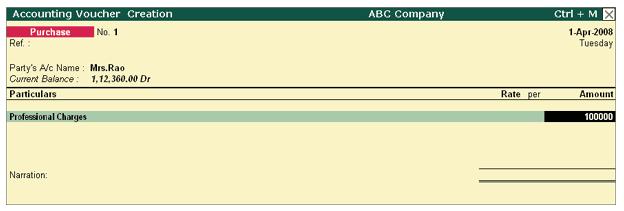

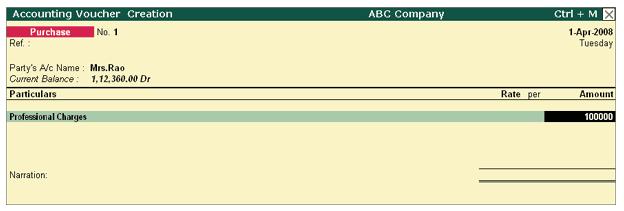

Step1. Book the Expenses

and Service Tax through Purchase

Voucher as shown

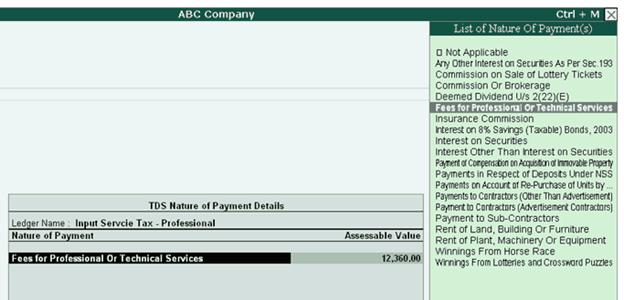

Select

the Expenses

ledger and

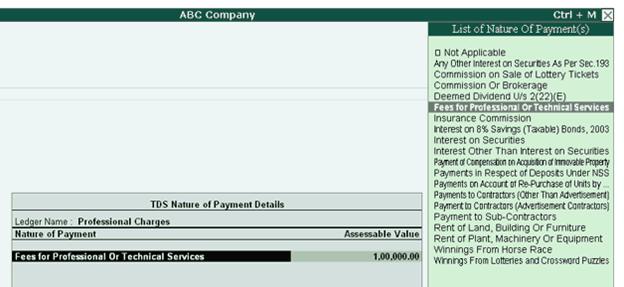

allocate the entire amount to the applicable TDS Nature of Payment

[13-27]

[13-28]

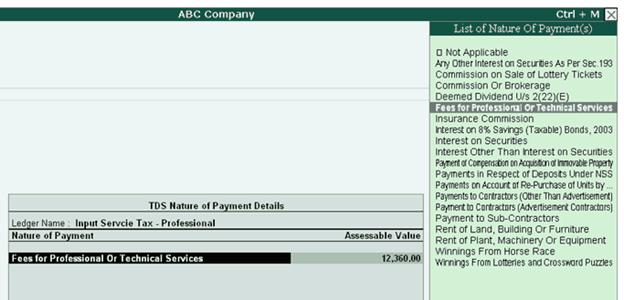

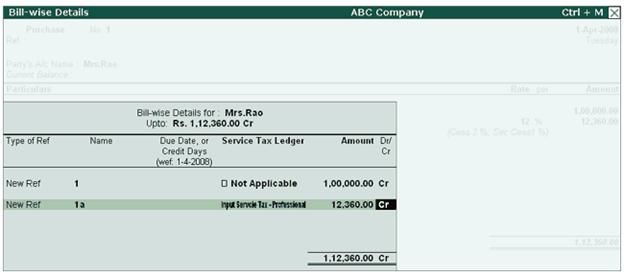

Select

the Input

Service Tax Ledger and in

the Service

Tax Bill-wise details screen select the default bill details

[13-29]

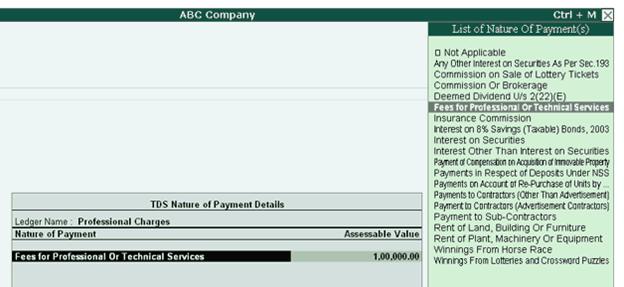

In

the Expense

Allocation screen

select the applicable TDS

Nature of Payment

Note: TDS Nature of Payment for the Input Service Tax Ledger as Even on the service Tax amount TDS needs to deducted.

[13-30]

In the TDS Details screen select the details as shown

[13-31]

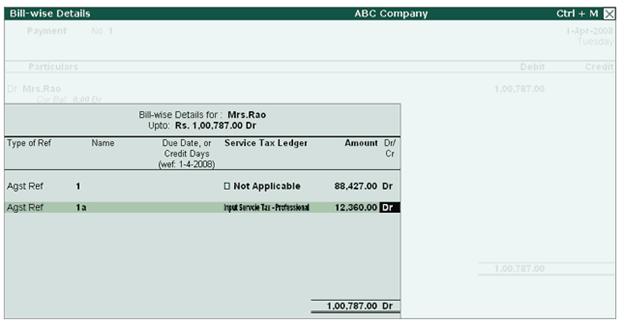

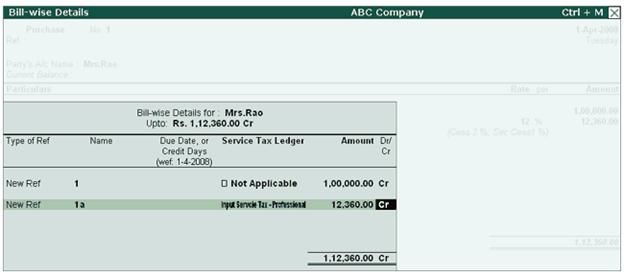

In

the Bill-wise

Details screen

enter the bill references as shown

[13-32]

Save

the purchase voucher

Adjust the Bill Number -

1 and save the voucher

[13-33]

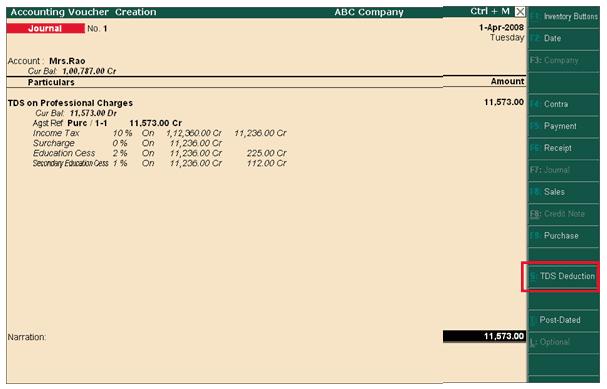

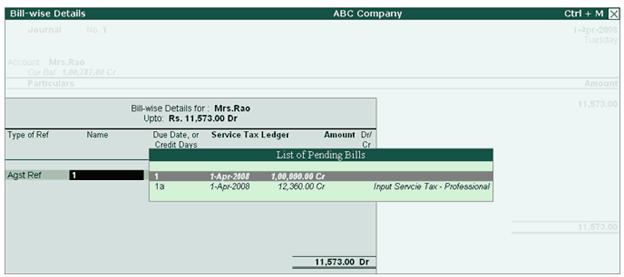

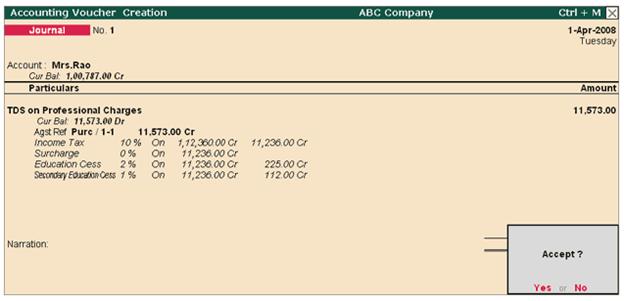

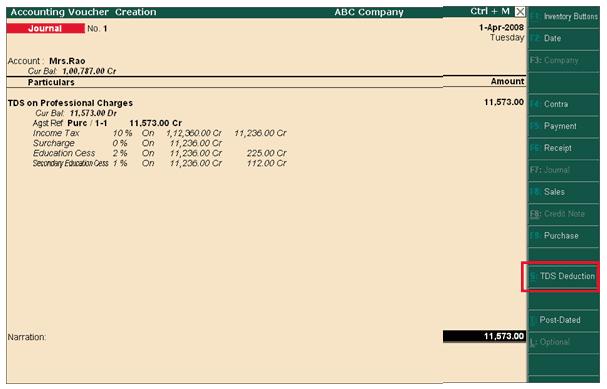

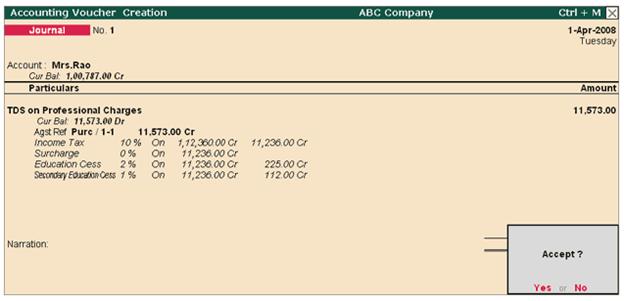

Step 2. Deduct TDS in a separate Journal Voucher using of Alt + S: TDS Deduction option as shown

[13-34]

[13-35]

[13-36]

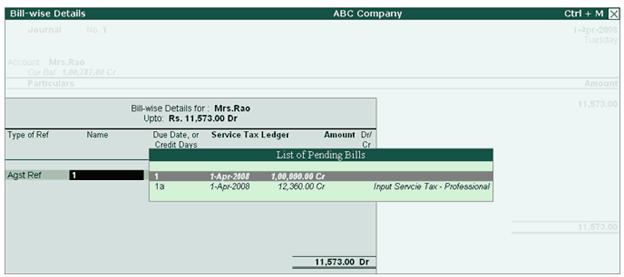

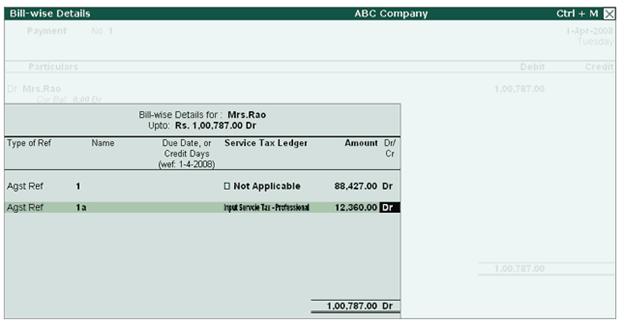

Step 3. Make the Payment to party

Select Mrs. Rao and in the Bill-wise Details screen select the bill reference as shown

[13-37]

Save the Payment Voucher

[13-38]

Step 4. Check the Service-Tax Input

credit Form -report displays the realised value & total credit as shown below

[13-39]

|