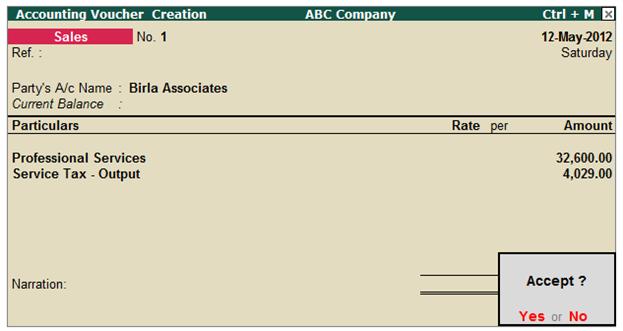

Solution

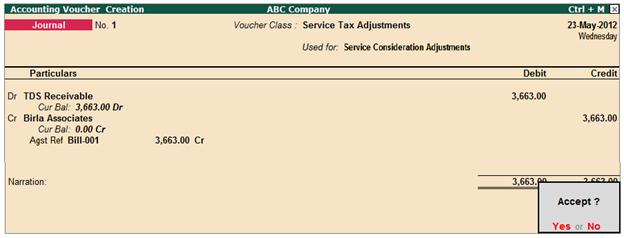

Step 1: Record Service Sales Invoice

[13-51]

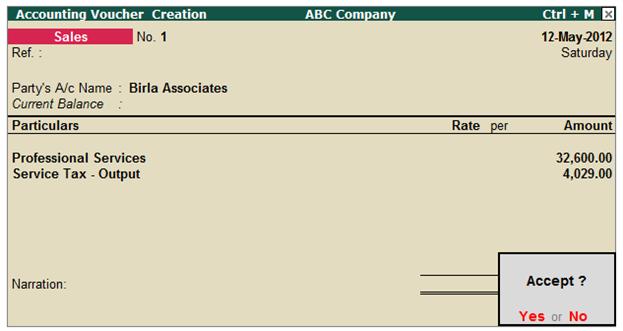

Step 2: Record a receipt voucher to account the receipt towards

the services sold

Assume that service

receiver has made full payment towards the above sales after

deducting TDS on Professional Services.

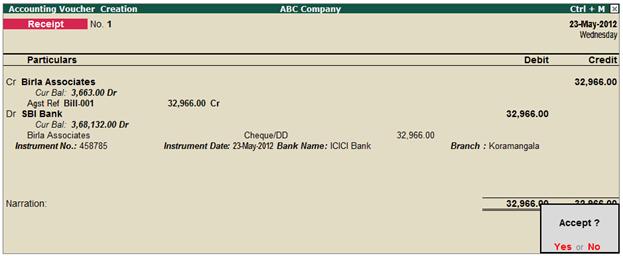

In Credit field select the party ledger - Birla

Associates and press enter. Service

Tax Details screen appears. In Service Tax Details screen select End of List.

[13-52]

In Amount field

enter the actual amount received from the customer. ABC Company received Rs. 32,966 from the customer.

In Bill-wise Details screen select the appropriate bill towards which the payment

is received. In Amount field the actual amount received will be displayed.

[13-53]

In Debit field, select the Bank/Cash ledger depending on the nature of receipt. Here the

receipt is in the form of Cheque hence Bank

ledger is selected.

Completed receipt entry

appears as shown:

[13-54]

Save the Receipt

Voucher.

Step

3: Accounting the TDS Deducted to

wards the services provided

In Tally.ERP 9 Releases 1.8 onwards

provision has been made to account the TDS amount on the servcies provided and capture the details in appropriate reports. To

account these types of adjustments - Service Consideration Adjustments flag has been provided in Journal Voucher (This flag will be avaialbe only when the vocuher class is created for Journal Voucher)

1.

Create Service Tax Adjustment Class in Journal Voucher

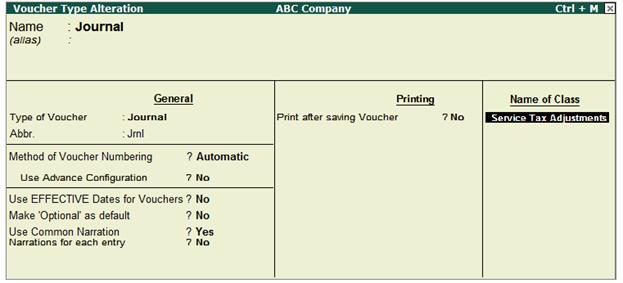

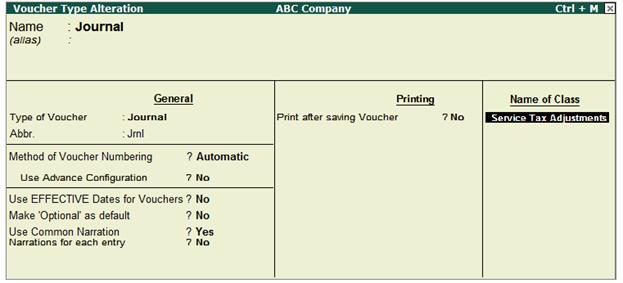

Go to Gateway of Tally > Accounts Info. > Voucher

Types > Alter > select Journal

In Voucher Type Alteration screen

- Tab Down to Name of Class field and enter the class name as Service Tax

Adjustments

[13-55]

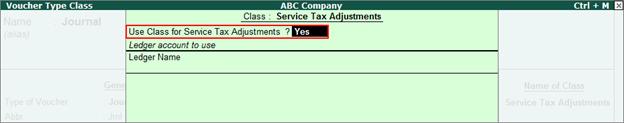

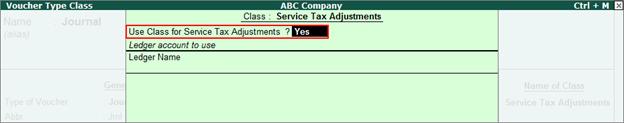

- In Voucher

Type of Class screen

- Enable the option Use Class for Service Tax Adjustments as “YES”

[13-56]

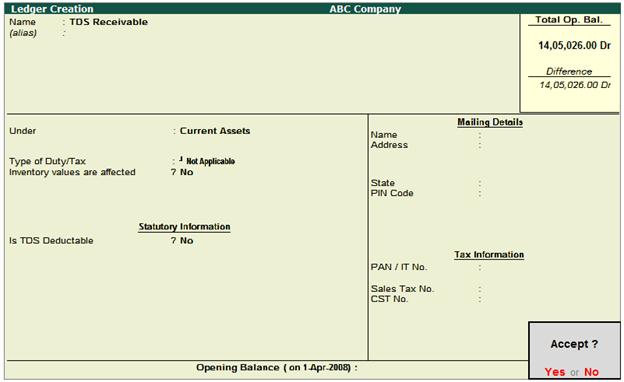

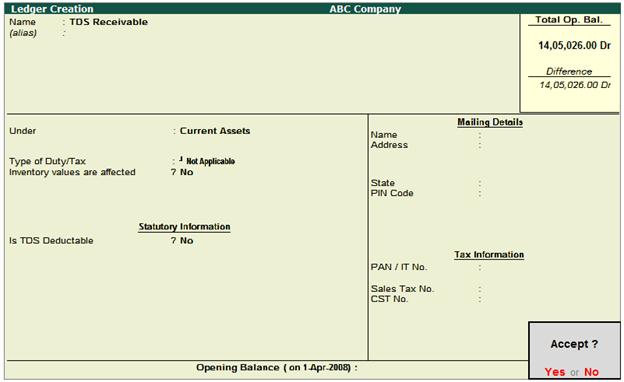

2.

Create ledger to account TDS Amount

Create the ledger under Crrent Asets as shown below

[13-57]

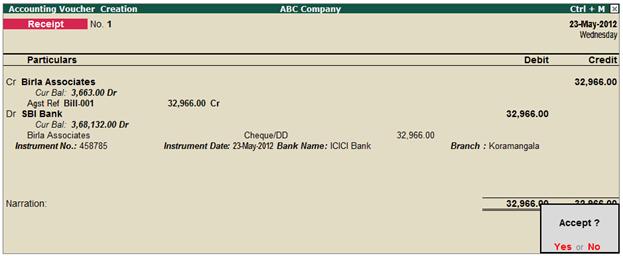

3.

Record the transaction in Journal Voucher

Go to Gateway of

Tally > Accounting Vocuhers > F7: Journal

Voucher

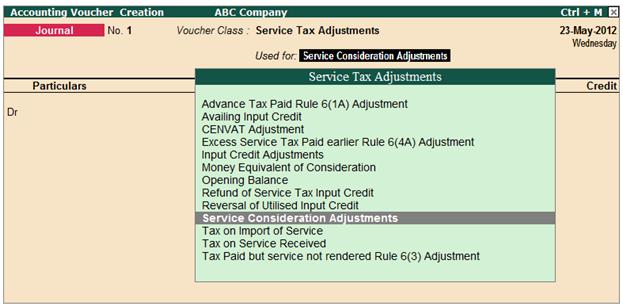

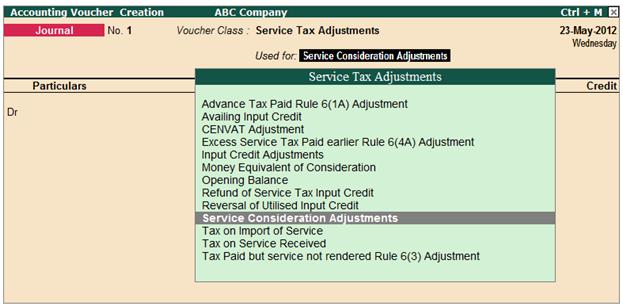

In Change Voucher Type

Class screen, select Service Tax Adjustments in Class field

[13-58]

In Used for field

select the flag “Service

Consideration Adjustments”

[13-59]

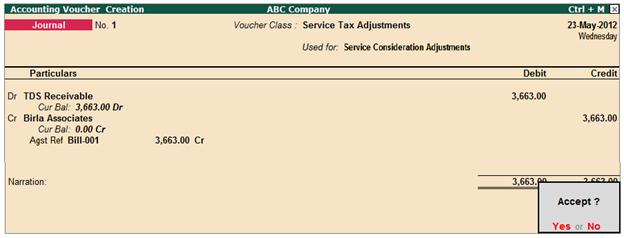

In Debit field select TDS Receivable ledger (grouped under current assets or any

group) and enter the amount which is deducted as TDS. In Debit (amount) field enter Rs. 3,663[Total Bill Amount (36,629) - Amount Received

(32,966)].

In Credit field select the Service Receiver - Birla Associates and press enter to view Service Tax Details

screen. In Service Tax

Details screen, select End of List.

[13-60]

In Bill-wise

Details screen select the

appropriate bill to adjust the amount deducted as TDS.

[13-61]

The completed Journal

Voucher appears as shown:

[13-62]

Save the Journal

Voucher.

Note: This adjustment entry can be

booked based on the TDS certificates received from service receiver

periodically or yearly depending upon users requirement.

|